In this day and age, folks are seekin’ all manner of peculiar oracles to guide their investments through the stormy seas of our modern financial circus. And lo and behold, the Benner Cycle has emerged from the dusty tomes of yesteryear, waving its hands like a barnyard rooster at dawn.

This economic chart is as old as your great-grandpappy’s favorite pair of suspenders—over 150 years, mind ye! Several dreamers contend it has spotted financial calamities like a hawk eyeing a hapless rabbit since the mid-1920s. Yet, as the wheel of fortune spins madly onward, recent calamities give that claim a bit of a ticklish challenge.

When Does This Antique Cycle Say to Hold Your Horses?

Our friend Samuel Benner, a man who lost more coin than he cared for during the debacle of 1873, took a deep breath (probably while chewing on a stalk of corn) and set to ponderin’ the trends of economic horseplay. His findings rolled into a book titled Business Prophecies of the Future Ups and Downs in Prices in 1875—introducing the fervently debated Benner Cycle.

This cycle ain’t any fancy-schmancy mathematical concoction from the world of high finance. No, sir! Instead, dear ol’ Sam based it on the ups and downs of good ol’ agricultural goods, having observed these cycles in his barnyard wisdom.

At the end of this intellectual jigsaw puzzle, our farmer-friend scratched down the enigmatic “Sure thing.” Nearly two centuries later, this little nugget’s makin’ a comeback—like bell-bottoms at a disco!

With his farmer’s goggles on, Sam claimed that solar cycles and the whims of the heavens had a hand in determining crop yields, which set the stage for his market predictions. Mighty ambitious for a chap who just wanted a few decent tomatoes!

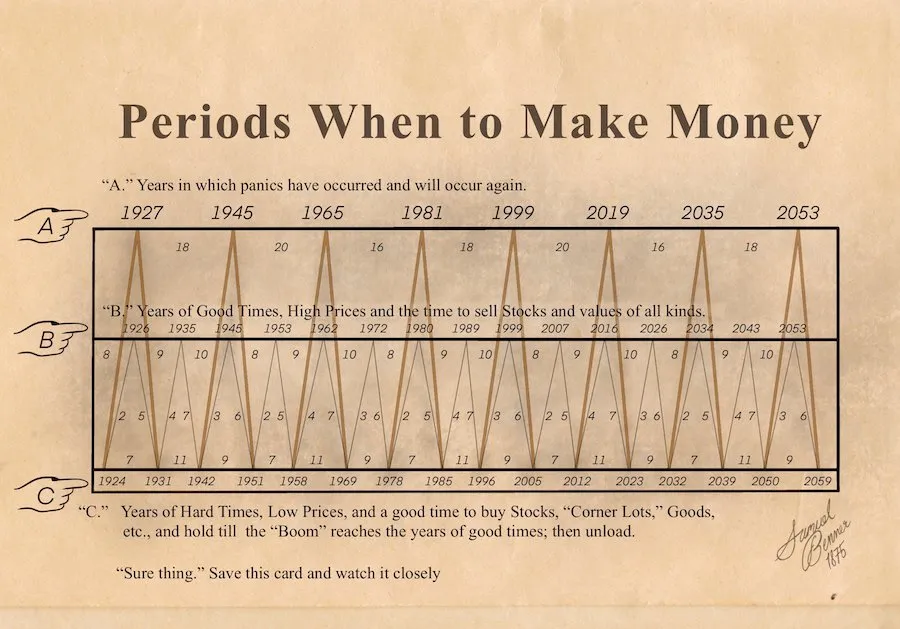

In the magic of the Benner chart:

- Line A marks the seasons of panic—hold onto your hats!

- Line B waves hello during boom times, perfect for sellin’ off your wares.

- Line C shout out for recessions, where savvy folk should be stockpiling their goodies.

Benner even had the gumption to map out his crystal ball forecast all the way to 2059, despite modern agriculture lookin’ like a sci-fi flick compared to his days of yore.

Wealth Management Canada claims that while this cycle doesn’t predict the years with pinpoint accuracy, it has, on the whole, been a reasonably decent oracle—not’d that it managed to align with Climactic events like the Great Depression of 1929. Just a few hiccups off, if you will.

Investor Panos posited that the Benner Cycle took the guesswork out of several big events: the Great Depression, World War II, the Dot-Com bubble, and the pandemic plunge. Might be that 2023 was prime rib for buying, and 2026 will roll out the red carpet for sellin’ high.

“2023 was the best time to buy in recents, and 2026 would be the best time to sell,” Panos blurted out, no doubt with fervor.

Retail investors in the crypto market are passing around this ancient parchment like a rare comic book, using it to bolster their cheerful optimism for 2025–2026. 📈

“Benner’s cycle suggests a market peak around 2025 before a correction sets in,” forewarned Investor mikewho.eth. “If this old chart sticks, expect the speculative frenzy around Crypto AI and other shiny baubles to balloon before it all goes kaboom!”

Belief in the Benner Cycle Faces Its Own Quagmire

Despite general ruckus, faith in this old chart is feeling the pinch, thanks to recent upheavals in the economic landscape.

On the 2nd of April—mark your calendars, folks—President Trump announced a tariff plan that could’ve made a cat laugh. Markets went into a tailspin, opening the week deeper in the red than a tomato on a hot summer day. 🍅

April 7 was so chaotic that some wags dubbed it “Black Monday,” giving a nod to that infamous stock crash of ’87. That day, the crypto market cap plummeted from a dizzying $2.64 trillion to a mere $2.32 trillion, leaving investors shaking like leaves in a storm. Although there’s a smidge of recovery, the sentiment is colder than a snowman’s backside.

JPMorgan decided to up their prediction of a global recession in 2025 to a staggering 60%. What spurred this madness? Ah, the chaos unleashed by the tariff announcement, all around Liberation Day. Not to be outdone, Goldman Sachs also upped its recession forecast to 45% in the next 12 months—the most since that glorious post-pandemic inflationary feast.

Now, our veteran trader, Peter Brandt, took a potshot at the Benner chart over on X (formerly known as Twitter) on that fateful April day.

“I do not know how much I would trust this. Ultimately, I need to deal with only the trades I enter and exit. This type of chart is more distracting than anything for me. I cannot go short or long with this specific chart, so it is all lala land for me,” he exclaimed, likely shaking his head.

Nevertheless, in spite of recession fears and market behavior kicking the Benner Cycle’s optimism to the curb, a handful of investors cling to Samuel Benner’s visions like a child to their favorite teddy bear.

“Market top in 2026. That gives us one more year if history decides to repeat itself. Sounds wild? Sure. But remember: markets are more than just numbers; they’re all about mood, memory, and momentum. And sometimes those quirky old charts work—not because they’re magical, but because enough folks believe they do!” — Investor Crynet mused wisely.

According to the great oracle known as Google Trends, interest in the Benner Cycle has soared over the past month. It appears retail investors are in a frenzy for optimistic tales, especially in the midst of swirling economic and political terrors.

Read More

- Silver Rate Forecast

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- 🚨 Senate Drops Crypto Bill: CFTC to the Rescue? 🚨

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- Gold Rate Forecast

- HBAR’s Perilous Plunge: Upgrade to the Rescue or Ruin?

2025-04-08 12:57