Ah, the crypto lending market—like a phoenix sporting a rather unfortunate haircut, it’s attempting to rise from the ashes yet again. Our dear Centralized finance (CeFi) and its scrappy sibling, Decentralized finance (DeFi), are dusting off their résumés in a bid to outshine each other in this latest performance.

This revival comes on the heels of a cataclysm that saw titans like Celsius, Genesis, and BlockFi topple like poorly balanced Jenga towers. Investors, bless their hearts, were left looking rather like startled deer in headlights—trust in this sector is about as stable as a tightrope walker on a windy day.

CeFi vs. DeFi: The Grand Face-Off in Crypto Lending!

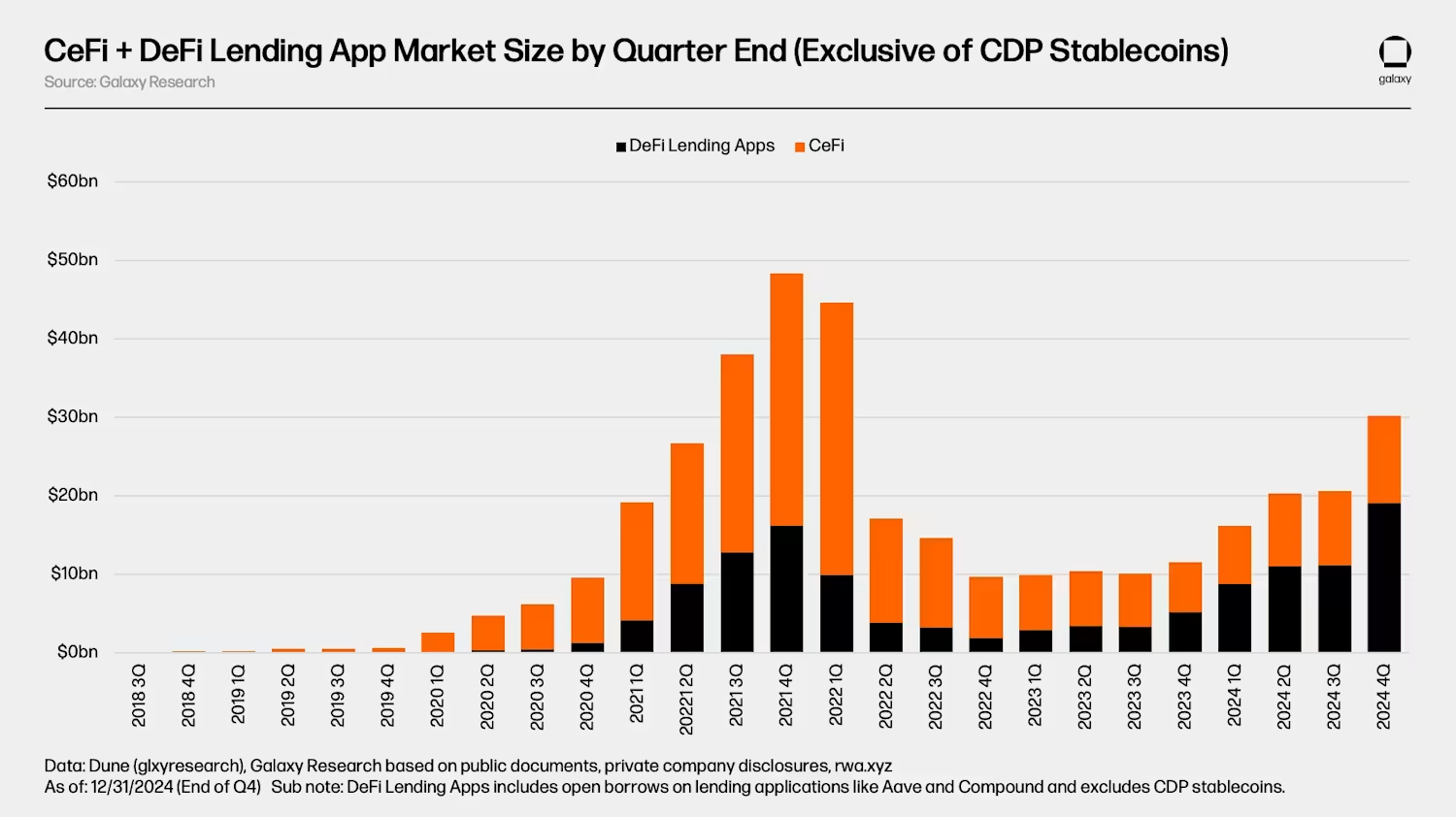

Now, if we believe the whispers of a recent tome from Galaxy Digital, the combined total of outstanding CeFi borrows as of Q4 2024 sits at a rather remarkable $11.2 billion. This marks a dazzling 73% leap from the pitiful bear market depths of $6.4 billion.

However, do keep your expectations modest; the CeFi lending market remains ensconced some distance below its former glories.

“This lingering malaise is attributed to the utter lack of recovery in CeFi lending post-2022 debacle, alongside the complete annihilation of several substantial lenders and borrowers,” the report sagely pontificates.

The total market size has plummeted by a jaw-dropping 68% from its zenith of $34.8 billion. One can only marvel at how the catastrophic implosion of these aforementioned colossal lending platforms has shattered confidence and sent loan volumes diving like a duck in a boxing ring.

Not to be outdone, the recovery in CeFi lending has also birthed a delightful consolidation of market share. The top three lenders—Tether, Galaxy, and Ledn—now grip an astonishing 89% of the market, a monopoly previously held in more innocent times by the now-defunct trio of Genesis, BlockFi, and Celsius, who commanded 75% market share back in 2022.

These new corporate titans are steering CeFi’s revival ship, albeit through increasingly choppy waters posed by the nimble DeFi protocols. Galaxy Digital makes it abundantly clear that our beloved DeFi lending has enjoyed a far mightier resurgence. In the euphoric bull run of yesteryear—2020 to 2021—DeFi lending enigmatically comprised a mere 34% of the market. Yet, fast forward to Q4 2024, and we find it now holding a commanding 63%!

“Most CeFi firms have since ceased to offer yield products to US clients as of 2022. Meanwhile, DeFi platforms cavalierly sidestep such trifling regulations and don’t have the foggiest notion of KYC, which could be a factor,” remarked Ledn’s co-founder Mauricio Di Bartolomeo with an air of casual indifference.

The upward trajectory is epitomized by DeFi borrowing reaching dizzying heights—an impressive 18% above the previous bull market zenith. With stalwarts like Aave (AAVE) and Compound (COMP) emerging from the bear market unscathed, their decentralized fortitude and robust risk management strategies are enough to make even the staunchest CeFi supporter raise an eyebrow. In all, DeFi lending has catapulted an astonishing 959% from Q4 2022 to Q4 2024.

“Aave and Compound have rebounded resoundingly from the bear market nadir of $1.8 billion in open borrows. At the end of Q4 2024, a sprawling $19.1 billion in open borrows flourished across 20 lending applications and 12 blockchains,” Galaxy diligently noted.

This resurgence has made quite the contribution to the overall uplift within the crypto lending market. Excluding those pesky CDP stablecoins, the crypto lending market enjoyed an astonishing 214% recovery from Q4 2022 to Q4 2024.

“The total market has swelled to $30.2 billion, chiefly fueled by the audacious expansions of DeFi lending applications,” the report blithely observes.

As CeFi lending steadies itself—more or less—in the clutches of a select few sizable entities, the nimble DeFi platforms emerge as the true champions in this recovery odyssey. Their decentralized and delightfully permissionless nature is laying a solid groundwork for growth in a market still shaking off the dizzying effects of its last tempest. Challenges abound, yet the substantial growth observed underscores the remarkable resilience of the crypto lending domain amidst adversity. 🤑🍾

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Bitcoin’s Wild Ride: Is It a Rally or Just a Bunch of Greedy Investors? 🤔💰

- KTA’s Rise: A Tale of 30% Gains & $1.20 Ambitions 📈

- Silver Rate Forecast

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- SOL’s October Drama: ETFs, Upgrades, and $350 Dreams? 😱💸

2025-04-15 09:01