Ah, the grand old American equities, those four dashing chaps, have decided to take a nosedive this week with all the grace of a tipsy butler tumbling down the stairs. It seems our dear President Trump’s latest caper in the trade arena has left our dear investors clutching their pearls and wondering if the game is truly afoot.

When the Stock Market Throws a Tantrum, Bitcoin and Gold Roll Out the Red Carpet

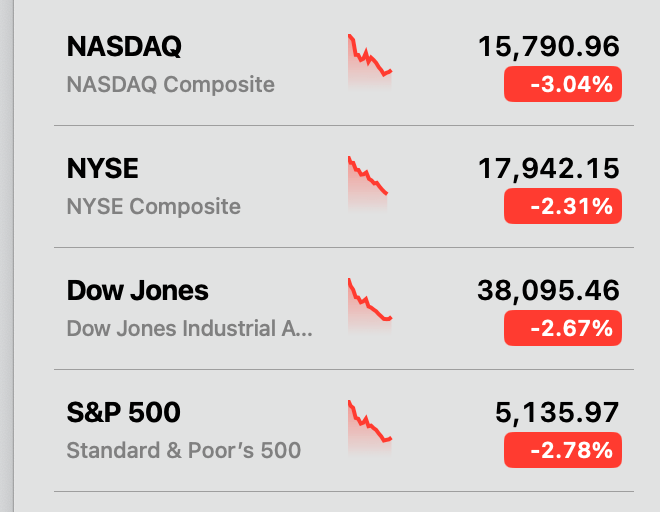

Fleeing faster than Bertie Wooster from Aunt Agatha’s wrath, investors abandoned U.S. assets with a gusto usually reserved for clearing the scene of a party gone awry. The Nasdaq Composite slipped 3%, the NYSE slid 2.31%, the Dow Jones took a tumble of 2.67%, and the S&P 500 tripped down 2.78% by the stroke of 1 p.m. Eastern. Meanwhile, the ICE U.S. Dollar Index performed a limbo under its three-year low of 97.92, only to shimmy back to 98.34. Quite the rollercoaster, old sport. This rare sighting of long-term yields rising while the dollar’s backpedaling suggests the moneyed masses are scratching their heads over the solidity of Uncle Sam’s policy handbook. 🤔

The 10-year Treasury, that stoic old relic, has crept up to 4.40% from a mere 4.34% (what a climb!) and stands head and shoulders above its usual 4.25%. The 20- and 30-year buddies joined the conga line at 4.82% and 4.88%, respectively. Investors are demanding spicier coupons like a diner demanding extra chili sauce, wary of everything from inflation sneaking in like a freeloading guest to political shenanigans rumored to rattle markets—especially since the greenback’s been hanging around that pesky three-year low. Quite the scene, I dare say!

Digital-asset capitalization strutted up over 3% Monday to a whopping $2.75 trillion. Bitcoin flirted with $88,527 on Bitstamp mere moments ago. Ether pranced up by 2.4%, BNB gained a sprightly 2.2%, and dogecoin—bless its heart—wagged up 4%. Market sages suggest this bullish jamboree might just carry Bitcoin to the promised land of $90,000 and beyond, provided the dance continues. Others whisper that BTC has donned the tweed jacket of gold’s digital cousin, proving itself more than just a flashy fad amid global gyrations. Of course, by 1 p.m. ET, BTC cooled its jets a bit, sliding back to a modest $87,200.

Gold kept its upward waltz, perched elegantly above $3,400 an ounce. This shiny fellow’s sprint upward is thanks to the increasingly tense global stage—our old friends, the U.S.-China trade tiff, stagflation concerns that just won’t quit, and geopolitical fireworks from Eastern Europe to the Middle East. Investors, ever the drama queens, are cozying up to bullion as their go-to refuge, like a warm brandy on a chilly night.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Unleashing the XRP Kraken: Will It Really Reach $15? 🤔🚀

- USD GEL PREDICTION

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- Silver Rate Forecast

- Will BNB’s $600 Wall Finally Crumble? Spoiler: The Hodlers Are Plotting 😉

2025-04-21 21:27