Good morning, crypto wanderers! ☕ Welcome to yet another episode of “What Did the Financial Wizards Predict Now?” (spoiler: it’s probably the end of money as we know it, again).

If you’ve made it this far into 2024 with your attention span intact, brace yourself—the experts have rolled out their latest fashion forecast, and it’s stablecoins. You know, the digital greenbacks welded to the US dollar, multiplying faster than rabbits at an all-you-can-eat carrot buffet. Apparently, things have gotten so out of hand even the US Treasury is now paying attention, a bit like a chaperone arriving late to an unsupervised teen party.

Stablecoin Market Poised to Balloon to $2 Trillion—And Nobody Knows Who Let It In

The US Treasury Borrowing Advisory Committee (which, let’s be honest, sounds like an organization determined to sabotage dinner parties with economic PowerPoints) peered into their crystal spreadsheet and confidently declared, “Ladies and gentlemen, by 2028, stablecoins will swell to a $2 trillion market cap.”

“Evolving market dynamics, structures, and incentives have the potential to accelerate stablecoins’ trajectory to reach ~$2 trillion in market cap by 2028,” their report dryly intoned—presumably while everyone else at the table was practicing their “interested face.”

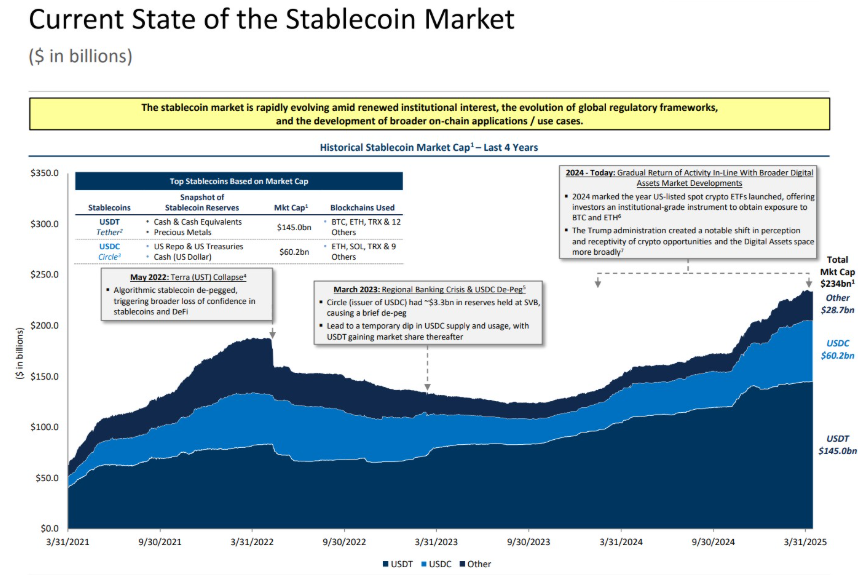

To put that bonkers number in perspective: stablecoins are currently worth $234 billion (peanuts, really), and, not to be dramatic, but the dollar-pegged versions run the joint—99% of the market, like a currency Mean Girls clique.

Tracy Jin, COO over at MEXC exchange (who might actually have a time machine) wagers we could hit that magical $2T milestone by 2026. Elsewhere, Treasury issued a “please-don’t-panic” by reminding everyone that new rules will force stablecoin issuers to hoard short-dated T-bills, as if these mysterious digital creatures were just misunderstood collectors at heart.

Still, not everyone thinks this is a harmless bit of fun. The Treasury warned that banks may have to cough up more interest for everyday depositors, so enjoy getting an extra 0.04% on your savings—woohoo! 🎉

Enter financial Cassandra Max Keiser, known for his uncanny ability to turn dinner conversation apocalyptic. BeInCrypto asked Keiser for comment, and he went straight for the jugular, dropping a warning spicier than a ghost pepper:

“Stablecoins,” announced Max, “are a financial hospice where fiat money like the US dollar goes to die.” I’ll give him this—no one ever accused Max Keiser of mincing words.

His basic take: the more people use stablecoins, the more the US dollar resembles a carton of milk you forgot at the back of the fridge. Eventually, “stablecoins will work the US dollar to death.” So, fun times ahead!

Could Stablecoins Take the Crown from King Dollar? The Bankers Join the Party

Never missing a chance to tie a good currency collapse to the national debt, Keiser mused that increased stablecoin use would shoot US debt skyward, regardless of what your favorite presidential hopeful might be promising.

“It also means that US indebtedness goes up, not down, as Trump has promised,” Max cheerfully added, probably while buying more Bitcoin.

Meanwhile, over in the vest-and-tie section, Geoff Kendrick from Standard Chartered piped up: “Hey, Treasury used our $2 trillion forecast for their own projection! The tail is really wagging the dog now.” — and you know things are upside down when the guy in the pinstripe suit is the one calling out governmental copy-paste tactics.

“Specifically, I think stablecoins will go from $230 billion to $2 trillion by the end of 2028. That growth will require an extra $1.6 trillion of US T-bills to be held as reserves, and that is all of the planned new T-bill issuance over that period,” he predicted soberly, as if anticipating the next spreadsheet-fueled doomsday prophecy.

Just to keep things spicy, Tether—the heavyweight champ of stablecoin issuers—may launch a US-only coin as early as 2025. CEO Paolo Ardoino, presumably wearing sunglasses and surrounded by patriotic bunting, declared in a recent interview:

“We are just exporters of what we believe to be the best product the United States ever created — that is, the US dollar.” A little modesty, Paolo! 🍔🗽

If the snowballing adoption of stablecoins isn’t already giving Wall Street an ulcer, it should, because more of these coins means more legitimacy for the crypto crowd—especially Bitcoin, the grizzled pioneer everyone thought was an oddball but now won’t stop winning awards at family reunions. Traditional investors are flocking to crypto, leaving stodgy old bonds to contemplate their life choices.

Chart of the Day (aka, Look How Big This Thing Is Getting)

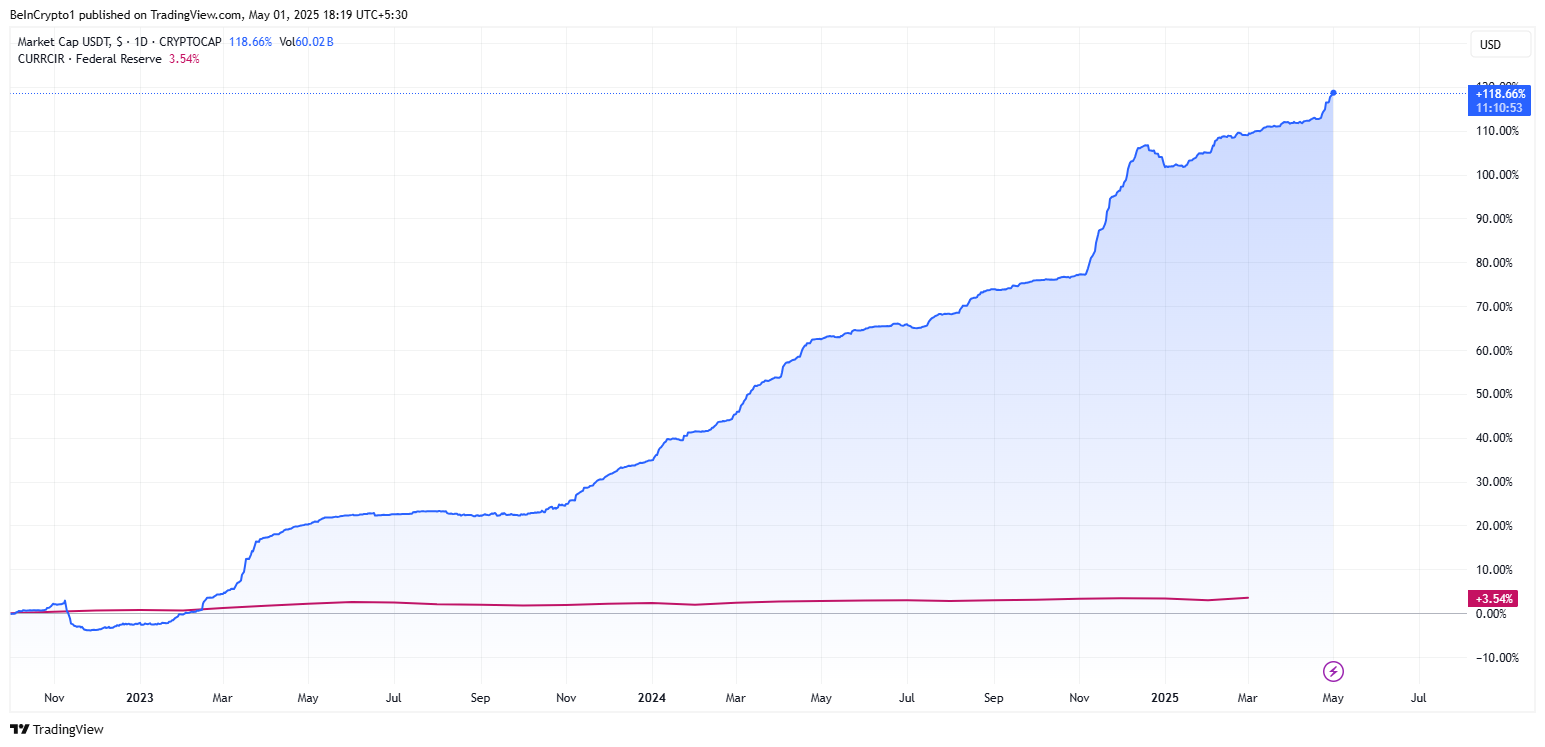

Above, you’ll find a chart. Yes, another chart. (Sorry, it’s a financial story—it’s the law.) That peppy blue line is USDT’s market cap—now the star of the stablecoin show, commanding 60% of the whole digital dollar theme park. Since November 2023, it’s been climbing like a caffeinated squirrel, while the Federal Reserve’s currency in actual circulation looks like it got lost somewhere on the way to relevance.

The upshot: Stablecoins are booming, and the US dollar had better hit the gym—or risk getting replaced by its digital doppelganger.

Crypto Equities Pre-Market: Today in Magical Number Soup 🥣

| Company | At the Close of April 30 | Pre-Market Overview |

| Strategy (MSTR) | $380.11 | $393.91 (+3.63%) |

| Coinbase Global (COIN) | $202.89 | $209.94 (+3.47%) |

| Galaxy Digital Holdings (GLXY.TO) | $21.92 | $22.78 (+3.94%) |

| MARA Holdings (MARA) | $13.37 | $13.95 (+4.34%) |

| Riot Platforms (RIOT) | $7.24 | $7.52 (+3.87%) |

| Core Scientific (CORZ) | $8.10 | $8.65 (+6.79%) |

Read More

- Gold Rate Forecast

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- XRP: The Calm Before the Storm?

- Brent Oil Forecast

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- Silver Rate Forecast

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- You Won’t Believe Why Bitcoin Just Smashed $99K – And What’s Next! 🚀💰

2025-05-01 16:10