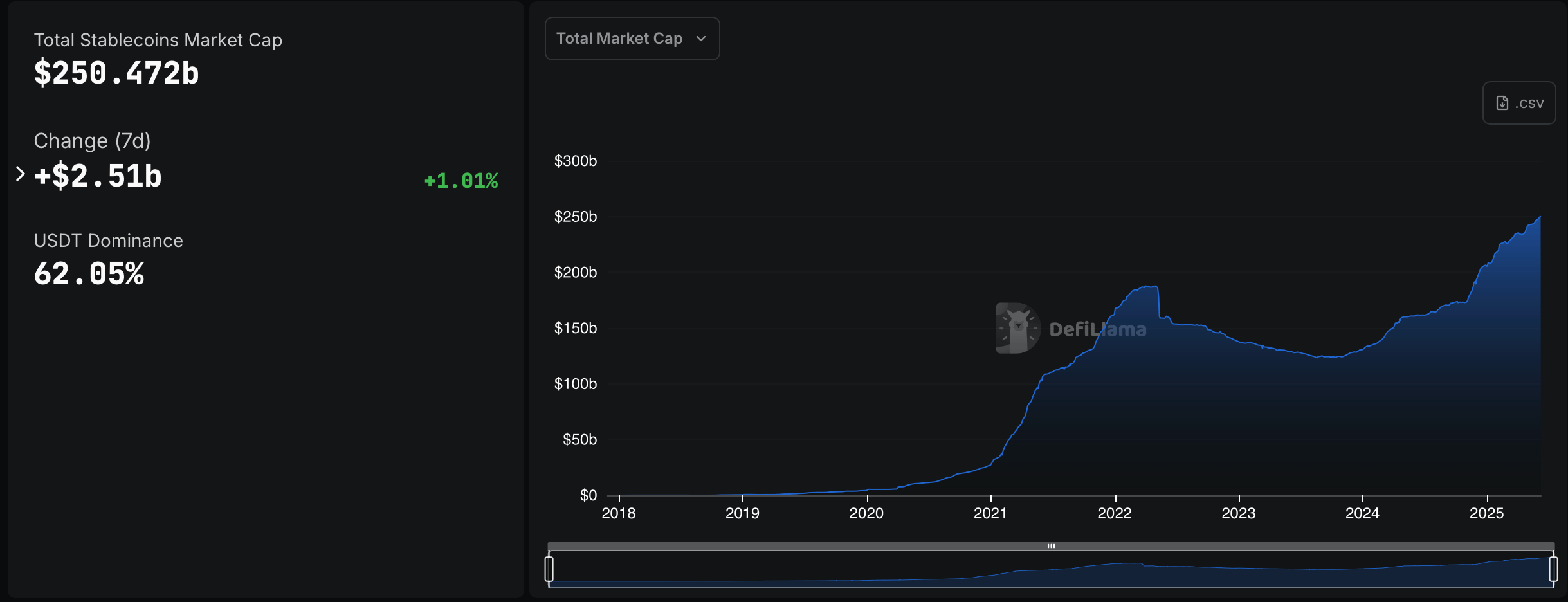

In a dazzling display of digital prowess, the stablecoin realm has catapulted beyond the $250 billion mark, as if propelled by the very winds of fortune themselves. Just last week, a staggering $2.51 billion cascaded into this burgeoning universe of fiat-tethered tokens, like a waterfall of optimism! 💦

For the first time in the annals of crypto history, the stablecoin market has shattered the $250 billion ceiling. According to the oracle of numbers, Defillama.com, the total now stands at a jaw-dropping $250.472 billion, representing a hefty 7.48% slice of the $3.35 trillion crypto pie. And lo and behold, Tether ( USDT) reigns supreme, clutching a commanding 62.05% share like a dragon hoarding gold! 🐉

This meteoric rise coincides with a crypto bull run that seems to have no brakes, as Bitcoin has been lounging comfortably above $100,000 for over a month—what a cozy spot! Meanwhile, the appetite for USDT and USDC is skyrocketing, while rival tokens backed by Treasuries and yield-hungry fiat assets are gaining traction faster than a cat on a hot tin roof! 🐱👤

According to the latest figures, tether ( USDT) leads the pack of stablecoins, boasting a staggering valuation of $155.408 billion. Circle’s USDC follows closely at $60.631 billion, while Ethena’s USDe struts in third with $5.897 billion, reflecting a sharp upward trend—like a rocket on a mission! 🚀 DAI from Sky holds fourth place with $4.354 billion, just edging out Sky’s USDS at $4.05 billion. Talk about a nail-biter!

Blackrock’s BUIDL sits comfortably in sixth place at $2.892 billion, followed by World Liberty Financial’s USD1 at $2.177 billion. Ethena’s second entry, USDTB, is eighth with $1.455 billion, while First Digital’s FDUSD ranks ninth at $1.301 billion. And let’s not forget Paypal’s PYUSD, which rounds out the top ten after recently crossing the $1.004 billion threshold—what a party! 🎉

The swift influx of capital into stablecoins signals not just confidence, but a delightful shift towards on-chain liquidity. As tokenized dollars gain credibility, they are steadily reshaping the financial landscape of crypto. This trend hints at a deeper integration between digital assets and traditional finance (TradFi) markets, suggesting that stablecoins may soon become the backbone of global financial infrastructure. Who knew digital dollars could be so important? 💸

With more players entering the stablecoin arena and capital flooding in, competition among issuers is heating up like a summer barbecue. This dynamic could ignite a wave of innovation as projects vie for supremacy in backing transparency, adoption, and yield mechanics. As the sector matures, the next chapter may be less about dominance and more about how well these digital dollars can dance to the evolving tune of user demands. 💃🕺

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- Mysterious Moves: Crypto Titans’ Bold Bet or Folly? 🤔

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

- Crypto Chaos: Will the White House’s New Report Save the Day? 🤔💰

- Bitcoin’s Price Madness: A Comedy of Bulls and Bears 🎭💰

- Silver Rate Forecast

- Doge Doomed?! 😱🐳

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- When Will the Long Traders Finally Give Up? 🤔

2025-06-09 17:03