Moody’s, the last of the famed “Big Three” credit rating agencies, has just dropped a bomb, downgrading the U.S. credit rating. But hey, what does that mean for you, me, or our favorite cryptocurrency? Well, grab a seat!

Moody’s U.S. Rating Cut Sends Bitcoin Back Above $105K

On Friday, the U.S. lost its precious perfect credit score. Moody’s, in a fit of fiscal concern, downgraded U.S. debt from its cozy “Aaa” to a slightly less perfect “Aa1.” Why? Oh, just a tiny thing like a $36.87 trillion debt. Nothing too crazy, right? (Details here)

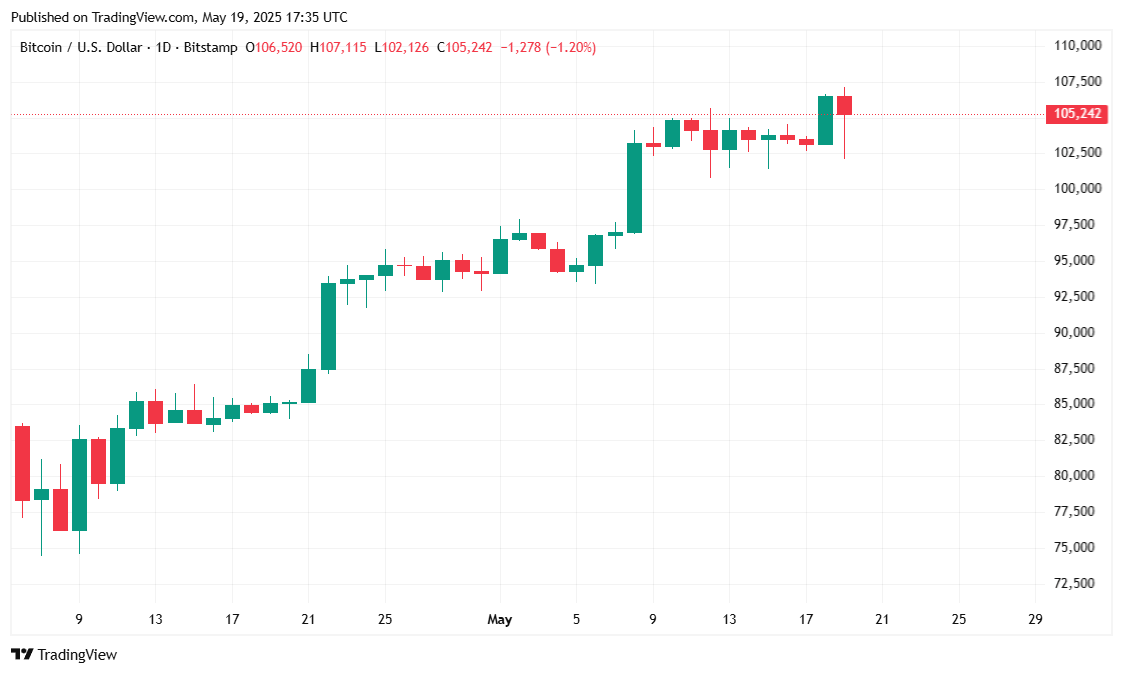

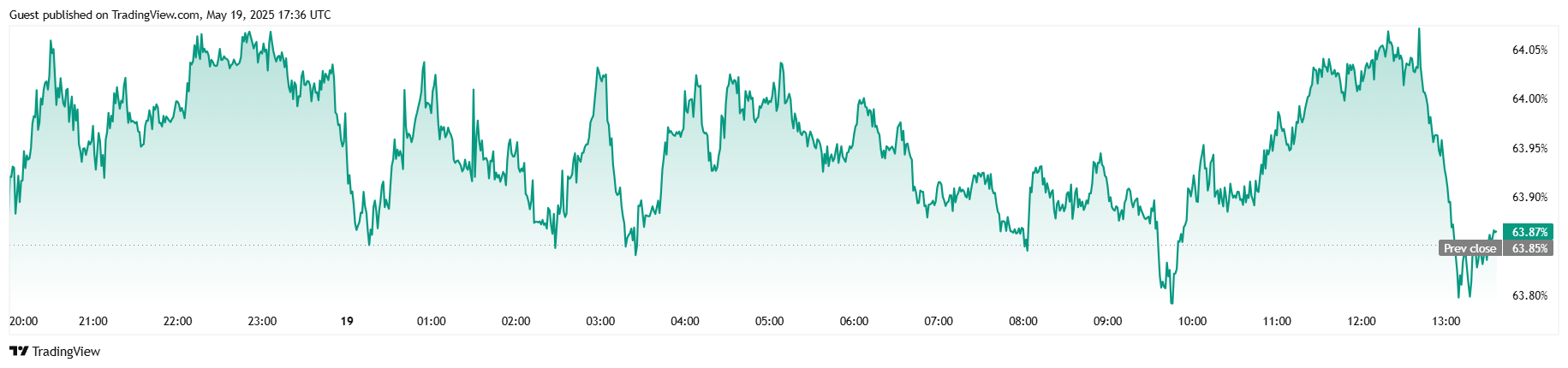

Stocks took a nap on Monday: The S&P 500 shed 0.13%, the Nasdaq slipped 0.31%, while the Dow clung to life with a teeny gain of 0.19%. But Bitcoin? Well, it did a little dance, up 1.87%, reclaiming $105K after a weekend roller coaster ride where it lost $5,000 in a single five-hour swoop. Classic crypto behavior. 😜

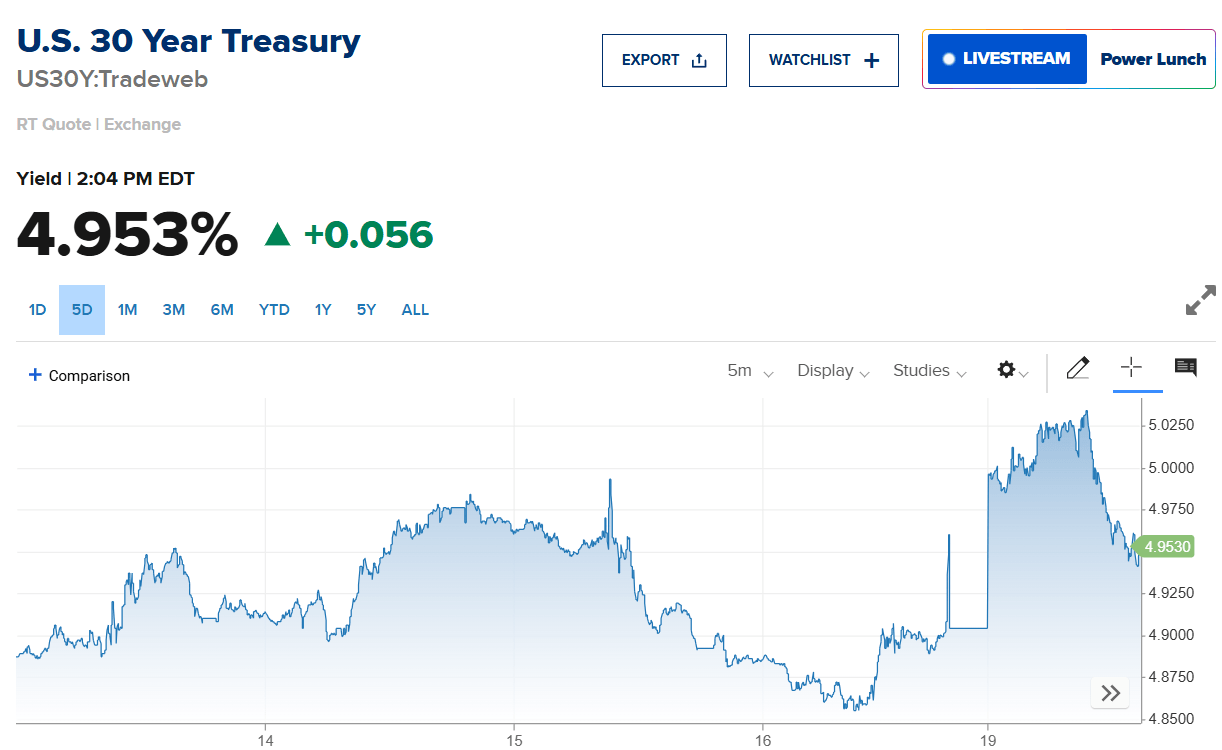

So, Moody’s was the last to join the cool kids’ club of debt downgrading—Standard & Poor’s did it in 2011, and Fitch joined the fun in 2023. With Moody’s downgrade, bond prices plummeted, and yields jumped to new heights. The 30-year treasury yield hit 5%, a level we haven’t seen since… ever. Hold onto your hats, folks—interest rates are heading up. Think mortgages and car loans. 🏠🚗

Now, Bitcoin’s gliding above $105K again, while the rest of the market yawned in mild disinterest. Investors are basically betting their chips on the big B. The U.S. government might just have to print more money to handle its mounting debts—so, naturally, people are running to Bitcoin, the anti-fiat hero. 💰

Ray Dalio, billionaire hedge fund guy, had this to say about credit ratings: “They only measure the risk of a government *not* paying its debt. But here’s the kicker—they ignore the bigger risk: the government printing more money to pay those debts, which ultimately ruins the value of the bonds.” Good luck with that, bondholders. 🤷♂️

Market Metrics Breakdown—In Case You Cared

Bitcoin’s still hovering above the $105K mark, at $105,166.72 (with a tiny 0.48% dip recently). It’s been a bumpy ride, with prices bouncing between $102,112.69 and $107,068.72. But don’t worry, it’s still up 2.10% on the week. A tiny dip? Just a cooldown after Bitcoin’s latest sprint. 🏃♀️💨

Trading volume? Oh, it’s surging! $68.01 billion, up by 68.72%. Clearly, people have nothing better to do on Monday mornings than to pour their dollars into Bitcoin. But market cap dipped slightly to $2.08 trillion—don’t worry, it’s just a little breather.

In the land of derivatives, BTC futures open interest is still climbing, up 0.96% to $71.45 billion. The bears? Oh, they’re losing big-time, with short positions losing $5.70 million. Long positions? Not so bad, only a small $417,220 loss. Looks like it’s a bear-eat-bull world out there. 🐻💥🐂

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Gold Rate Forecast

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin’s Bouncy Castle? 🚀

- Dogecoin’s Wild Ride: Will It Bark or Bite? 🐶💰

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

2025-05-19 22:00