Right then, gather ’round, you lot! Seems Pi Coin, bless its little digital heart, has taken a bit of a tumble – a rather spectacular 45% nosedive, to be precise. All that talk from Consensus 2025? Seems it was mostly hot air, and now the indicators and on-chain data are all pointing downwards faster than a goblin on a greased slide. Unless, of course, some new magical catalyst appears, which is about as likely as finding a sober dwarf at a brewery. 🍻

Key Highlights:

- Pi Coin, currently changing hands at a measly $0.6984, is down a rather hefty 45% from its recent high. Ouch.

- The market cap, bless its cotton socks, swelled by 95% in a mere 5 days before deciding to shed a casual $3.7B within 3 days. Talk about a volatile stomach!

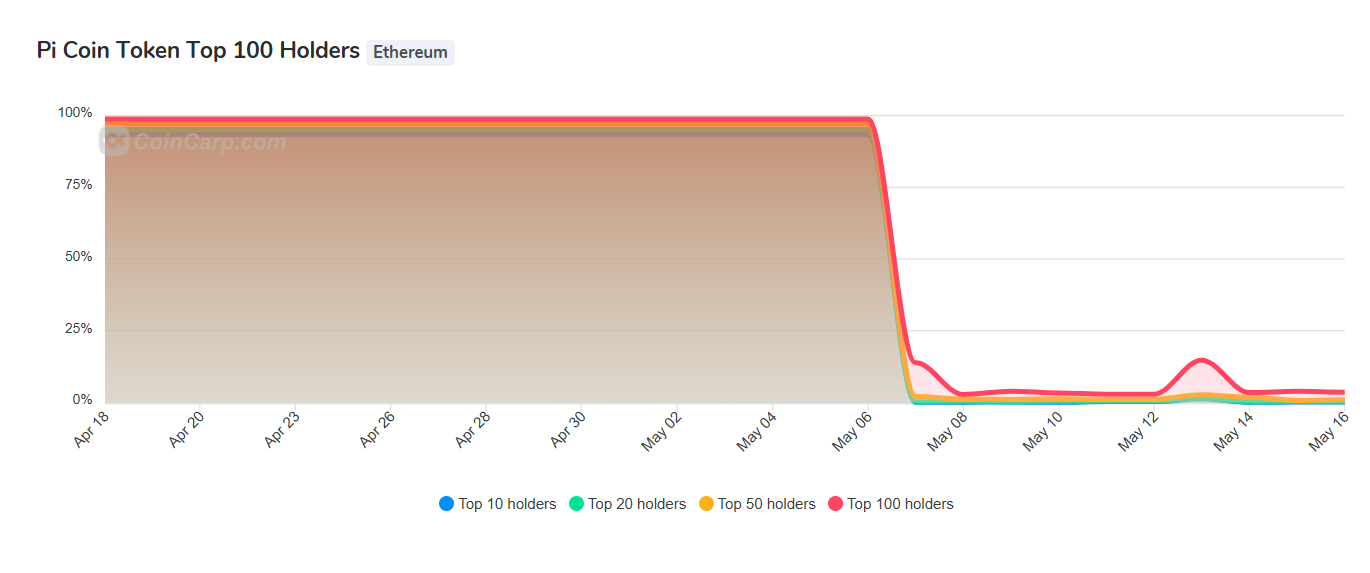

- The top 100 wallets? Used to hold 98.76% of the pie (no pun intended). Now? Less than 5% from May 6 to May 16. Someone’s been sharing, or, more likely, running for the hills. 🏃♂️

- Those EMAs at $0.79–$0.85? Once promising support, they’ve now turned into resistance. Like a bouncer who’s had enough. 😠

- Analysts, bless their cautious souls, remain bearish. Fading indicators and failed support will do that to a body.

Pi Network (PI) is presently loitering around the $0.6984 mark, a considerable drop from its recent jaunt to $1.57, leaving its market cap whimpering at $5.1B. Remember those heady days between May 8 and May 13 when Pi’s market cap almost doubled, soaring from $4.5B to $8.8B? Good times. Alas, by May 16, it had returned to earth with a bump, shedding over $3.7B in value in a mere three days.

This precipitous drop followed a brief flirtation with fame sparked by big announcements – including the shuttering of Pi’s central node and the launch of a $100M Pi Network Ventures fund, both unveiled at Consensus 2025 (May 13–14). Like a magician pulling rabbits out of a hat, only for the rabbits to immediately hop away. 🎩🐇

The meteoric rise and equally rapid fall demonstrate that Pi’s price still dances to the tune of news rather than steady growth. While the rally briefly grabbed the market’s attention, the subsequent drop has left traders more cautious than a dragon guarding its hoard. 🐉

The rally, which commenced on May 8, propelled Pi above $1, culminating in a peak of

$1.57 on May 13, all thanks to those announcements. But the buying power evaporated faster than a puddle in the Discworld sun.

Currently, Pi is meandering below the 20, 50, 100, and 200-day EMAs – all huddled together between $0.79–$0.85 – which have now become resistance. The

MACD has donned its bearish cloak, with the line threatening to cross below the signal. The histogram, though not yet red, is narrowing, indicating a dwindling enthusiasm for buying. The

RSI, currently at 42, suggests a neutral-to-bearish outlook.

The On-Balance Volume (OBV), reflecting the tug-of-war between buyers and sellers, has slumped by over 12% from its recent high, indicating a slowdown in net accumulation. Resistance, as previously mentioned, lurks at $0.79–$0.85.

Pi Coin is currently testing key support levels at $0.68 and $0.59, important price zones from before the May 8 rally. Instead of ambling sideways, the price has plummeted from its peak and is now settling where buyers once gathered, awaiting a fresh catalyst. Like waiting for Godot, but with more charts.

A plunge below $0.59 could pave the way to $0.45. The analysis of the Pi network remains cautiously bearish unless Pi manages to reclaim its EMAs with considerable volume. So, not looking good, then. 😟

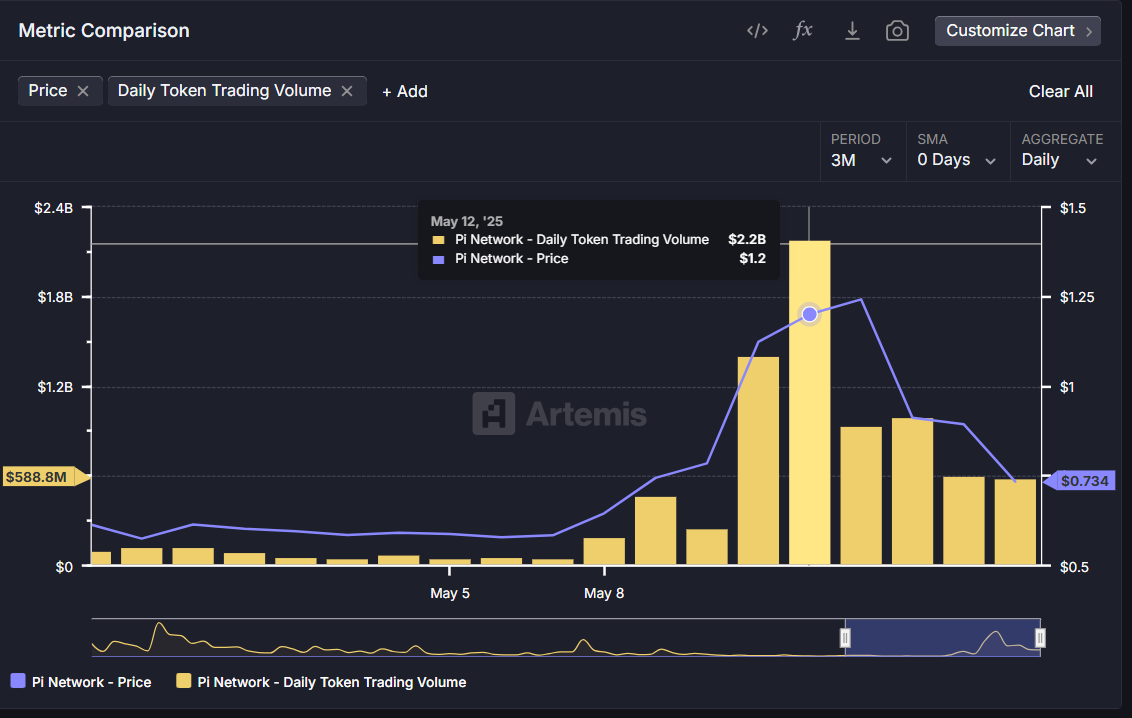

Volume surged to a dizzying $2.2B on May 12, only to crash to $588M by May 16, a 73% drop, suggesting the hype cycle has run its course. Like a firework that’s gone damp. 🎆

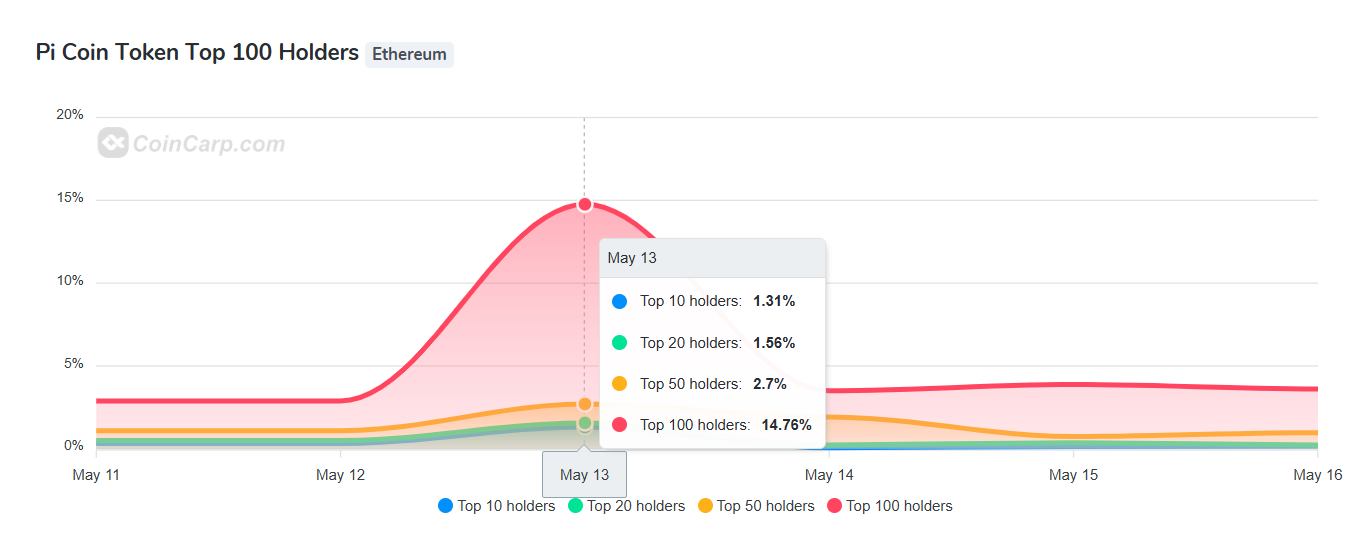

The CoinCarp chart, displaying wallet distribution by holder ranks, reveals that the Top 100 wallet concentration plummeted from 98.76% on May 6 to a paltry

14.76% by May 13, before settling under 5% by May 16. Someone’s been moving things around, it seems.

On May 13, the top 10 holders owned a mere 1.31%, and the top 50 held 2.7%. This dramatic shift likely reflects internal wallet reshuffling rather than a genuine redistribution. The rapid redistribution during the rally aligns with bearish technical indicators, suggesting that major holders may have taken profits during the hype phase. Smart move, if you ask me. 😉

Pi Network’s 45% rally and the subsequent sharp correction were fueled by

short-lived hype, primarily from announcements at Consensus 2025 (May 13–14).

This illustrates how event-based sentiment continues to drive Pi’s price more than fundamental progress. The rapid market cap swing – a $3.7B decline in just three days – highlights Pi’s sensitivity to major headlines.

Looking ahead, potential catalysts such as a mainnet activation or

ecosystem adoption could reignite interest. Until then, Pi Coin is likely to continue trading on speculative momentum, and traders should keep a close eye on support zones for further downside risk or relief bounce attempts. Good luck with that. 🍀

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- ETH PREDICTION. ETH cryptocurrency

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Silver Rate Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Will BNB’s $600 Wall Finally Crumble? Spoiler: The Hodlers Are Plotting 😉

- Banks Might Actually Need XRP When Sh*t Hits the Fan—CEO Spills Tea

- You Won’t Believe How $3B in Real Estate Is Now Just Tokens. Mind-Blowing, Right?

2025-05-17 11:24