A recent report by JPMorgan has rained on the stablecoin parade, predicting that its market size will only reach a paltry $500 billion by 2028 🤑.

This new prediction is a far cry from the optimistic forecasts from some institutions, which anticipated a market capitalization that could reach a whopping $2.5 trillion 🤯.

JPMorgan’s Stablecoin Skepticism

According to JPMorgan’s prediction, the growth of stablecoins is being held back by limited adoption beyond cryptocurrency transactions 📊.

The report indicates that a whopping 88% of the current demand for stablecoins comes from activities within the cryptocurrency ecosystem, such as trading, decentralized finance (DeFi), and reserves held by crypto companies 📈. Meanwhile, only 6% is used for payments, equivalent to approximately $15 billion 💸.

These figures suggest that stablecoins have yet to become a widely used payment tool in the real economy 🤔.

JPMorgan also dismisses the possibility of stablecoins replacing traditional money in the short term 💸. The reasons cited include a lack of attractive yields and barriers to converting between fiat currency and cryptocurrencies 🚫. However, a survey revealed that 49% of the 259 global institutions surveyed currently use stablecoins for payments, while another 41% are in the testing or planning stages 📊.

Furthermore, the bank argues that models such as the digital Chinese yuan (e-CNY) expansion or the success of Alipay and WeChat Pay are not templates for the future development of stablecoins 🚫.

Nevertheless, several forecasts have been more optimistic about the future of the stablecoin market 🌟. The US Treasury Secretary Scott Bessent previously predicted that the USD-backed stablecoin market could surpass $2 trillion by 2028, thanks to clear regulations like the GENIUS Act, passed by the US Senate in June 2025 📜.

Another report from BeInCrypto also projects that the stablecoin market size could reach $2.5 trillion, driven by increasing interest from financial institutions and the integration of stablecoins into commercial transactions 📈.

The Stablecoin Market: A Mixed Bag

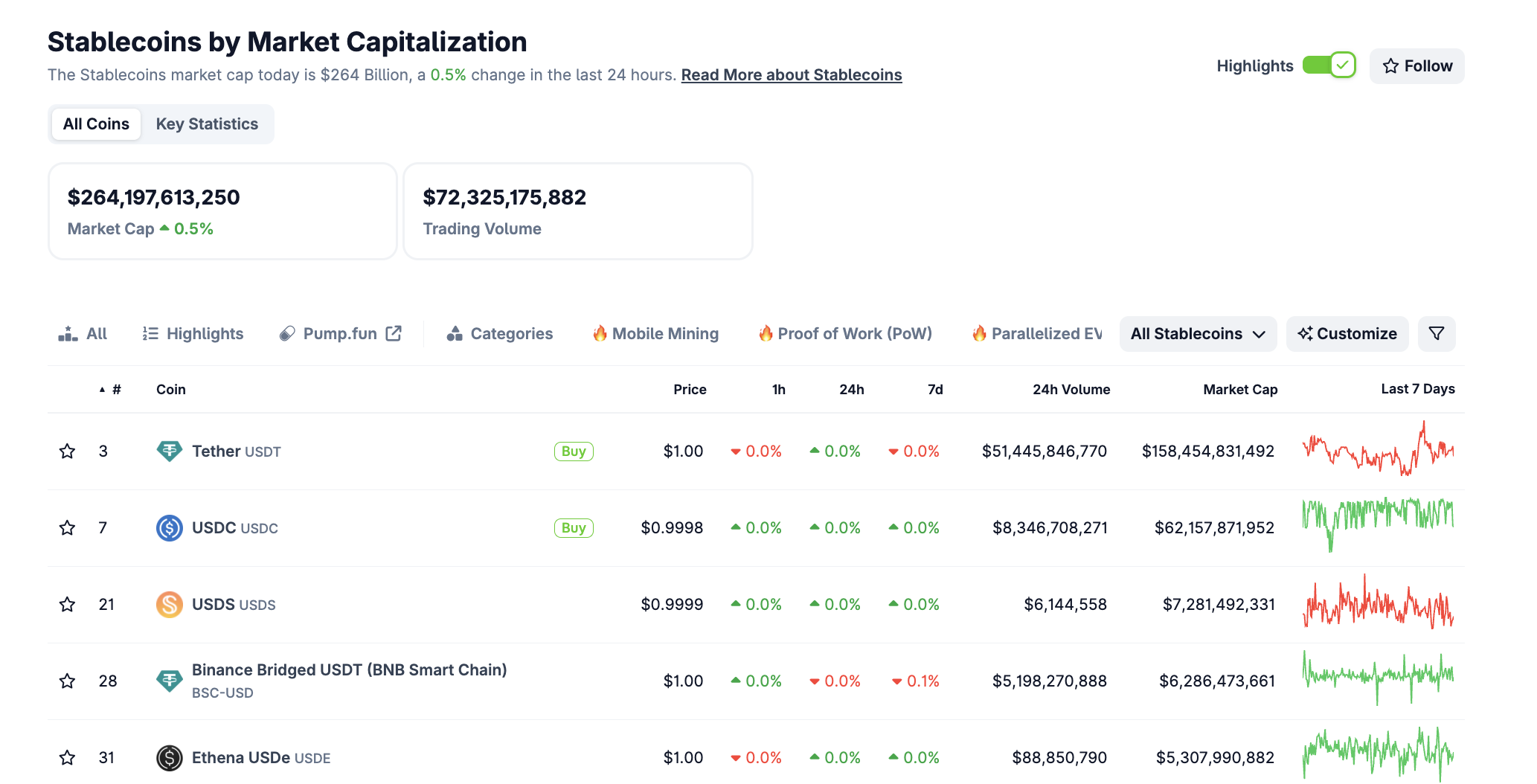

This divergence reflects differing perspectives on the potential of stablecoins, raising questions about the ability of this digital asset class to integrate into the traditional financial system 🤔. Nevertheless, the stablecoin market is still witnessing unprecedented growth, with a market capitalization exceeding $264 billion 🚀.

The dominance of stablecoins in over-the-counter (OTC) cryptocurrency trading is also a positive sign 📈. According to Finery Markets, stablecoins now account for 74.6% of institutions’ total OTC trading volume in the first half of 2025, a significant increase from 46% the previous year to just 23% in 2023 📊.

“The true potential of stablecoins is unlocked by seamlessly connecting issuance with active, deep secondary markets. For stablecoins to achieve widespread utility and confidence, they must be highly liquid, easily tradable, and legally sound across diverse liquidity pools and various secondary venues.” Finery Markets’ report added 📜.

This indicates that stablecoins are increasingly becoming critical tools in financial transactions, particularly cross-border transactions and fast payments 💸.

Read More

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Silver Rate Forecast

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- XRP’s DeFi Adventure: The Liquidity Awakens! 🚀💸

- Bitcoin Fever: Taiwan Watchmaker Turns to Crypto for Glory and Giggles

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Ethereum Whales Stumble, But Still Bet Big! 💸💰

2025-07-04 14:36