In a rather audacious maneuver, Ripple has flung open the doors of its treasury to release an additional twenty million of its dollar-pegged stablecoin, the RLUSD. This latest act, which could be mistaken for a generous gift to the market, is merely a subtle attempt to bolster its on-chain liquidity as it stares into the abyss of an increasingly cutthroat regulated stablecoin arena.

💵💵💵💵💵💵💵 Behold! 20,000,000 #RLUSD minted at RLUSD Treasury.

– Ripple Stablecoin Tracker (@RL_Tracker) February 19, 2026

On the esteemed platform of Etherscan, one can find confirmation of this minting extravaganza, documented with the precision befitting a fine Russian novel. The tokens were minted at the RLUSD Treasury and whisked away by a wallet charmingly dubbed “Ripple: Deployer,” finalizing in mere seconds-a feat that would make any timekeeper weep with joy.

Ripple Exec Reports Breakthrough in DC Crypto Meeting

Crypto Market Review: XRP Faces 85% Volume Reset, Shiba Inu (SHIB) Bull Run Chances Are Slim, Analyzing Dogecoin‘s Possibility to Return to $0.10

The $20 Million Mint: A Ripple Effect or Just a Splash?

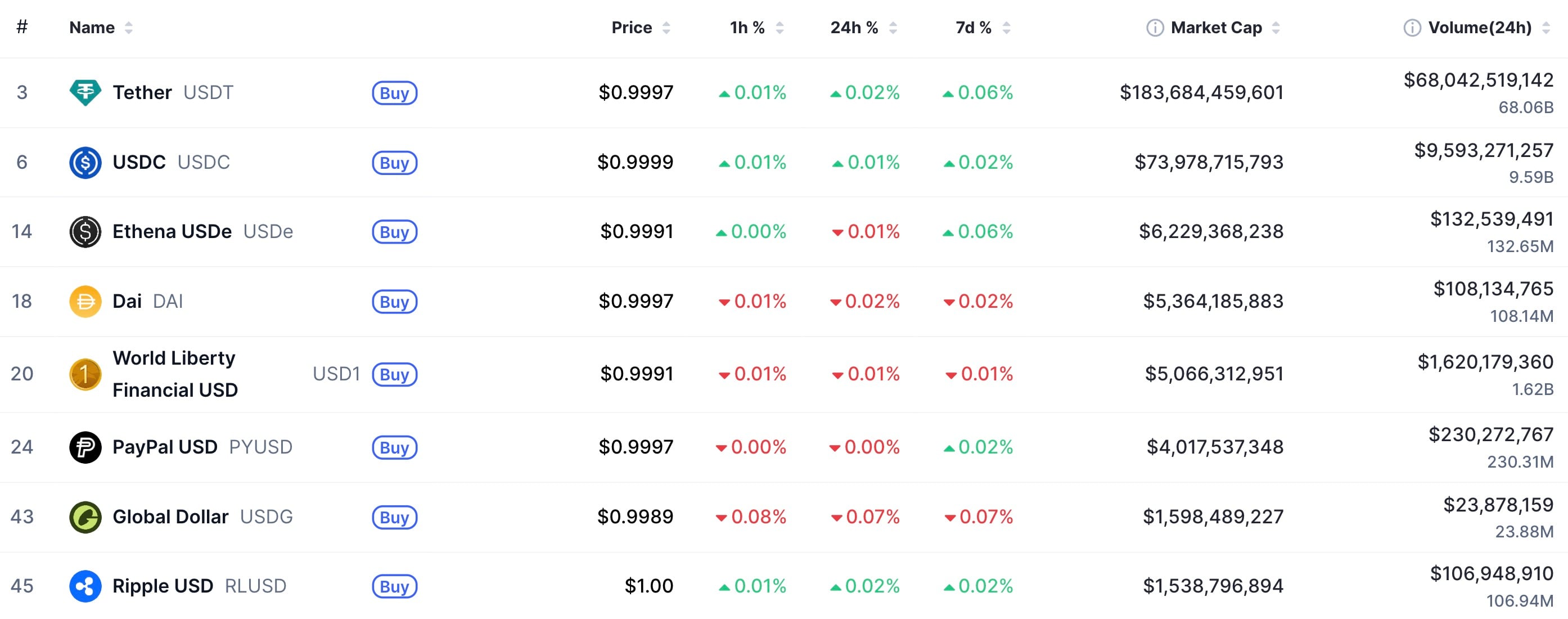

Following this grand release, the total supply of RLUSD swells to a staggering 1.53 billion tokens, positioning it snugly in the middle of the stablecoin pack-an admirable feat, though perhaps not one worthy of a standing ovation. Tether’s USDT reigns supreme with a market cap eclipsing $183 billion, while USDC lounges comfortably above $74 billion, leaving RLUSD to ponder how it might bridge this vast chasm.

One might note that RLUSD is weaving itself into Ripple’s grand tapestry of aspirations, which include intricate plans for custody infrastructure, the tokenization of real-world assets for institutions, and use cases that stretch across borders like a well-traveled diplomat. Such increases in supply typically hint at fresh institutional demand, a rebalance of the treasury, or perhaps a whimsical liquidity provision for exchanges and DeFi platforms.

Market whispers suggest that RLUSD remains tethered to its dollar peg, with daily trading volumes soaring above $100 million-indicating a lively circulation rather than a hoard of dormant treasure. While this issuance may not rock the boat in the larger market, it holds significance for RLUSD’s liquidity profile, much like a well-placed joke in a Chekhov play.

In essence, this $20 million expansion is poised to broaden the available depths for payment flows, exchange pairs, and perhaps even a few playful DeFi integrations on Ethereum. Whether this translates into sustained utility hinges less on the sheer volume of RLUSD produced and more on whether the good folks out there will embrace it to settle, collateralize, and manage their treasury operations in the months to come.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Silver Rate Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

2026-02-20 13:53