Remember when Africa’s crypto scene was just a Bitcoin fan club? Well, hold onto your hats, folks, because the plot has THICKENED! Chris Maurice, the big cheese over at Yellow Card, is here to spill the beans about how they’re putting stablecoins on the map. And guess what? It’s not just another tech trend—this is a financial lifeline! 🍞💰

In a jaw-dropping exclusive with BeInCrypto (it’s like the gossip column for crypto insiders, right?), Maurice dishes out how Yellow Card is creating a stablecoin network across Africa that’s about to leapfrog traditional finance faster than I can say “blockchain.” It’s a wild ride fueled by clearer regulations, crumbling fiat systems, and let’s not forget the epic remittance revolution. 🚀💸

Stablecoins: Africa’s Financial Superheroes!

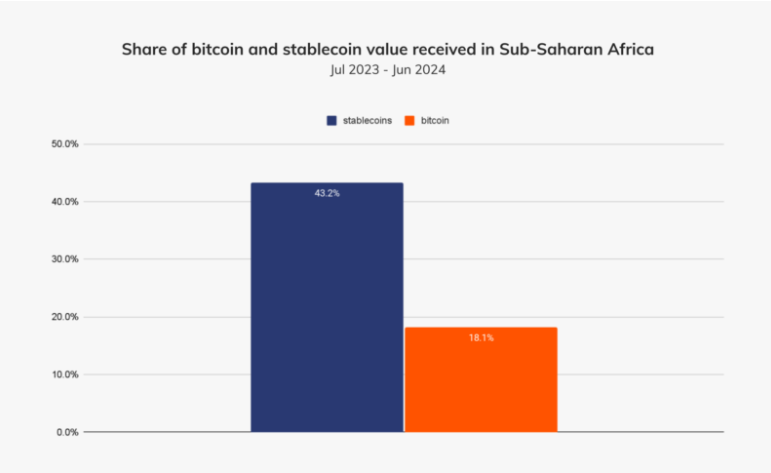

They’re not just serving coffee in over 20 markets; stablecoins are booming! Apparently, they’re responsible for over 99% of Yellow Card’s transactions. That makes them the big deal in a financial landscape that’s about to get a serious makeover. 💄💅

“When we first launched Yellow Card in 2019, people were exclusively buying Bitcoin. Now, the most popular asset is Tether (USDT),” Maurice explained, probably while sipping a fancy latte. ☕💸

Here’s the kicker: Africans are not chasing volatile dreams like they’re on a pogo stick. They’re choosing stablecoins because REALITY is knocking at their doors. Africa has the highest peer-to-peer (P2P) crypto trading volume in the world. While others are flipping coins for fun, these folks are hustling for survival. Talk about a different vibe! 🌍💪

And oh boy, those local currencies are under siege from inflation (looking at you, Nigeria!). With stablecoins in their arsenal, they’re keeping value safe and making cross-border payments feel like a walk in the park. 🌳💵

“Stablecoins are solving practical financial services challenges in Africa. People aren’t in love with the tech. They need faster, cheaper ways to move money to survive and thrive,” Maurice quipped, and honestly, who can blame them? ⏩💸

Infrastructure That Says “NO BANK ACCOUNTS REQUIRED”!

But wait, there’s more! Yellow Card isn’t just about trading. They’re integrating mobile money systems (M-Pesa, anyone?) to help the unbanked join the crypto party. 🎉 They’re like that friend who always knows the best spots! What a world, huh?

With them managing all the boring compliance stuff, businesses can focus on, you know, actually growing instead of breaking a sweat over infrastructure challenges. 🙌✨

“Our mission is to let companies invest, hire, and grow in emerging markets without needing to stress over infrastructure. We’ve built the back office [meaning] cybersecurity, AML, [and] data protection, so they can focus on growth,” Maurice said, likely still on his caffeine high. ☕🚀

Regulatory Waters: A Breakthrough?

Maurice noted that African regulators have kept crypto in a box for too long. But 2024? Oh, that’s the year everything changes! 🎊

“There is regulatory momentum in Africa that is only accelerating. The dam has broken,” he declared, probably with a bit of celebratory confetti. 🎉💧

Countries are waking up—South Africa is now treating crypto like a prized financial product! And others are joining the adventure. 🚀

Fighting Off the Dark Side!

Yet, challenges lurk. Some places are treating crypto users like they’re on a secret mission. The underground world of high-risk P2P networks? No thanks! Yellow Card is here to play fair. 🙅♂️💥

“We face a lot of competition from companies that don’t maintain high AML standards…A level playing field is all we seek,” he said, sounding like a superhero on a justice mission. ⚔️🤖

With $85 million in the bank, Yellow Card is ready to roll out compliance like a red carpet. They’re strutting toward the title of best infrastructure provider for global firms eager to dive into African waters. 🌊🐬

Africa to the World: Here Comes Yellow Card!

Cross-border payments? Yellow Card’s got that DOWN! Maurice claims their stablecoin-powered magic tricks are helping businesses grow like weeds in spring! 🌱✨

“We’ve had clients tell us we’ve enabled them to scale into new countries and reduce their costs dramatically. That’s real economic impact,” Maurice stated, probably while imagining all the confetti to come. 🎊💼

And they’re not stopping at Africa—their plans extend to other tough frontier markets. Talk about ambition! 💪✈️

Saying Goodbye to SWIFT?

And now, for that show-stopping statement from Yellow Card—are we witnessing the age of the SWIFT killer? Looks like it! 💣

“As we look out five years, SWIFT is in trouble. In ten, no one will be making international wires again,” Maurice teased as if he was revealing the big twist in a movie. 🎥🌀

With security that would make James Bond proud and a splash of regulatory flair, Yellow Card is catching the eyes of big players like PayPal and Coinbase. 💼👀

“Stablecoins are already a standard part of the financial infrastructure in Africa. CFOs and treasurers in traditional industries are now routinely using them to store and transfer value,” he added, likely grinning like a Cheshire cat. 😺💰

So yes, while Africa’s crypto market may not be as massive as global giants, it’s a real-life fairy tale of utility over speculation. Economic empowerment? Check! And Yellow Card is right at the forefront of this transformative saga. 🏆📈

“We’ve built a company for longevity and scale. Crypto adoption in Africa is stablecoin adoption,” Maurice concluded, and honestly, I’d grab popcorn for the next chapter! 🍿🌍

Read More

- Crypto Analyst Claims Bitcoin’s Weekly RSI Is About to Go “Avengers” Mode 🚨

- ETH PREDICTION. ETH cryptocurrency

- Mantra’s 90% Crash: Exchanges or CEO’s Excuse? 🤔

- ETH: Still Fab or Total Flop?! 😱📉

- FLOKI’s Gaming Gambit: Valhalla Awaits 🎮

- Crypto Chaos Unleashed: Shocking Gains and Ironic Downfalls 😂

- Tech Stocks Soar! Is This the Start of a Financial Comedy? 🍏💰

- Immutable X Soars 56% Today: Is This the Big Break? 🚀

- When Bitcoin’s Snoozin’, Trump Token Takes a Tumble—Hold onto Your Hats! 🤠💸

- Crypto Chaos: Hackers Make a Killing While CEOs Insist “Nothing’s Changed” 😒

2025-04-08 23:38