Finance

What to know:

- XPL has lost more than 80% of its value since September, dropping 13.6% in the past day alone and risking exclusion from the top 100 cryptocurrencies.

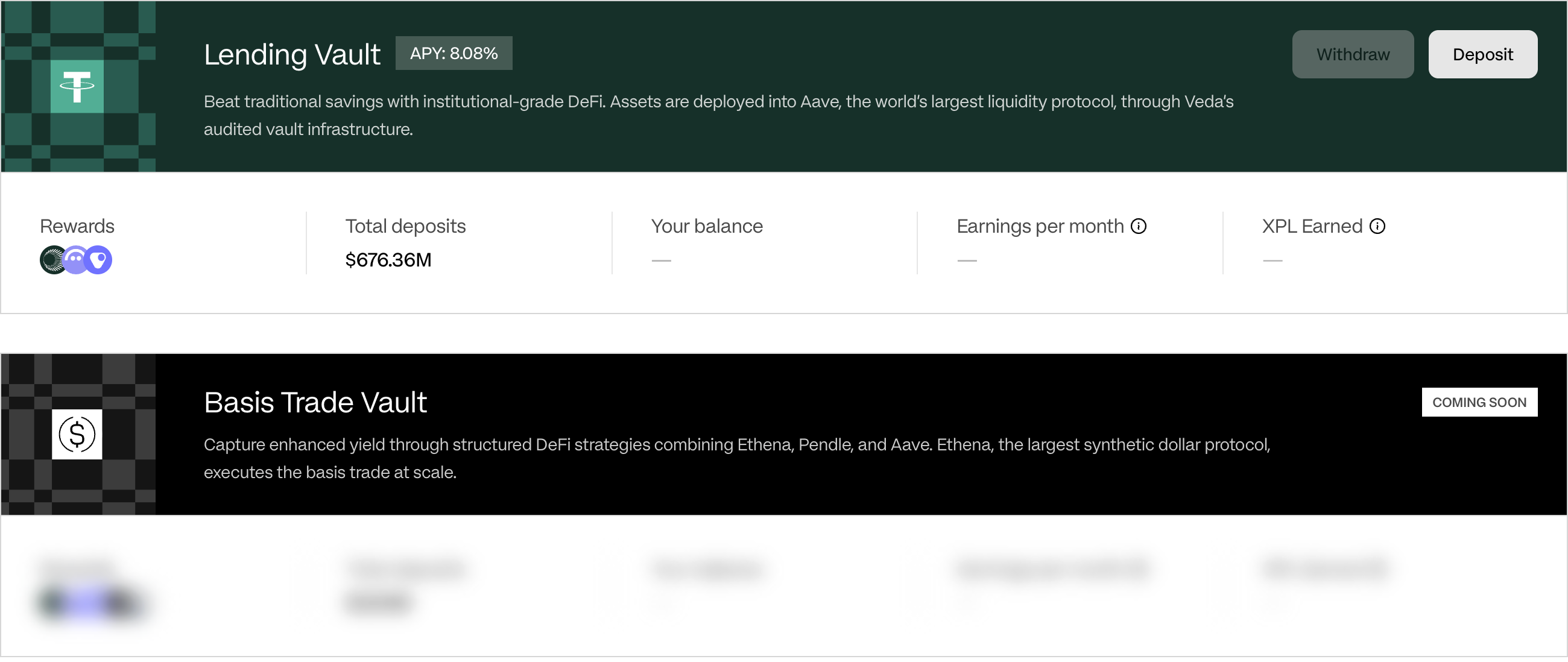

- Despite claims of 1,000 TPS, the Plasma chain is processing just 14.9 TPS, with limited use beyond a $676 million lending vault and no major utility expected until staking launches in 2026.

When Plasma’s XPL token debuted a month ago, investors were practically foaming at the mouth to grab a slice of the new blockchain built for stablecoins. It was like the crypto version of a rockstar coming to town-everybody thought it was the next big thing.

Fast forward to today: XPL has crashed more than 80% since its brief moment of glory in September when it peaked at $1.67. Now, it’s limping along at a sad $0.309, having dropped another 13.6% in just 24 hours, causing around $8 million in liquidations. Ouch.

At this rate, it might just be on its way out of the top 100 cryptocurrencies, with a market cap of $550 million-just barely above the 100th spot at $540 million. Talk about falling from grace.

What went wrong?

Investors are scratching their heads, wondering how this promising project went belly up so quickly. Plasma was supposed to be one of the hottest projects of the year. It had big backers like Bitfinex, Framework Ventures, and the famous Jordan Fish (Cobie). It raised a whopping $24 million in two rounds, according to Icodrops. Sounds promising, right?

Then came the public sale, which raised another $50 million by selling 1 billion tokens at $0.05 each. The early birds who bought at those prices are still swimming in profits, but those who bought when it hit exchanges in September? Not so much.

Sentiment took a nosedive immediately after the launch, as rumors swirled that the Plasma team was allegedly working with market makers to short the XPL token and lock in profits. Not exactly the “trustworthy” vibe you’re looking for when you’re betting on a new project.

Plasma’s founder, Paul Faecks, was quick to deny these allegations in a tweet, insisting: “No team members have sold any XPL. All investor and team XPL is locked for 3 years with a 1-year cliff.” He also assured everyone, “We have not engaged Wintermute as a market maker and have never contracted with Wintermute for any of their services.” Okay, sure, Paul.

But veteran trader Alex Wice wasn’t buying it, challenging Faecks with a direct question: “Did you engage with another market maker to short XPL, effectively ‘locking in’ profit? Yes or no?” Faecks didn’t bother to respond. And yet, the relentless selling continued.

Onchain metrics

Now, let’s talk tech. Plasma was designed to be the blockchain for stablecoins, promising zero-fee transfers and “high” throughput. Well, “high” is a bit of an exaggeration. Currently, Plasma is processing a measly 14.9 transactions per second (TPS). They promised 1,000 TPS, but it looks like someone needs to recalibrate their expectations.

In reality, Plasma has turned into just another lending protocol. The Plasma website boasts one lonely “lending vault,” which holds $676 million in total value locked (TVL), offering a mediocre 8% annual return. But that’s about all it’s doing right now.

As of now, the XPL token’s main use case seems to be reducing fees for non-stablecoin transfers. There’s a big promise of staking and delegation in Q1 2026, but until then, well… don’t hold your breath.

And get this-Plasma claims to offer sub-second block times, with new blocks supposedly being created every second. Too bad most of those blocks are essentially empty, containing only a handful of transactions. Yikes.

What next for XPL?

It’s not all bad news. The XPL token might actually have a real use case when staking becomes active in 2026. But until then, investors are going to need something more than wishful thinking to keep the demand up. Without a solid stimulus to drive that demand, XPL could very well fade into obscurity faster than you can say “hype bubble.”

Here’s the kicker: one of the reasons people bought XPL was to reduce transaction fees. But wait-Plasma’s entire value proposition is that it already offers minimal fees. So, owning XPL? Not exactly necessary. It’s like buying a raincoat when it’s already sunny.

Maybe things will pick up when Plasma releases its “Plasma One” card. Or maybe not. For now, though, it’s a sad sight in terms of price action and relevance. Good luck out there, XPL holders. You’ll need it.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Discover the Hidden Gems: Altcoins Under $1 That Could Make You Rich! 💰

- Brent Oil Forecast

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- SOL’s October Drama: ETFs, Upgrades, and $350 Dreams? 😱💸

- You Won’t Believe What Bitcoin Whales Are Doing—And How It Could Wreck the Market 🚨

- Tokens, Trinkets, and Trials: The Crypto Conundrum Unveiled!

2025-10-30 15:46