What to Know:

- Paolo Ardoino, Tether’s chief custodian of stablecoins, is reportedly dialing back a $20B plan to consolidate reserves, a move that reads like a corporate diet-lots of cutting, minimal drama, and perhaps a hope for fewer calories in risk.

- Capital is slipping from broad tech bets into Bitcoin infrastructure-specifically Layer 2s that tackle the perennial headaches of scalability and programmability, without needing a degree in cryptography to understand the menu.

- Bitcoin Hyper uses the Solana Virtual Machine to bring high-speed smart contracts to Bitcoin, and it’s pulling in over $31.2 million in its ongoing presale.

Tether’s strategic roadmap has taken a sharp turn, as if someone waved a wand and said, “Let’s reconsider everything we thought we were doing.”

Reports suggest Ardoino is recalibrating the company’s venture allocations. In an interview with Cointelegraph, the stablecoin giant indicated a misreading of the $20B funding plan, but stood by a lofty $500B valuation. That signals a drift from aggressive expansion into AI and data mining toward a more defensive consolidation of liquidity reserves.

That pivot matters. When the issuer of the market’s dominant stablecoin tightens its belt, liquidity often shuffles out of the peripheral sectors. But this seems to be a sector-specific trim, not a wholesale decluttering spree.

While broad venture funding slows, smart money is sprinting into infrastructure that directly upgrades Bitcoin’s base layer.

It’s a vivid contrast. As Tether exercises caution on wider tech bets, capital floods into protocols that fix Bitcoin’s historic scalability issues. The market isn’t chasing Bitcoin killers anymore; it’s funding Bitcoin enablers.

In this new landscape, Bitcoin Hyper ($HYPER) has emerged as a major beneficiary. It’s attracting inflows by promising to solve the blockchain trilemma with a high-speed architecture. The divergence-Tether consolidating while L2 infrastructure explodes-suggests investors are prioritizing practical utility over speculative tech in Q1.

Bitcoin Hyper Integrates SVM to Deliver High-Frequency Trading on Layer 2

What’s driving capital away from generalist VC funds and into Bitcoin Hyper?

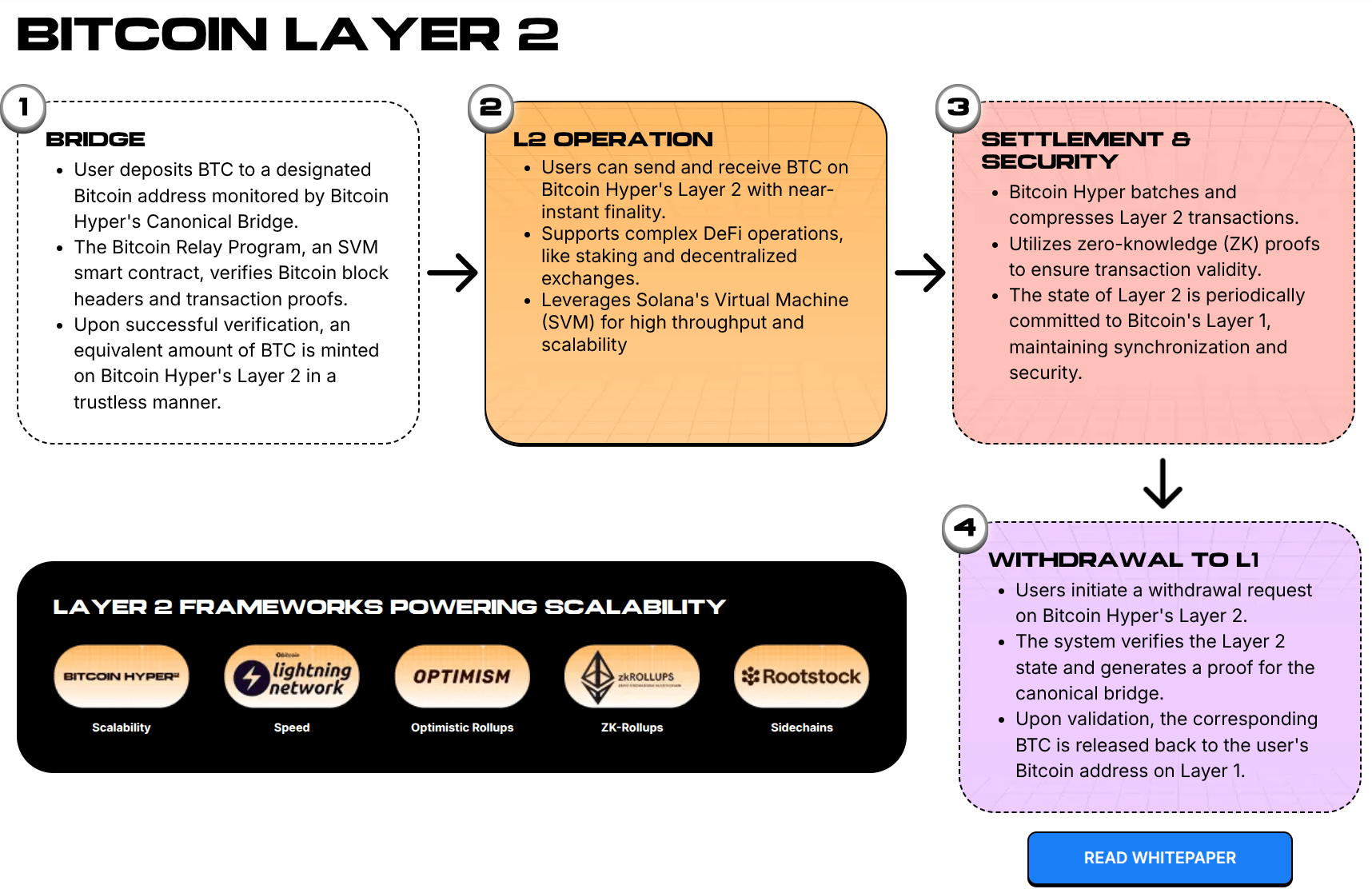

It centers on a key breakthrough: integrating the Solana Virtual Machine directly onto a Bitcoin Layer 2. For years, developers faced a choice between Bitcoin’s security and Solana’s speed. Bitcoin Hyper marries them.

This creates a modular blockchain environment where Bitcoin L1 handles settlement and security, while the SVM-powered L2 manages execution. The result? A network with sub-second finality and negligible gas costs.

That makes high-frequency trading and complex DeFi applications viable on Bitcoin. This isn’t merely a faster chain; it’s a structural overhaul. It allows the $1.5T Bitcoin asset class to be used in programmable, high-speed environments previously reserved for Solana or Ethereum.

The architecture includes a decentralized Canonical Bridge, ensuring trustless transfers of BTC into the ecosystem. By supporting SPL-compatible tokens modified for L2, Bitcoin Hyper opens the door for Rust developers to build dApps on Bitcoin without wrestling with archaic scripting languages.

That’s huge because it lowers the barrier to entry for institutional-grade applications, from gaming dApps to sophisticated lending protocols, to launch natively on Bitcoin.

FIND OUT HOW TO BUY $HYPER HERE

Presale Data Signals Institutional Appetite

While Tether rethinks its billions, on-chain data suggests retail investors are already staking their bets within the Bitcoin Hyper ecosystem. The project’s presale has surged past major milestones, with official data showing over $31M raised to date. $HYPER is presenting itself as one of the best crypto buys of the moment.

That level of liquidity during a presale phase is unusual; frankly, it points to deep conviction from early backers regarding demand for a scalable Bitcoin L2. The current price point of $0.0136751 per token still creates a low-entry barrier that’s likely to attract even more volume, especially with staking rewards of around 37% on offer.

The capital inflow aligns with the broader market thesis: yield and utility are migrating toward Bitcoin. With staking programs offering high APY (and a 7-day vesting period for presale stakers), the protocol nudges long-term lock-ups over quick flips.

As money moves away from stagnant VC deals and into active infrastructure, Bitcoin Hyper appears poised to capture the liquidity seeking the next evolution of Bitcoin.

BUY YOUR $HYPER HERE

Read More

- Silver Rate Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Gold Rate Forecast

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- 🚨 Senate Drops Crypto Bill: CFTC to the Rescue? 🚨

2026-02-04 20:23