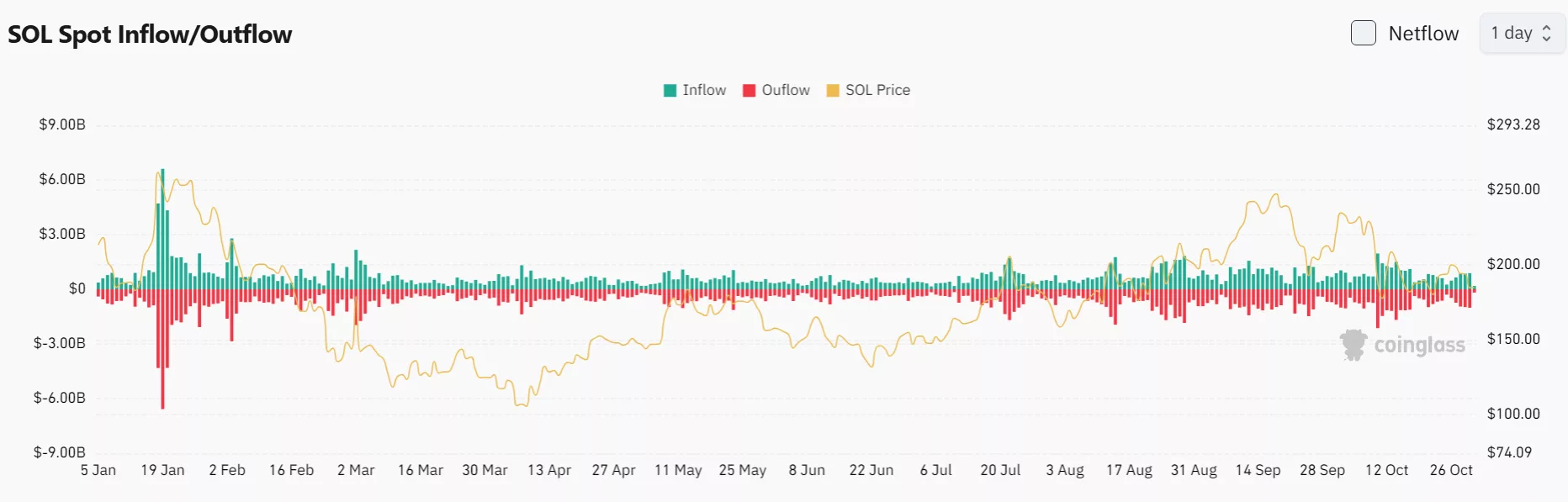

In an utterly charming twist of fate, Solana’s spot inflows have plummeted to a six-month low of $180 million, right after it dipped to the ever-glamorous $185 mark. And no, this is not due to a sudden wave of investor brilliance, but rather a decline in the excitement over two recently launched SOL ETFs in the U.S. market. Because, of course, that’s exactly how these things go. 🙄

- Solana’s spot inflows have taken a nosedive, as investor interest in the freshly minted SOL ETFs fades faster than you can say “pump and dump,” leading to a thinning liquidity and increasing outflows. How very delightful!

- Having failed to keep its composure above the $200 mark, Solana is now clinging to a price of $186, while technical indicators whisper about the potential for a bearish trend. Who doesn’t love a good decline?

As per the ever-helpful data from Coinglass, Solana’s inflows are now teetering at an almost tragic $180.7 million-a far cry from the glory days of $885.02 million just a day earlier. Low inflows, of course, indicate that the market is growing rather bored with our dear Solana. Apparently, the spark of excitement over its ETFs has flickered out like an old candle in a drafty room.

Meanwhile, exchanges are having a fabulous time with an uptick in net outflows after weeks of relative calm. What does this mean, you ask? It means more tokens are heading into exchanges, rather than being tucked away in cold storage, presumably because people think that’s where their investments should be-on the exchange, just waiting for the next moment of excitement (or despair). On October 31st, major exchanges like Binance, OKX, Coinbase, and Bybit were all playing host to more SOL outflows. Spooky stuff.

Binance, always the life of the party, has seen about $52.89 million in net outflows from SOL, while OKX, the quieter cousin, recorded $26.98 million. The only exchanges throwing a little parade of inflows are Bitstamp with $1.19 million and Kraken with $501,160. Really, it’s not quite the bustling, heartwarming scene you might have hoped for after the launch of those ETFs.

And here’s the cherry on top-Solana’s price has slipped to a sad $185 after its brief flirtation with the $200 psychological threshold. The Chaikin Money Flow indicator, as always, is here to remind us that liquidity is weakening and big investors are, for lack of a better phrase, just not that into Solana right now. 😬

Following the exciting debut of the Bitwise Solana Staking ETF and Grayscale’s SOL-backed ETF, it seemed as though Solana might just be the next big thing. Investors were thrilled, prices briefly spiked, and everything felt just a little too perfect. Then reality hit, as Solana quickly fell back to $195. And now, alas, it’s even further from the coveted $200 milestone. How tragic.

Even with over $110 million in daily net inflows following the ETF launch, the excitement fizzled out faster than a balloon at a very low-key party. Inflows for these ETFs have plummeted to a mere $37.33 million. Seems like investors are far more interested in those old reliable Ethereum (ETH) and Bitcoin (BTC) ETFs. Go figure.

Solana Price Analysis

Here’s a thrilling development: after failing to break the elusive $200 mark, Solana is just kind of… floating downward. In the last 24 hours, the token has slipped 4.7% and is now trading at around $186-just below its 30-day moving average of $187.50. Oh, joy.

The moving average has turned into resistance, which basically means that the short-term trend is pointing downward. Every little attempt at a rebound has been swiftly crushed by the moving average, proving that sellers are absolutely ruling the roost. Unless Solana can get back into the $190 to $195 zone (good luck with that), we’re probably looking at a dip toward lower support levels near $180 and maybe even $172. If you like a good descent, this is your moment!

The Relative Strength Index, that ever-helpful guide, is currently chilling around 47. Translation: there’s not a lot of bullish enthusiasm here. The RSI’s lower highs suggest that buying pressure is fading faster than your hope for a Solana rebound. This is in line with the idea that both liquidity and demand for SOL are dwindling.

It’s safe to say that Solana’s failure to break through the $200 barrier is a sign of a cooling market sentiment. After a strong few months, the bulls seem to have lost their energy, leaving the door wide open for bears to charge in. To change this, bulls would need to push Solana back above $190 with real volume. And, of course, they’d have to do it soon before everyone just forgets about it entirely.

But hey, if Solana fails to rally, we might just be looking at more consolidation-or even a further drop below $180 before any hopes of recovery. How exciting! 🎉

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- XRP Boss Bails… But Wait, He’s Back? 😏

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- SEC Gives Galaxy Digital a Green Light—But Will They Survive Delaware?

- XRP’s DeFi Adventure: The Liquidity Awakens! 🚀💸

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Pantera Denies Akio’s $5M Scam! 🚨

2025-10-31 14:45