Ah, the enigmatic machinations of cryptocurrencies, a realm where even the most astute minds occasionally trip over their own wit. Recently, the crypto bard, MANDO CT (@XMaximist), purveying his prophecies on the illustrious platform called X, exclaimed with the flair of a stage magician: “$BNB is moving beautifully. 1K is the nearest target.” Well, one can only admire his optimism, especially with our dear Binance languishing around $819-obviously eloping with that newly unshackled price range.

BNB Technical Breakout: A Dance of Bullish Momentum

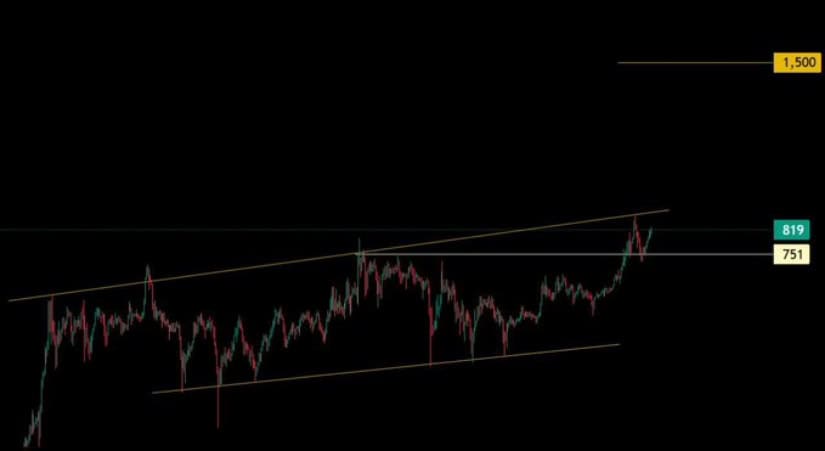

It is worth noting that, according to the ancient scrolls of technical analysis, BNB has been frolicking within an uplifting price channel as if it were the star of a merry dance. The most recent performance was an impressive pirouette past the formidable horizontal resistance at $751-a truly pivotal moment, feigning a transition from the dreary clutches of consolidation.

As it pirouetted to $819, Binance Coin appeared set to saunter toward the upper echelons of this channel, waving its bullish flag with all the gusto of a well-trained butler.

This theatrical breakout ceremoniously dismisses its prior range-bound behavior, suggesting that a spirited new leg of uptrend is indeed afoot. The chart, which might as well have been crafted by a whimsical artist, depicts a projected long-term target near $1,500-truly an artist’s ambition! If only reality were as accommodating, perhaps a touch of fairy dust would help.

Price Movement and Volume Patterns from Brave New Coin

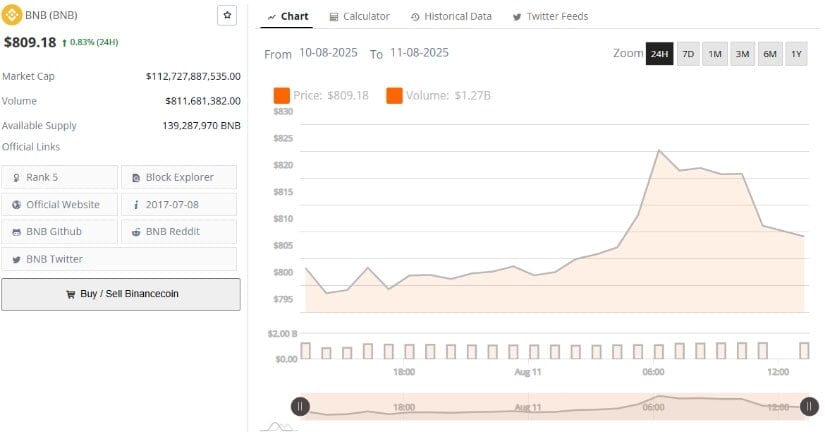

According to the latest gossip from Brave New Coin’s 24-hour gossip column, Binance Coin has been frolicking about at approximately $809.18-with a modest gain of just 0.83%. The price action resembles a farcical melodrama; it opened with a spirited rally from $795, skipping higher to over $820, before having a moment of reflection and correcting back to a contemplative stance around $810. This kind of volatility is apparently the new black in market sentiment.

The trading volume-ah, the show must go on!-was substantial! An impressive over $811 million, with spikes that could only be described as melodramatic during both the rally and its subsequent corrective waltz. This gregarious volume during the price surge signals eager buyers, while the pullback spurred an equally vivacious crowd of profit-takers, all clamoring to exit stage left.

Such a complex relationship between price and volume showcases an audience charged with enthusiasm, dancing between bullish momentum and the cautious embrace of profits. A veritable soirée of monetary exchanges!

With the market capitalization soaring past $112 billion, Binance Coin revels in its fifth-ranked position among the cryptocurrency elite-its market presence unwavering, like an aging aristocrat who insists on staying fashionable despite the passing of time.

Technical Breakdown of Binance Coin’s Glorious Pursuits

As we pen this screed, TradingView reports our dear Binance Coin settling near $810.50, showing a modest ascent of approximately 0.41% for the day-a mere trifle in the world of crypto commerce.

The daily tableau reveals our coin in a robust uptrend since late June, reaching new heights fit for a king. A small hiccup in early August caused a momentary swoon; however, it recovered with grace, remaining steadfastly near the upper limits of its recent trading range. A truly gallant display of bullish strength!

The Chaikin Money Flow (CMF) indicator, bless its soul, hails at +0.04, fostering an air of net inflows with an undeniable buying pressure. Contrarily, the Moving Average Convergence Divergence (MACD) seems to whisper a cautionary tale, showcasing a recent bearish crossover, with the MACD line gossiping just below the signal line, accompanied by burgeoning red bars in the histogram.

Yet, dear reader, don’t let this dastardly dip fool you! The histogram bars are but wee whispers, promising a fleeting cooling-off rather than a complete reversal. This striking technical melange hints at continued bullish ambition, albeit with a minor pause for breath.

Traders will undoubtedly be on high alert, cupping their ears to catch news of the price holding above current support levels while sustaining that above-average CMF reading to fortify the ongoing uptrend. Should support falter, we may witness increased volatility, but let us not dwell on dire outcomes. Overall, our technical tableau remains decidedly favorable.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Silver Rate Forecast

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

2025-08-11 20:37