Bitcoin’s Boring Bubble: Will It Ever Break Free? 🤔💸

Bitcoin, that digital gold we all love to chase, just dipped below the oh-so-important $90,000 mark – like a clumsy clown slipping on a banana peel, down more than 1% in the last 24 hours. Oops! 🙃

Bitcoin, that digital gold we all love to chase, just dipped below the oh-so-important $90,000 mark – like a clumsy clown slipping on a banana peel, down more than 1% in the last 24 hours. Oops! 🙃

Glassnode’s been busy grilling the numbers: $350B in crypto despair, with Bitcoin taking a $85B punch. volatile? Obscene! Yet Digital Asset Treasuries are winking at the selloff like it’s a clearance sale. ETFs? They’re tagging along, thinking, “Case of the whale-sized 666 Squad.”

It appears that the lords and ladies of the US Securities and Exchange Commission-those guardian angels of the marketplace-have taken it upon themselves to release a missive on the myriad intricacies of crypto wallets and the perils of custody. Their aim? To light a torch for investors, lest they wander, bewildered, into the murky woods of digital assets. The SEC has softly whispered into the ether: “Consider thine choices, for they shall determine the fate of thine assets.”

Crypto Patel, the soothsayer of the digital realm, declared that Bitcoin has done a fancy little dance called “confirmed the top” – basically, it’s saying “I’ve reached my peak, folks!” Now it’s sashaying into a macro retracement, which is just a fancy way of saying it’s zigzagging down like a fat slug after a rainstorm. The Head and Shoulders pattern, a lovely technical fancy-dress, has strutted its stuff, making everyone believe the party might be over. The projection suggests a big ol’ slide, like dropping from a second-story window, all the way down to the 35K mark-pretty healthily bearish, if you ask me. Better start practicing your hibernation dance! 💤

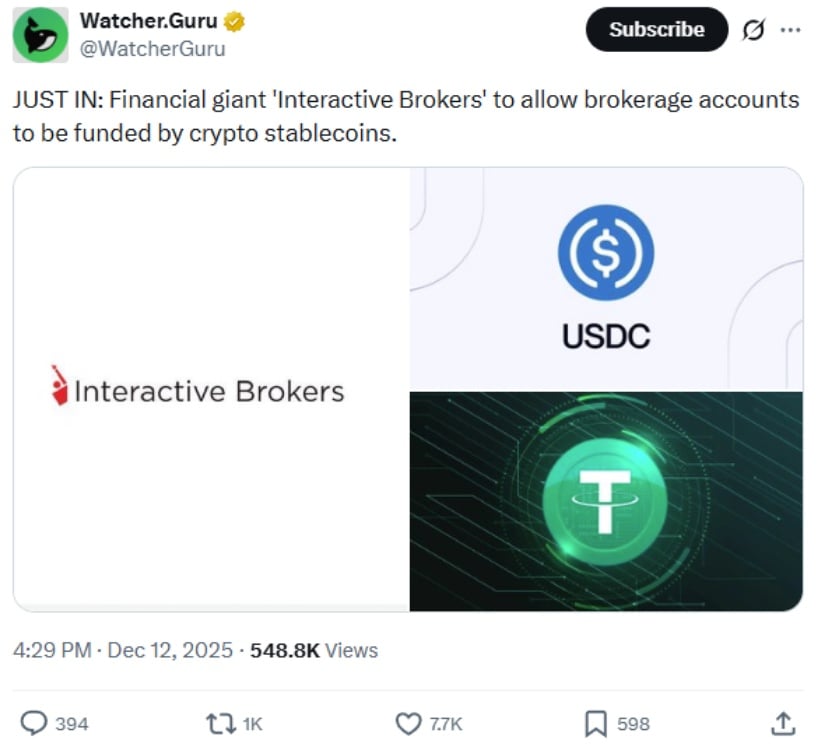

Interactive Brokers partnered with ZeroHash, a crypto infrastructure company, to power the stablecoin deposits. Customers can now transfer USDC directly from their personal crypto wallets to their brokerage accounts.

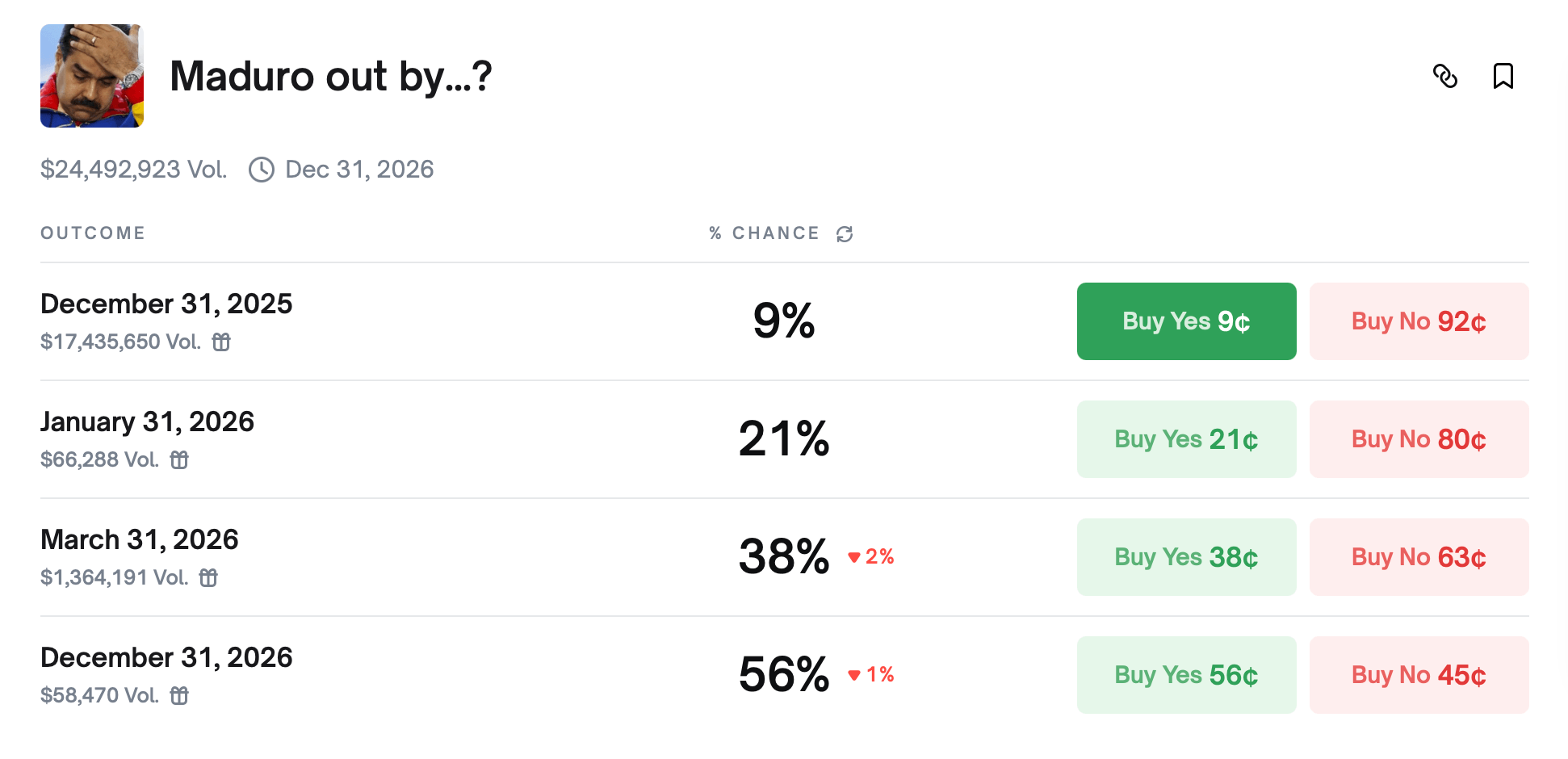

For years, the United States hath gazed upon Nicolás Maduro’s reign with the skepticism of a man who once trusted a fox to guard a henhouse. Election fraud, the slow strangulation of democracy-Maduro’s rule is a farce draped in the garb of legitimacy. With Donald J. Trump, that most theatrical of presidents, back in the saddle, Maduro’s government now faces accusations of narco-trafficking, as if Venezuela were a mere pawn in a drug-running chess match. One might think the Cartel de los Soles were but a figment of American paranoia, yet here we are.

Itaú Asset Management, with all the gravitas of a matron at a ball, now proclaims Bitcoin a stabilizer, a balm for portfolios beset by the whims of traditional assets. A mere sliver of one’s fortune, they say, can absorb shocks that stocks and bonds cannot. How very convenient! 🧐

On the cold, gray morning of December 12, the CFTC approved an expansion of cross-margining for US Treasuries-because who doesn’t want to tango with margin requirements? 🕺

The Bank of Japan (BoJ) is expected to raise interest rates for the first time since January, increasing the policy rate by 25 basis points to 0.75% from 0.50%, according to Nikkei. The decision, which is expected on Dec. 19, would take Japanese interest rates to their highest level in roughly 30 years. 🕰️

The company, previously known as MicroStrategy, has become the largest corporate holder of Bitcoin (BTC). With its latest purchase of 10,624 Bitcoin for around $962.7 million last week, Strategy’s total holdings stand at 660,624 BTC, worth nearly $60 billion. A digital gold rush, or a fool’s errand? 📉💰