Well, old chap, it seems Bitcoin‘s sugar rush has come to an abrupt end. By Monday afternoon, the poor thing had sunk to a dismal $107,700, wiping out its entire weekend gain and posting a 0.8 percent 24-hour loss. Ethereum, that faithful sidekick, mirrored the slide at –0.6 percent, while those mid-caps Solana, Dogecoin, and Sui gave back 1–2 percent. The lone rebel, XRP, was up more than 2 percent, powered by its own legal-saga tailwinds. It’s a feeling of déjà vu, if you will, for Bitcoin holders – every time the old girl gets some momentum behind her, Trump starts another round of tariff terrors and momentum slides away.

Tariffs From 0-to-25 in 280 Characters, or How to Start a Trade War with a Tweet

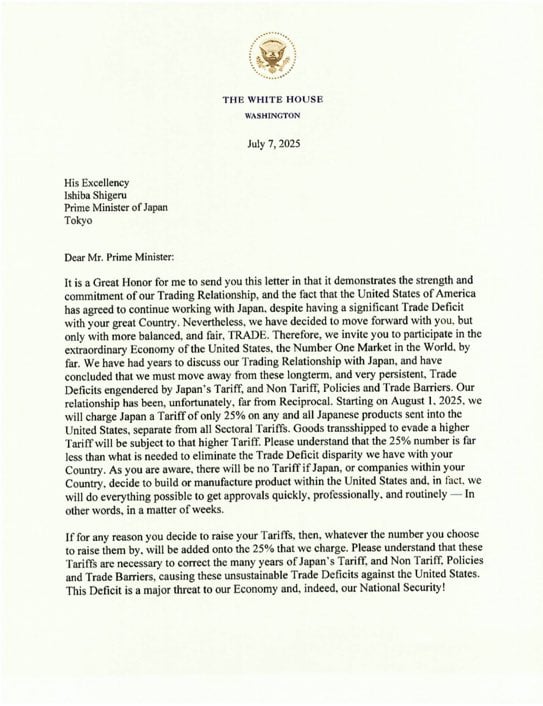

The spark that set off this whole kerfuffle was another Twitter-but-for-presidents blast from Donald Trump’s Truth Social posts, revealing 25 percent levies on imports from Japan and South Korea starting August 1. Letters to Kazakhstan and Malaysia carried the same 25 percent sting; South Africa drew 30 percent; Myanmar and Laos, 40 percent. The White House simultaneously moved its self-imposed trade-deal deadline from July 9 to August 1, buying time for frenetic negotiations – and for markets to sweat, of course.

In a separate volley, Trump threatened an extra 10 percent tariff on any country that “aligns with the anti-American policies of the BRICS.” BRICS – now an 11-nation bloc spanning from Brazil to Saudi Arabia – was wrapping day one of a Rio summit when the threat landed. One can only imagine the looks on their faces – a mix of shock, horror, and “oh dear, not again.”

Press Secretary Karoline Leavitt hinted that more letters are “in the mail,” stoking fears that the tariff net could soon cover most of Asia and Africa. Investors, being the nervous Nellies they are, translated that into higher input costs and stickier inflation, dumping risk assets accordingly.

Macro Dominoes: Stocks, Bonds, and the Fear Trade

Wall Street, never one to miss a cue, heard the message loud and clear. The S&P 500 and Nasdaq each fell roughly 1 percent, while the 10-year Treasury yield poked above 4.35 percent – its highest level since early May – as bond traders braced for another inflation pulse. That environment, my friends, is kryptonite for speculative bets: higher yields make holding dollars more attractive and tighten global liquidity. Crypto, still a teenager in macro-cycle years, duly flinched.

A Tariff on Your Friends? How to Win Enemies and Influence People (Not)

Targeting Japan and South Korea – America’s long-time security allies – sent an especially jarring signal. Tokyo and Seoul supply everything from EV batteries to semiconductor etchers. Slapping 25 percent on that pipeline is the policy equivalent of eating your seed corn. The move also complicates U.S. efforts to build a “Chip-Four” alliance (U.S., Japan, South Korea, Taiwan) to blunt China’s semiconductor rise. If South Korean giants Samsung and SK Hynix decide Washington is a fickle partner, expect more fabs on Chinese soil – precisely what the Biden-era CHIPS Act tried to prevent.

But, as the saying goes, “when life gives you lemons, make lemonade.” Or, in this case, when Trump gives you tariffs, make a contrarian bet. The tariffs may accelerate de-dollarization, nations feeling the tariff heat could settle bilateral trade in yuan, rupees, or – sacrilege – USDT. Every basis-point shift away from the dollar nudges Bitcoin toward reserve-asset respectability, even if the first-day reaction is a panic sell-off. In other words, Monday’s drop might be the dress rehearsal for a long-term bullish narrative. So, yes, now could still be a good time to buy Bitcoin and crypto. But do keep a stiff upper lip, old chap.

Crypto Micro-Moves: Why XRP Outshone the Pack

While Bitcoin and ether slipped, XRP’s 2 percent pop underscored that protocol-specific catalysts can override macro gloom. In Ripple news, rumors swirl that Ripple’s long-running SEC case may settle this quarter, potentially unlocking U.S. exchange relistings. If that happens, the token’s relative insulation from tariff-driven dollar moves could make it a quirky hedge within the crypto basket. The XRP price could be set to outperform, if you will.

Looking Down the Barrel of August 1

The new drop-dead date matters, old bean. If no trade pacts materialize, $150 billion-plus in Asian exports will be taxed overnight. Multinationals racing to front-load shipments could jam West Coast ports next month, echoing the 2020 supply-chain crunch. That’s inflationary for Main Street and liquidity-draining for markets – a double whammy Bitcoin typically hates in the short run.

Traders now eye support around $105,000. A decisive break could open the slide toward the psychological $100,000 handle, last visited in early May. Conversely, any hint of tariff detente – or a softer-than-expected July CPI print on July 12 – could hand Bitcoin the narrative ammo to reclaim $110,000 and push on to new all-time highs. Our Bitcoin price prediction remains new all-time highs sooner, not later.

The Bigger Picture: Trade Wars, Currency Wars, Value Wars

2018’s tariff skirmish was about steel and soybeans. 2025’s version feels existential: align with Washington or face the bill. That binary proposition pushes the U.S. vs BRICS fault line into everyday commerce, from phones to shoes. History says tariff wars rarely end neatly – they morph into currency wars, and Bitcoin’s birth in 2009 was itself a reaction to fiat chaos.

In the near term, Bitcoin remains hostage to macro headlines. But if the tariff drumbeat hastens a multipolar trading system, the blockchain native that settles anywhere, anytime, looks less like a speculative toy and more like an escape hatch. Monday’s dip could be Mr. Market temporarily mispricing that insurance. So, keep calm and carry on, old chap. The show is far from over.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Brent Oil Forecast

- ETH Does What Now?! 😱

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- Crypto Drama: A16Z’s $55M Bet on LayerZero – Will It Pay Off? 💰😱

- Pi Network’s New Apps: The Future of Crypto or Just Another Snake Game? 🐍

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

- EUR MXN PREDICTION

2025-07-08 01:20