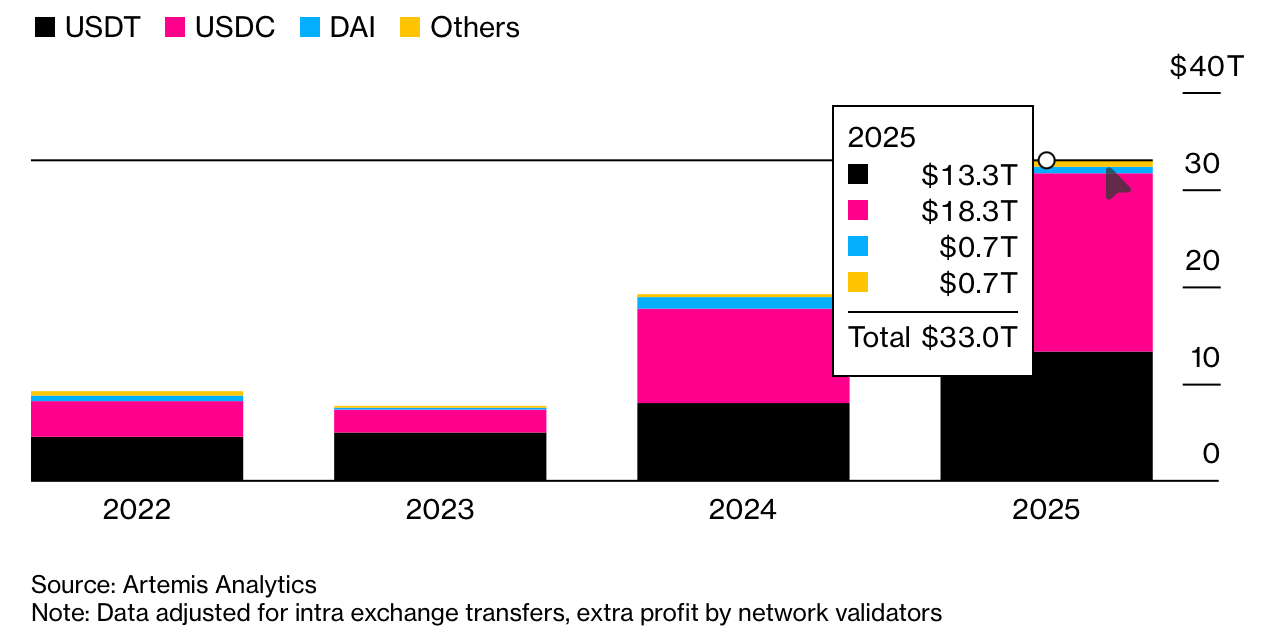

Well butter my biscuits and call me a blockchain! Stablecoin volumes done skyrocketed to a mind-bogglin’ $33 trillion faster than a politician changes promises. Seems Uncle Sam’s new crypto-friendly policies got folks throwin’ digital dollars around like confetti at a banker’s funeral. USDC’s leadin’ the charge while USDT’s still sittin’ fat and happy on its market cap throne – some things never change, like my distrust of centralized money printers.

Stablecoins: The Government-Approved Casino Chips 🎰

According to them fancy Artemis Analytics folks (who probably wear monocles), stablecoin usage done exploded like a poorly coded smart contract – up 72% year over year to $33 trillion. Turns out when President Trump Jr. or whoever’s runnin’ the circus these days says “crypto’s dandy,” Wall Street comes runnin’ faster than a scalded dog.

USDC’s doin’ the hoedown with $18.3 trillion in transactions, while Tether’s USDT – that mysterious stablecoin we all pretend is fully backed – hauled in $13.3 trillion. Together they’re dominatin’ the scene like two drunk uncles at a family reunion.

Then came the “Genius Act” (named either ironically or by someone who failed naming class). This legislative masterpiece made stablecoins legal tender for bribes – I mean, “institutional transactions.” Now even Walmart’s gettin’ in on the action, probably plannin’ to pay their employees in WallyCoin™ (redeemable for 10% off toilet paper).

Funny thing – while volumes are up, decentralized platforms are gettin’ less action than a librarian at a biker rally. Seems the big boys want their stablecoins centralized, regulated, and as exciting as watching paint dry on a blockchain.

USDT’s still king by market cap ($187 billion and countin’), probably because it’s the preferred currency for shady backroom deals and offshore accounts. Meanwhile USDC’s the goody-two-shoes of the bunch, dominatin’ them fancy DeFi platforms where folks pretend they’re revolutionaries while sippin’ $8 lattes.

And bless their hearts, the growth ain’t slowin’ down! Q4 alone saw $11 trillion in stablecoin action – enough to buy Twitter 37 times or fund another season of “The Apprentice.” Bloomberg’s predictin’ $56 trillion by 2030, which coincidentally is about when they say USDT might actually get around to that audit.

FAQ (Frequently Avoided Questions) 💸

• Why’d stablecoins go bonkers in 2025?

Same reason dogs lick themselves – because they can! Also something about “institutional adoption” and politicians discoverin’ crypto donations.

• Who’s winnin’ the stablecoin race?

USDC’s leadin’ in transactions while USDT’s winnin’ in “creative accounting” – I mean market cap.

• Why’s USDT still the big cheese?

Same reason cockroaches survive nuclear wars – adaptability and nobody askin’ too many questions.

• Where’s all this stablecoin action happenin’?

Less in DeFi, more in “real world” applications like corporate bonuses and paying off politicians – allegedly.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- When Will the Long Traders Finally Give Up? 🤔

- Crypto Clash: Bitcoin, Ethereum, or Solana – Who’s the September Superstar? 🌟

- Bitcoin’s Price Madness: A Comedy of Bulls and Bears 🎭💰

- PLUME: 60% Down?! 😱

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- Ethereum’s Fee Fiasco: When Blockchains Play Hard to Get! 🤡

- USD THB PREDICTION

- How Ethereum Became the Unexpected Hero of AI Finance 🚀💰

2026-01-10 08:58