Imagine this: Solana’s daily active addresses have plummeted more than 80%, yet the price of SOL has somehow doubled-and no, that’s not a typo. 🚀💸 It’s almost as if traders are playing a game of “let’s see how high we can send the price before the whole thing collapses like a house of cards.” This begs the question: are we riding a wave of pure sentiment or just chasing our tails in the crypto circus?

Let’s dig into the chaos. The article shines a spotlight on analysts sounding the alarm about this peculiar divergence-and possibly hinting at an upcoming market tantrum.

Solana’s Network Activity: The Ghost Town That Went to Market

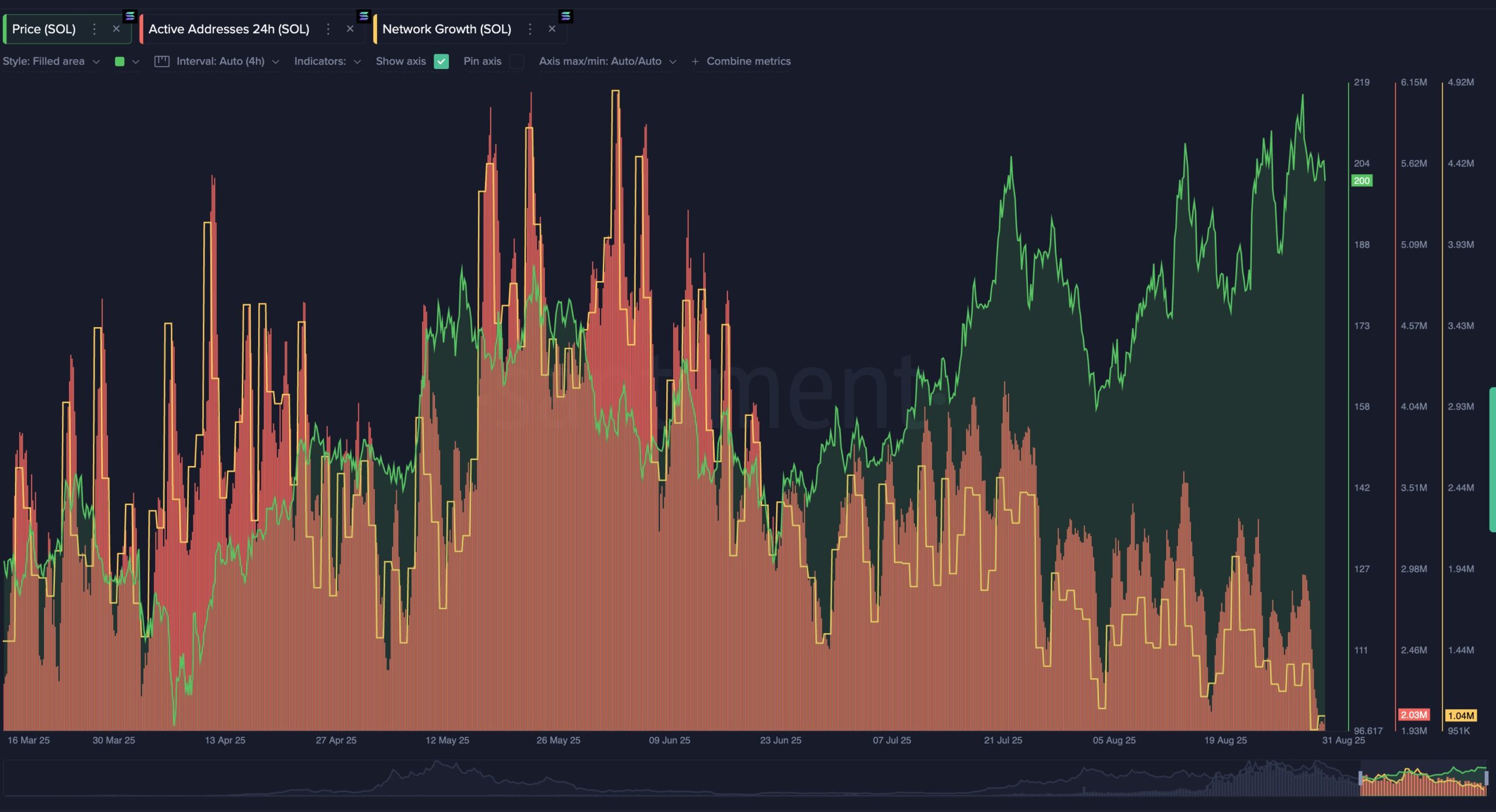

Maksim, the wise owl of Santiment, pointed out a jaw-dropping trend: even though SOL’s price is shuttling skyward, its network activity-think active addresses and overall growth-has gone *poof*. Poof. Gone. Since May, daily active addresses have nosedived from 6 million to a measly 1 million, and network growth has shrunk from 4.9 million to 1 million. It’s like a bustling city suddenly turning into a ghost town overnight. 🏙️👻

The chart? Oh, it’s a masterpiece of irony-a perfect bearish divergence: prices climbing faster than a squirrel on espresso, while the on-chain metrics stumble behind. It’s classic market nonsense distilled into a single graph.

Maksim’s crystal ball suggests that this pattern isn’t just bad fashion-it’s often the first sign of a trend flip. Basically, history says this dance ends badly, like a sitcom that runs a little too long.

“Early data shows familiar patterns. Right now, we’re seeing a classic bearish divergence: price pushing up while network activity lags. Historically, this often signals a trend shift,” Maksim muttered, probably while twirling his metaphorical mustache.

And the plot thickens. According to Santiment’s crystal ball, these kinds of divergences have about a 90% chance of ending in a spectacular reversal-think of it as crypto’s version of a ‘hang on tight’ rollercoaster. 🎢

Meanwhile, BeInCrypto reports that traders on Solana’s decentralized exchanges have dropped by a staggering 90% over the past year. That’s like going from a lively party to an empty dance floor in the blink of an eye, highlighting waning demand for tokens in the ecosystem.

Market Sentiment: The Cherry on the Top-or Just Cherry-Flavored Confusion?

Despite the ghost-town-like activity on the network, SOL’s price has climbed from below $100 in April to over $200 right now. It’s enough to make your head spin faster than a rodeo clown. 🤠🎪

The traders? Oh, they’re blissfully ignoring the on-chain doom and gloom and buying SOL as if it’s on a one-way ticket to the moon. 🚀🌙 Several big shot asset managers-think Fidelity, VanEck, Franklin Templeton-have been busy tweaking their Solana ETF filings for the SEC, and most now bet their house on it getting approved (more than 90%). They’re dreaming of gigabucks-up to $8 billion-flowing into Solana’s coffers.

And lest we forget, SOL has become a strategic darling for companies like Sharps Technology, Artelo Biosciences, and Ispecimen that have raised hundreds of millions to stash into SOL reserves-because nothing says security quite like betting on a meme coin with a declining network.

So, while the underlying activity weakens like a deflating balloon, these high-stakes moves might just be enough to keep SOL’s price levitating-at least until the bubble pops or markets catch a cold. Meanwhile, the crypto circus continues, and we’re all just popcorn in the front row.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Brent Oil Forecast

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- SUI ETF? Oh, the Drama! 🤑

- ETH Does What Now?! 😱

- ETC PREDICTION. ETC cryptocurrency

- Bitcoin Apocalypse Imminent?! 😱

- Pakistan’s Hilarious Bitcoin Mining Adventure: Can It Save the Day?

2025-09-02 12:37