U.S. equities, like weary peasants trudging through a blizzard, slumped late Thursday, their spirits dampened by the twin specters of rising oil prices and the Federal Reserve’s cryptic whispers. Geopolitical tensions, that old nemesis of calm, further stirred the pot, tempering the previous day’s AI-fueled euphoria, which had briefly made technologists feel like kings of the mountain.

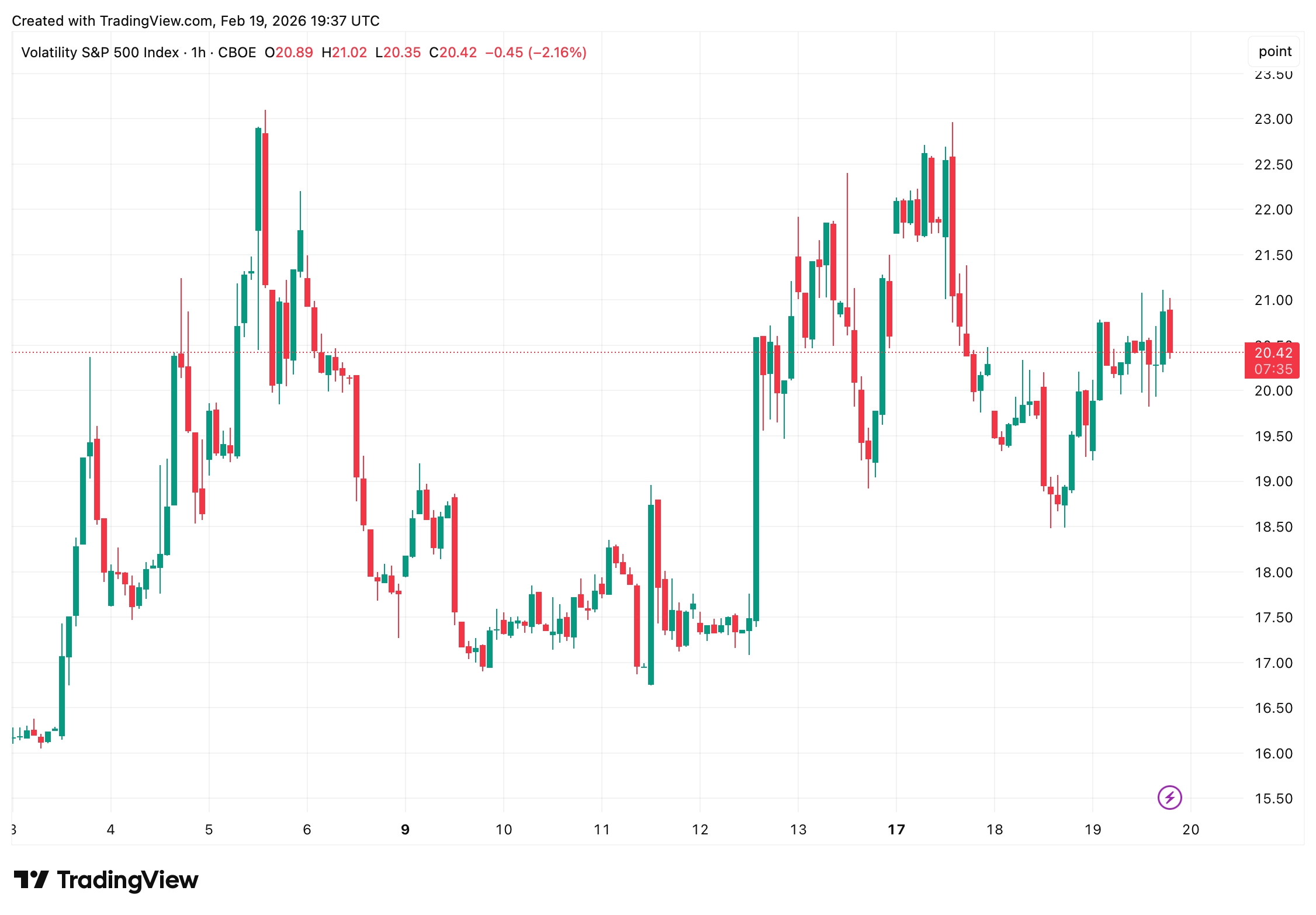

As the clock struck 3:30 p.m. EST on Feb. 19, the Dow Jones Industrial Average languished at 49,349, a 0.63% descent that would have made a Russian peasant weep for joy. The S&P 500 stumbled 0.41%, and the Nasdaq Composite followed suit with a 0.47% drop. The CBOE Volatility Index, ever the dramatic flair, rose 4% to 20.41, as if to say, “Behold, uncertainty reigns!”

The prior day’s rally, fueled by AI’s golden promises, had left investors giddy. Technology shares, like drunkards at a wedding, had danced their way to a 0.8% Nasdaq gain. Yet, as Tolstoy might muse, “All happiness is fleeting, and all markets are fickle.” The Dow, in its wisdom, had seen fewer than two-thirds of its components rise-proof that not even a feast can satisfy every guest.

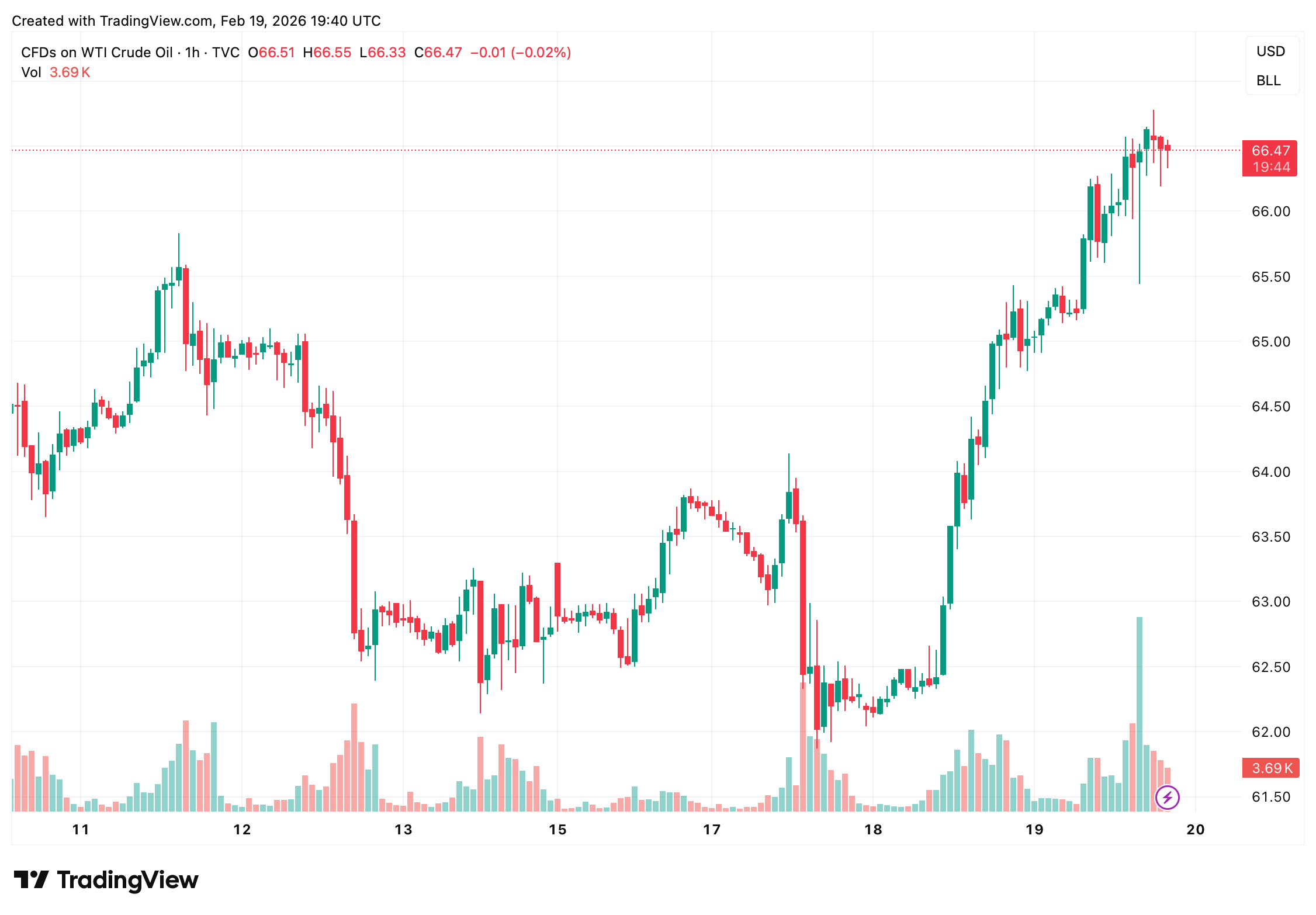

Energy markets, that ancient Greek chorus, now sang a different tune. U.S. crude oil, with the audacity of a young upstart, surged 2% to $66.52 per barrel, a six-month high. Rumors of President Donald Trump’s impending military decision-whether to strike Iran or merely to strike a pose-had investors clutching their wallets. Energy stocks, emboldened, rallied, while the broader market whispered, “Caution, dear friends, caution.”

Corporate earnings, that old masquerade ball, brought mixed gifts. Walmart, ever the pragmatist, reported results better than expected but offered a guidance so meager it would have made a beggar blush. Deere, however, danced in the spotlight, rising 11% after outperforming, as if to say, “Even in winter, some seeds grow.”

Economic data, like a stubborn old horse, refused to be tamed. Manufacturing output rose 0.7%, housing starts jumped 6.2%, and jobless claims clung to 223,000. Yet the Fed, that grand inquisitor of inflation, hinted at potential rate hikes, as if to say, “Do not get too comfortable, for winter may yet return.”

The 10-year Treasury yield lingered near 4.07%, while the U.S. dollar index, ever the opportunist, climbed 0.2% to 97.90. Futures markets, with the foresight of a soothsayer, priced in two rate cuts in 2026-though, as Tolstoy might add, “Hope springs eternal, but data has a way of dousing it.”

Friday’s Personal Consumption Expenditures report loomed, the Fed’s favored oracle. Core PCE, expected to rise 3% year-over-year, would either bless the market with relief or curse it with restraint. Meanwhile, after-hours earnings from Booking, Block, Intuit, and Rivian threatened to stir the pot further, as if the market needed more chaos.

With geopolitical tensions simmering and inflation data pending, the market, like a horseman galloping into the unknown, braced for volatility. The week’s close promised drama, as if the gods of finance had decided to stage a tragedy in four acts.

FAQ ⏱️

- Why are U.S. stocks lower on Feb. 19, 2026?

Stocks, like a peasant’s wages, are modestly down due to rising oil prices, geopolitical tensions, and the looming shadow of key inflation data. - What is the Dow Jones level in late trading?

The Dow Jones Industrial Average, in its infinite wisdom, stood at 49,349, down 314 points, as of 2:30 p.m. EST. - What is core PCE expected to show?

Core Personal Consumption Expenditures inflation, that ever-elusive beast, is forecast at 3% year-over-year, a number that may yet prove as elusive as a snowless winter. - How are oil prices affecting markets?

Crude oil, with the audacity of a young prince, hovers above $66 per barrel, buoying energy stocks while casting a pall over broader risk sentiment.

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Silver Rate Forecast

2026-02-20 00:18