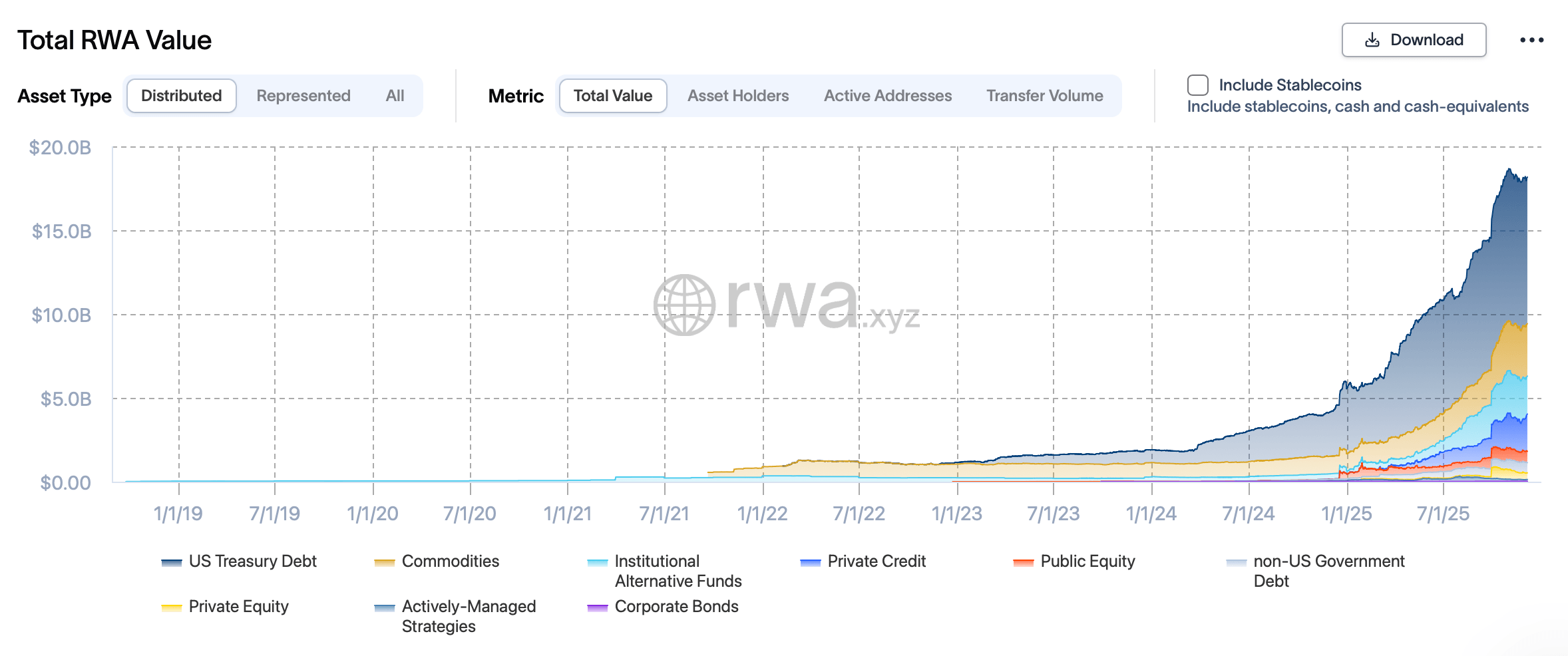

Ah, the fickle dance of numbers! Tokenized real-world assets (RWAs), those digital darlings of the TradFi world, have taken a modest siesta this month. A 1.09% dip, you say? 🥱 Well, $268 million has tiptoed out of the room since November began, leaving the sector to ponder its next waltz.

The Global RWA Waltz Continues, Though Slightly Offbeat

These onchain doppelgängers of traditional financial instruments-treasuries, commodities, private credit, and more-have expanded their repertoire, even as their total value took a brief curtsy. But fear not, for the show must go on! From tokenized T-bills to digitized oil, the RWA orchestra is still tuning its instruments, even if the conductor has momentarily lowered his baton.

Yes, the sector has eased off the gas, but it’s hardly parked by the roadside. December may be quiet, but the RWA engine purrs on, a testament to its resilience-or perhaps its stubborn refusal to take a proper holiday. 🏎️💤

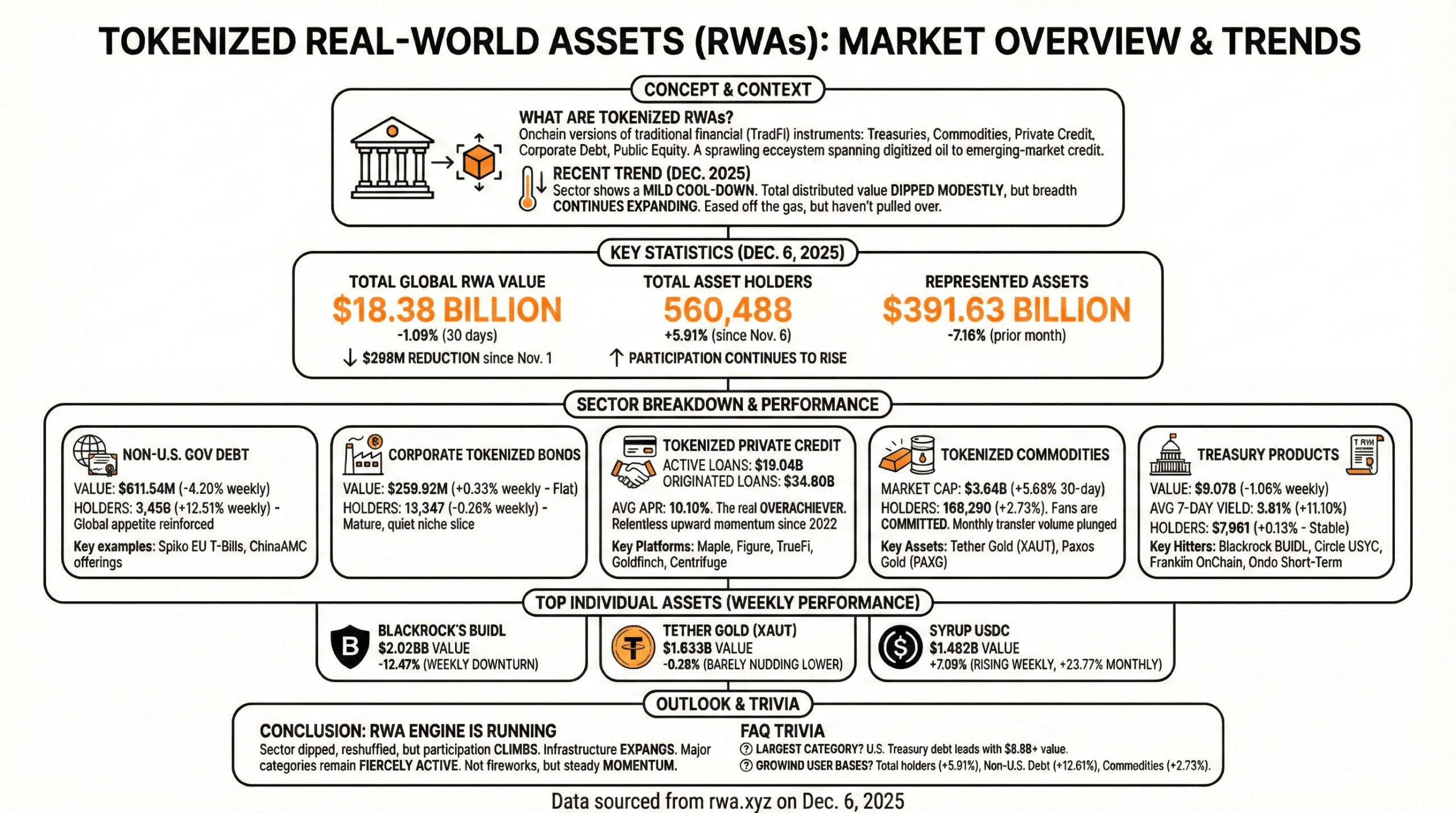

As of Dec. 6, the global RWA value stands at $18.38 billion-a slight dip, but nothing a good cup of tea can’t fix. Participation, however, is having a field day, with 560,488 asset holders, up 5.91% since Nov. 6. The crowd may be whispering, but it’s growing. 🌱

Non-U.S. government debt, that quiet achiever, sits at $611.54 million, down 4.20% in a week. But its holders? Oh, they’re doing the victory lap, up 12.61% to 3,430. Funds like Spiko EU T-Bills and ChinaAMC’s offerings are the unsung heroes here, proving that even a tiny haircut can’t dampen the spirit. ✂️💇♂️

Corporate tokenized bonds, at $259.92 million, are essentially flat-a 0.33% weekly gain, though holders dipped slightly. Ten assets hold this niche together, maturing quietly without the fanfare of their flashier cousins. 🧘♂️

And then there’s private credit, the overachiever of the bunch. Active loans total $19.04 billion, with originated loans hitting $34.60 billion. Platforms like Maple, Figure, and Centrifuge are the marathon runners here, their charts a testament to relentless upward momentum. 🏃♂️💨

Commodities, with a $3.64 billion market cap, are up 5.68% over 30 days, though transfer volume took a nosedive. Holders, however, rose 2.73% to 168,290-proof that gold and oil fans may not be chatty, but they’re loyal. Tether Gold and Paxos Gold remain the anchors, steady as ever. ⚓

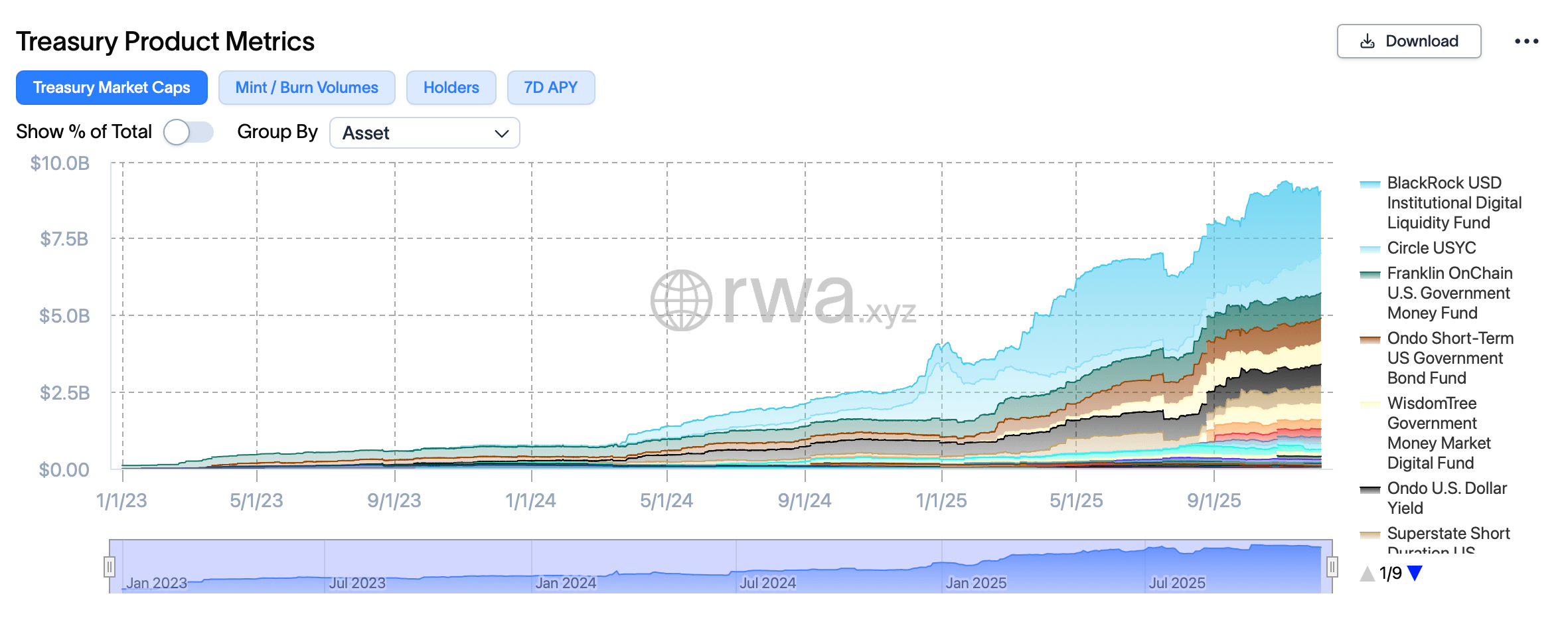

Treasury products, at $9.07 billion, are down 1.06% week-over-week, but yields climbed 11.10% to 3.81%. Blackrock’s BUIDL, Circle’s USYC, and Franklin Templeton’s offerings are the heavy hitters here. Holder counts? Virtually unchanged. Stability, or boredom? You decide. 🤷♂️

Blackrock’s BUIDL leads the pack at $2.028 billion, though down 12.47% on the week. Tether Gold follows with $1.633 billion, barely nudging lower. Syrup USDC, however, has been hitting the gym, rising 7.99% weekly and 23.77% monthly to $1.482 billion. Circle’s USYC also flexed, up 8.12% weekly and 30.92% over 30 days. 💪

In short, RWAs have taken a breather, reshuffled their decks, and occasionally broken into a jog. The sector’s value may have dipped 1.09%, but participation is climbing, infrastructure is expanding, and major categories remain fiercely active. December may not be delivering fireworks, but the RWA engine is very much still running. 🚂

FAQ ❓

- What are tokenized real-world assets?

Blockchain-based representations of TradFi assets like treasuries, commodities, and corporate bonds. The digital doppelgängers of finance. 🕶️ - How much have RWAs declined since November?

A modest 1.09%, or $268 million. A tiny stumble in a long marathon. 🏃♂️💨 - Which segments grew their user bases?

Total asset holders climbed 5.91%, non-U.S. debt holders rose 12.61%, and commodity holders increased 2.73%. The crowd may be quiet, but it’s growing. 🌱

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Why Switzerland’s Bank Said “No Thanks” to Bitcoin (And Probably Enjoys Paper Money More)

- Wallet Wars! TRON, $100 Million, and the Blockchain Blacklist Brouhaha 🤡

- Crypto Dreams Shattered: PI’s $100M Fund Debuts, Token Sinks Below $1 Anyway 😬

- This Trader Turned Pocket Change Into Millions With LAUNCHCOIN (And You Didn’t!)

- Is Jack Ma’s Alibaba Secretly Betting Big on Ethereum? Find Out! 🚀

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- Bitcoin Apocalypse Imminent?! 😱

2025-12-07 11:00