Markets

What to know:

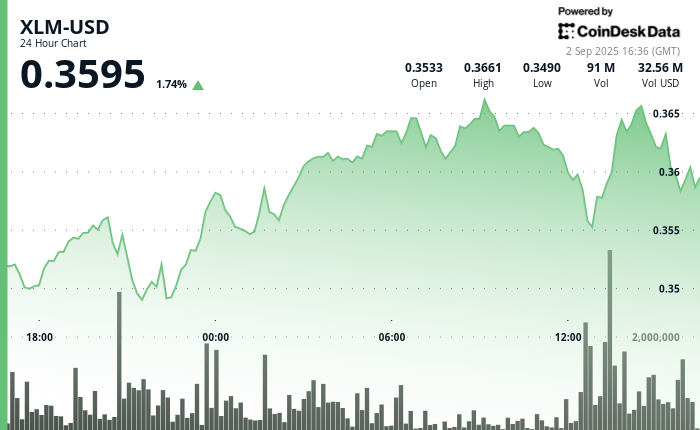

- XLM, that fickle lover of fortune, climbed 3% from Sept. 1-2, breaking through $0.37 resistance with the grace of a courtier dodging a sword. 🗡️💰

- Bithumb and Upbit, those diligent scribes, will pause deposits and withdrawals on Sept. 3 to support Stellar’s Protocol 23, a grand scheme as mysterious as a philosopher’s riddle. 🧠✨

- The upgrade aligns with $460 million in tokenized assets, a sum so vast it could fund a kingdom… or at least a very wealthy noble. 🏰💸

Stellar Lumens (XLM), that perennial flirt with the markets, extended its recent rally over the past 24 hours, climbing 3% as buyers absorbed heightened selling pressure and pushed the token into fresh resistance levels. Between Sept. 1 at 15:00 UTC and Sept. 2 at 14:00 UTC, XLM advanced from $0.36 to $0.36, with volatility of 5% underscoring active participation-though one might call it a mere dance of chaos. 🕺🌀

The asset found support at $0.35 following a brief wave of selling before consolidating in the $0.36 range. Resistance emerged around $0.37, where the market saw two rejection points, though trading volumes above the daily average of 31.2 million tokens signaled sustained institutional interest-though “sustained” might be a generous term for these folks. 🤷♂️📊

The bullish structure carried into the final hour of the session, when XLM gained 2% from $0.36 to $0.37. The move was bolstered by a volume spike of 2.7 million units at 14:00 UTC, enabling the token to briefly pierce the $0.37 ceiling before stabilizing above $0.36. The breakout reinforced the 24-hour trend and suggested buyers are building a foundation for further upside if volume momentum continues-though let’s not get too hopeful. 🚀📈

At the same time, leading South Korean exchanges Bithumb and Upbit said they will suspend XLM deposits and withdrawals beginning Sept. 3 at 09:00 UTC. The move is part of preparations for Stellar’s Protocol 23 upgrade, which aims to modernize network infrastructure and expand interoperability-because nothing says “innovation” like a 3% rise. 🤖🛠️

Protocol 23 has been framed as a step toward broadening Stellar’s utility for real-world assets, of which roughly $460 million are already circulating on the network. The synchronization of price gains with network enhancements highlights a growing narrative of enterprise adoption-though one might argue it’s more of a narrative than a reality. 📈💼

CoinDesk Data‘s technical analysis model note that the consolidation above $0.36, combined with systematic accumulation around key support levels, points to ongoing institutional positioning that could pave the way for a sustained move beyond $0.37. But let’s not forget: the markets are as predictable as a Shakespearean comedy. 🎭🎭

Market Analysis Reveals Strengthening Corporate Interest

- Price established fundamental support at $0.35 during heightened selling pressure on September 1, 21:00. A valiant effort, if not a bit dramatic. 🎭

- Robust accumulation activity developed between $0.36-$0.36 following decisive market recovery. A tale of two prices, or perhaps one price with a split personality. 🤯

- Resistance parameters identified at $0.37-$0.37 where price encountered dual rejection events. A double rejection? How unoriginal! 🤡

- Trading volume increases above 24-hour average of 31.20 million validated institutional market participation. Or, as I call it, “the rich playing with toys.” 💰

- Asset maintaining consolidation within ascending price channel formation. An ascending channel? How pedestrian. 🚶♂️

- Breakout potential above $0.37 resistance dependent upon sustained volume validation. Sustained? We’ll believe it when we see it. 🤔

- Trading momentum accelerated during 13:35-13:46 session with decisive upward movement. A decisive upward movement? How thrilling! 🎉

- Enhanced support structure established around $0.36-$0.36 price levels. A support structure? More like a crutch. 🦵

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- Brent Oil Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- KuCoin’s Bold Foray Into Thailand: Crypto Drama Meets Tropical Charm! 🐘💸

- How I Lost $1.25M Talking to Myself (And Thought It Was MrBeast) 😂💸

2025-09-02 20:57