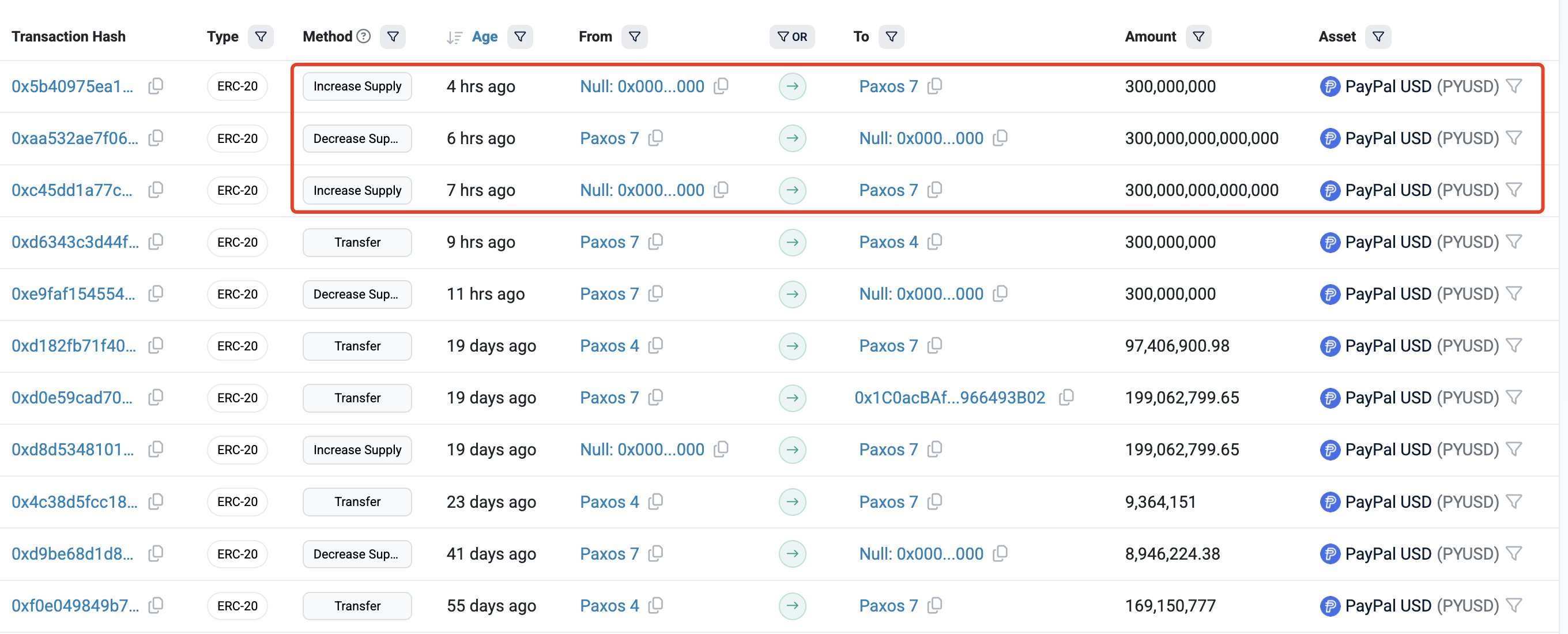

Well, folks, it happened. Paxos, the mastermind behind PayPal’s PYUSD stablecoin, decided to go BIG today. And by “BIG,” I mean accidentally minting a ridiculous 300 trillion PYUSD. Yes, you read that right-300 trillion with a “T.” Oops, a tiny mistake involving six extra zeros, and boom-suddenly Paxos was the Fed, but with a very questionable grasp on math. Don’t worry though, they quickly burned the excess tokens and fixed things, but not before the entire crypto world did a collective double-take.

Let’s take a minute to digest this: 300 trillion PYUSD would have dwarfed the entire US money supply (M2) by nearly 14 times. That’s right, 14 times! And in global terms, it’s almost three times the total estimated global M2-roughly $100 trillion. So, for a hot second, Paxos was sitting on enough digital cash to buy, I don’t know, the entire stock market? A casual Thursday mistake, clearly.

Social media went wild, as you can imagine. Crypto traders and analysts alike were having a field day with this blunder. Some called it the “largest minting error” in crypto history, while others had a good laugh imagining what could have been-the sudden appearance of enough digital dollars to buy the planet. Paxos, however, acted fast, clarified there were no funds affected, and fixed the issue before it became the next big crypto horror story.

Paxos Responds to Minting Error, Sparks Debate on Stablecoin Oversight

By Wednesday afternoon, Paxos addressed the situation like a parent who just broke the vase and promised it was a total accident. They confirmed that the whole 300 trillion PYUSD incident was an internal mistake during a routine transfer. And for those of us who need a little more reassurance, Paxos threw in a “no security breach, no funds lost” just to calm us down. And, naturally, it was met with the obligatory round of crypto jokes.

As Paxos tweeted:

“At 3:12 PM EST, Paxos mistakenly minted excess PYUSD as part of an internal transfer. Paxos immediately identified the error and burned the excess PYUSD. This was an internal technical error. There is no security breach. Customer funds are safe. We have addressed the root cause.”

Well, that certainly cleared everything up, right? Not quite. The crypto world still couldn’t resist roasting Paxos for their minor slip-up. Let’s be real: who needs trillions of dollars in excess liquidity, even if it was for a millisecond? That’s just a fun Tuesday afternoon for Paxos!

While the dust settles, this whole ordeal has sparked renewed discussions about the need for tighter oversight in the stablecoin sector. Some are calling for more regulatory standards, especially with big players like PayPal involved. Others, however, pointed out that blockchain’s transparency was the real hero here-it was a hot mess, but at least we saw it and fixed it quickly.

The real question, though, remains: How do we balance the wonders of innovation with just a *little* more accountability? Apparently, Paxos is still figuring that out.

Stablecoin Dominance Shows Growing Market Caution

Speaking of caution, here’s a little side note: stablecoin dominance has been creeping back up to 8.49%. That’s right, after last week’s market correction, traders have clearly decided that it’s better to hold stablecoins than to risk it all on the volatile rollercoaster that is Bitcoin or any other altcoin. A little less YOLO, a little more “let’s be smart about this.”

Last week’s dominance surge-peaking near 9.5%-lined up with some serious minting activity from Tether and Circle. Over $4.5 billion in new stablecoins were issued after the market sell-off. This suggests that the big players are preparing liquidity reserves, maybe to sit tight and wait for the market to calm down a bit before diving back in. And you know, we’ve all been there, right? Waiting for the storm to pass.

If stablecoin dominance sticks around 8-9%, it suggests a cautious market. But if it dips below 8%, well, maybe things are looking a bit more bullish for Bitcoin and altcoins. Only time will tell-but for now, everyone seems to be in “wait and see” mode, hoping that this whole market volatility thing will just, you know, chill.

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Whale of a Time! BTC Bags Billions!

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

2025-10-16 23:33