Under a pale January sky, Coinbase flung wide the doors to prediction markets across the nation on January 27, with Kalshi as a quiet witness at its side, as if the future itself needed a permit and the permit was written in numbers. A gesture that nods to the stubborn rhythm of the crypto age, the rhythm that won’t be silenced by the dust of old ledgers.

From sea to shining sea, Americans may wager on politics, sports, entertainment, and the weather of the macroeconomy, all while their crypto and equity holdings murmur in the background. The news arrived through X, after first hinting in November 2025, as if fate kept whispering and the market finally listened.

Out: the house keeps the tally in frost.

In: the price rises from the chorus of the crowd.

Now there is a new way to trade your takes, with a sly smile at the capriciousness of fate.

Prediction markets are live in all 50 states on Coinbase.

Trade any real-world outcomes across sports, politics, culture and more.

– Coinbase 🛡️ (@coinbase) January 28, 2026

This nationwide push gathers domestic hunger that offshore platforms like Polymarket cannot legally feed. The mood of 2024 was loud-the three largest prediction markets swelled by 565.4% in the third quarter, swelling to $3.1 billion during the US presidential cycle, as if the air itself had learned to gamble.

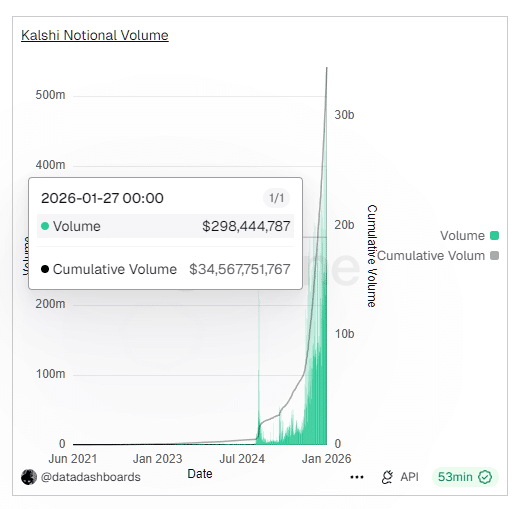

Kalshi’s ledger keeps its own bright tally: a cumulative notional volume of $34.5 billion as of January 27, 2026, according to data from Dune.

Kalshi has reached a cumulative notional volume of $34.5B | Source: Dune

Market Timing and Integration Into Their Ecosystem

Traders can summon event contracts using either USD or USDC directly within Coinbase’s interface, so the maze of accounts across services can finally retire to the shelf. Brian Armstrong, the man who keeps speaking of an “everything exchange,” imagines a world where traditional finance and digital assets share a single stage.

Coinbase first unveiled these markets in December 2025 at its System Update conference, though access was limited to select regions, a door ajar for a winter that might grow into a season.

This phased rollout gave the system time to learn its own breath. In late December, Coinbase acquired The Clearing Company to accelerate the development of compliant technology for event-based trading, as if teaching the machine to dream in regulations and risk.

Fighting For a Part of The Market Share

Coinbase now squares off with established operators and traditional brokerages stepping into the arena, eyeing the same prize with a wink and a nudge.

Gemini secured regulatory approval for its Titan platform in late 2025, while Robinhood joined the LedgerX sweep with this objective. With its existing user base and brand recognition, Coinbase aims to snatch market share before competitors harden their positions, a high-engagement, high-frequency product that pulls users beyond cryptocurrency, according to analysts at Benchmark who pretend not to be surprised.

The launch suggests prediction markets have shed their crypto niche and walked into the broad street of mainstream trading, where exchanges now pretend they were always listening and finally decide to follow the rhythm.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- New ETF: Bitcoin and Gold Tango to Save Your Wallet from Currency Woes!

- Brent Oil Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- SEI’s Suicide Dive to $0.20! 🚀😱 Or the Greatest Trick Since Woland Came to Moscow?

- NFT Crash Comedy: Markets Bounce Back in Hilarious Tantrum! 📉😂💸

- EUR UAH PREDICTION

- Crypto Drama: Sui’s Price Soars Like a Pigeon in a Storm! 🐦💸

- XRP ETF: Will Crenshaw’s Stubborn Soul Crush Crypto Dreams? 😱

2026-01-29 02:43