It is with a sense of profound relief and a touch of bewilderment that we report the recent launch of the xStocks platform, which has enabled Solana to achieve a position of such dizzying dominance in the tokenization of stock markets that one can almost hear the distant sound of champagne corks popping in the offices of Backed Finance.

Solana, a blockchain platform that has been making waves in the DeFi (Decentralized Finance) world, has now become the go-to place for those who wish to dabble in the tokenization of real-world assets, particularly stocks. According to the data analytics platform SolanaFloor, the launch of Backed Finance’s xStocks platform has been nothing short of a coup, catapulting Solana to the forefront of tokenized stock trading.

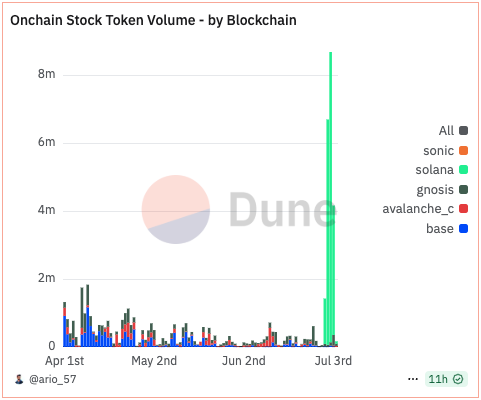

Notably, the data from Dune Analytics, a source as reliable as a butler who never spills the soup, shows that since xStocks’ launch on June 30, Solana has accounted for more than 95% of all tokenized stock trading volume. Currently, xStocks offers 60 tokenized assets on its platform, 55 stocks, and 5 ETFs, a selection as varied as a gentleman’s wardrobe.

On the first day of trading, xStocks’ volume surpassed $1.3 million, with Strategy’s stocks capturing 30% of that figure. However, stocks and indices like Tesla and the S&P 500, with the grace of a seasoned fox at a hunt, quickly overtook it in trading activity. The $SPYx tokenized stock, a veritable star of the show, recorded $4.67 million in daily volume on July 2, representing more than 50% of all trading that day. Still, by July 3, trading volumes had dropped by more than half, a clear indication that the initial trading enthusiasm had cooled, much like a cup of tea left unattended on a side table.

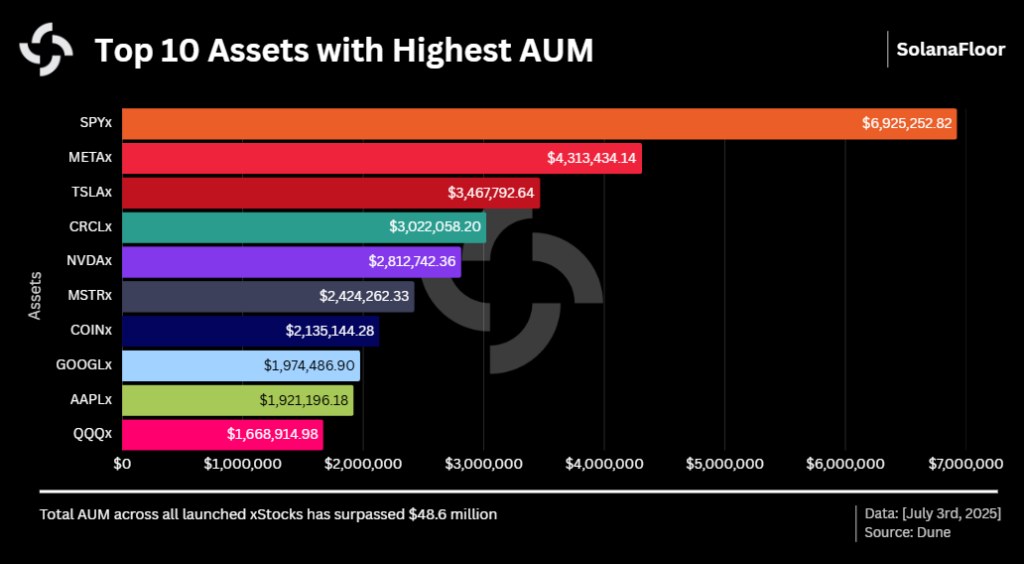

xStocks AUM Reaches $48.6 Million

Despite the decline in trading volumes, major users on the platform continued to hold their stock tokens, a display of faith as steadfast as a loyal hound. On July 3, xStocks’ assets under management reached $48.6 million. The leading asset was the $SPYx token, with $6.9 million in AUM, followed by $METAx with $4.3 million, and $TSLAx coming in third at $3.4 million.

The platform also saw significant user adoption, with over 20,000 unique wallets holding tokenized stocks. Among them, the $SPYx token was the most popular, held by more than 10,000 wallets. $TSLAx and $NVDAx followed, with 8,100 and 5,500 holders, respectively. Still, despite this early engagement, liquidity remains low, SolanaFloor cautioned. The platform noted that liquidity will likely be the key factor in determining whether tokenized stock trading on Solana proves viable, a sentiment as true as the dawn.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- EUR UAH PREDICTION

- USD RUB PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- Why Bitcoin Will Soon Be the Price of Your Childhood Dream and More

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- A Most Alarming Decline: Bitcoin’s Dismay Amid Transatlantic Tensions 📉

2025-07-04 22:25