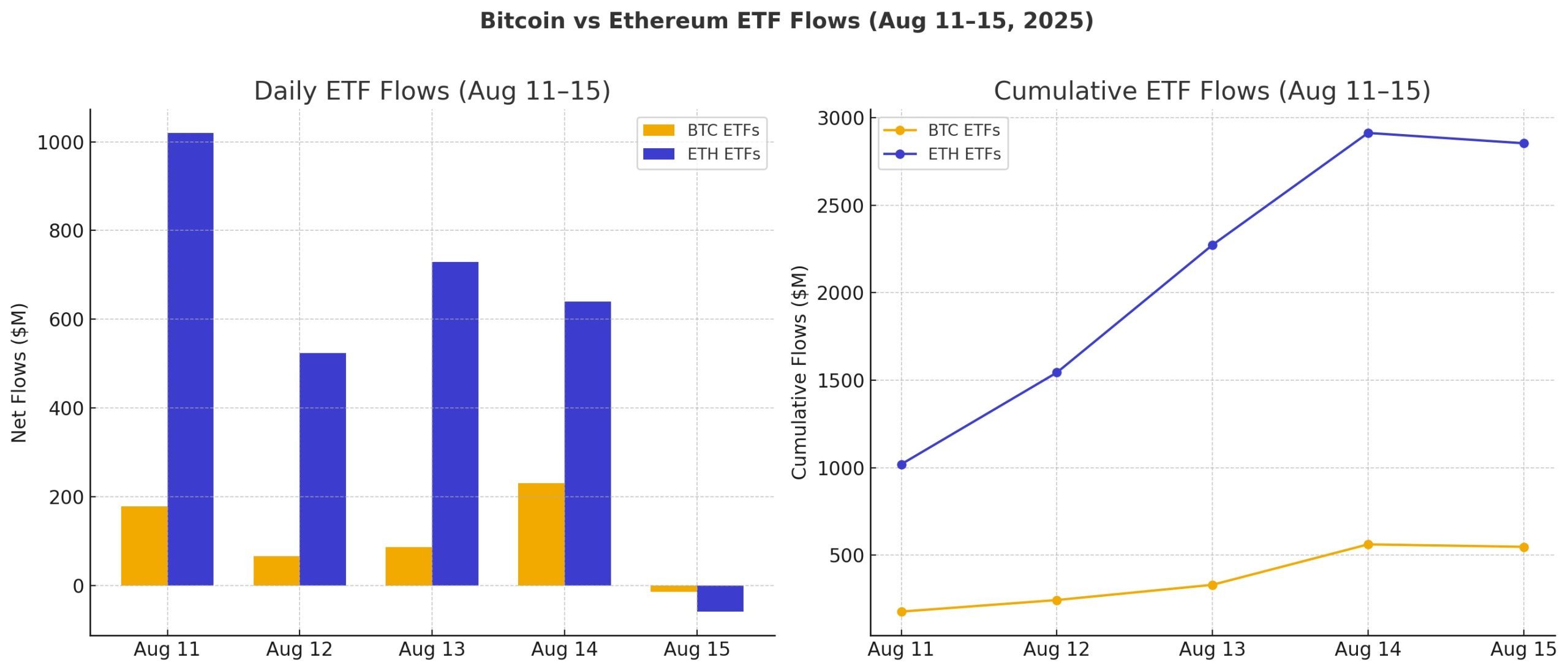

In the dusty plains of the crypto world, where dreams and investments often collide, ether ETFs had a week to remember, raking in a whopping $2.85 billion. Meanwhile, bitcoin ETFs, like a tired old mule, managed a modest $548 million, trailing behind like a shadow.

The Great Divide: Ether ETFs Rise, Bitcoin ETFs Yawn

The week of Aug. 11-15 was a tale of two cryptocurrencies. While ether ETFs basked in the glory of unprecedented inflows, bitcoin ETFs seemed to be taking a much-needed nap. Investors, with wallets as deep as the Salinas Valley, poured their hard-earned cash into ether, signaling a shift in the institutional landscape.

Bitcoin, once the king of the hill, watched as ether ETFs had their moment in the sun, locking in $2.85 billion in inflows. Blackrock’s ETHA led the charge with a staggering $2.32 billion, followed by Fidelity’s FETH at $361.23 million. It was a sight to behold, like a farmer watching his crops grow taller than the barn.

Grayscale’s Ether Mini Trust brought in $219.58 million, though its ETHE counterpart lost $71.57 million-proof that even in the best of times, there’s always a little rain. Vaneck’s ETHV added $14.36 million, Franklin’s EZET brought in $8.48 million, Invesco’s QETH added $2.26 million, and 21shares’ CETH added $1.26 million. Small numbers, but every bit counts in this game.

On the other side of the ledger, bitcoin ETFs recorded a total of $547.82 million in inflows for the week. Blackrock’s IBIT carried the momentum with $887.82 million, while Grayscale’s Bitcoin Mini Trust picked up $32.97 million, and Invesco’s BTCO added $4.90 million. But even these gains couldn’t hide the fact that some were taking a step back: Ark 21shares’ ARKB (-$183.92 million), Grayscale’s GBTC (-$95.96 million), Fidelity’s FBTC (-$73.78 million), Bitwise’s BITB (-$18.36 million), and Vaneck’s HODL (-$5.85 million) all saw redemptions.

The milestones were clear as day: ether ETFs posted their largest single-day inflow ever on Aug. 11 ($1.02 billion), followed by their second-highest inflow on Aug. 13 ($729 million). Bitcoin ETFs, on the other hand, never crossed the $500 million daily mark. It was like watching a turtle try to keep up with a hare.

Trading volumes told the same story. Ether ETFs traded $14.1 billion across the week, while bitcoin ETFs saw $20.8 billion. But the real kicker was in the net assets: ether’s net assets jumped to $28.15 billion, now sitting at 5.3% of ethereum’s market cap. The data made one thing crystal clear: institutional money is warming rapidly to ether ETFs, with bitcoin left to play defense.

And so, the crypto landscape continues to evolve, with ether ETFs leading the charge and bitcoin ETFs taking a well-deserved rest. It’s a new world out there, and the farmers of finance are planting their seeds in the fertile soil of ether. 🌾💰

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Brent Oil Forecast

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Silver Rate Forecast

2025-08-18 19:08