tags, and the content within.

End of Thought (8.18s)

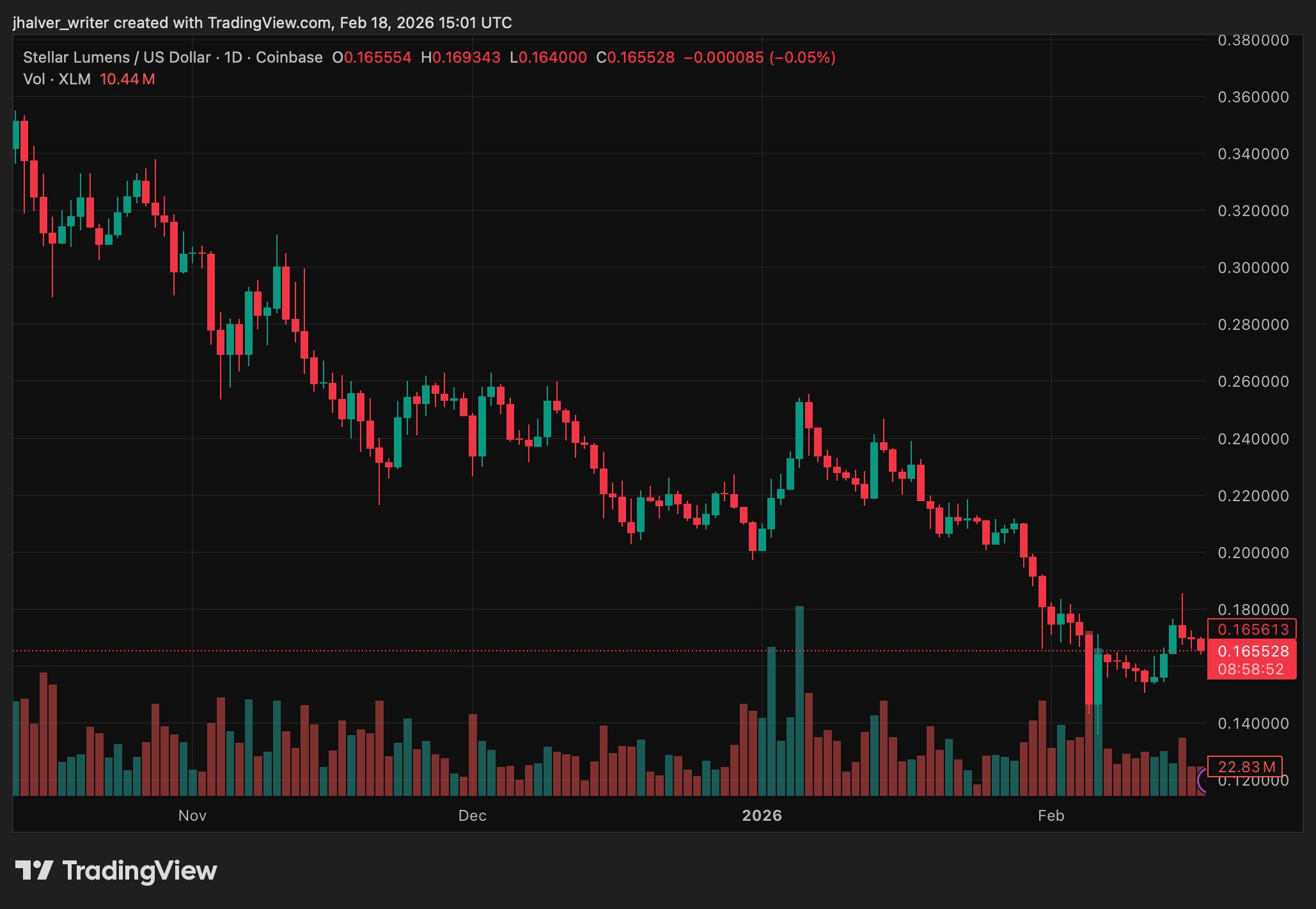

Ode to the downtrodden XLM! Behold, a tale of price fluctuations so dramatic, it would make a tragic playwright weep with envy. After a period of relentless selling, our noble token now seeks solace near its support levels, as if begging the market for mercy.

Alas, the resistance remains unyielding, and the price languishes in a consolidation phase, much like a man trapped in a social gathering he regrets attending. Analysts, those modern-day sages, whisper of a possible recovery, yet their words echo hollowly amid the bearish whispers of derivatives markets.

Currently, XLM dangles at $0.16-$0.17, a price so low it might as well be a joke told by a disgruntled investor. The token’s ability to hold this support? A test of patience, akin to waiting for a punchline that never arrives.

The Market’s Divided Heart: A Tragicomedy

Traders, those fickle lovers of finance, remain split on Stellar’s fate. Funding rates turn negative, a sign that shorts reign supreme, while the long-to-short ratio languishes below one, a testament to the market’s cautious waltz of uncertainty.

Yet, amid this chaos, spot and futures markets dance in balance, a curious indecision that suggests no one truly knows the plot. Whales, those enigmatic figures, may be accumulating, but their intentions remain as clear as a foggy morning in Paris.

The recent rejection at the descending trendline? A cruel joke, capping upside momentum. Yet, price stability hints at weakening selling pressure-like a drunkard finally finding his footing, albeit wobbly.

Technical Indicators: A Fickle Courtier

The RSI, that fickle courtier, now dances in neutral territory, a precarious balance between hope and despair. A move above 50? A spark of optimism, though likely to be extinguished by the next market whim.

The MACD, once a harbinger of doom, now stabilizes, hinting at a potential bullish shift. Bollinger Bands, those capricious judges, place XLM in the mid-range, a testament to the market’s indecisive nature.

Resistance looms overhead, a descending trendline and 50-day MA at $0.19-$0.20. A breakout? A dream as fleeting as a candle’s flame in a hurricane.

March Outlook: A Gamble on $0.20

In a world where hope is a currency, holding $0.16-$0.165 could see XLM climb to $0.18, a modest victory. Yet, to retest $0.20? A quixotic endeavor requiring stronger buying volume and a market in a better mood.

Failure to defend support? A descent to $0.136, a fate as grim as a forgotten sonnet. The market, that mercurial lover, remains locked in a decisive range, its next move as unpredictable as a Molière character’s final line.

Cover image from ChatGPT, XLMUSD chart on Tradingview

Read More

- Gold Rate Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Silver Rate Forecast

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

2026-02-19 11:41