XRP’s Descent: How Low Will It Go? 📉

Bitcoin, that paragon of stability, and other cryptos have joined the downward spiral, adding to the selling pressure on XRP. A true tale of woe, isn’t it? 😢

Bitcoin, that paragon of stability, and other cryptos have joined the downward spiral, adding to the selling pressure on XRP. A true tale of woe, isn’t it? 😢

Enter Crypto Wimar, the modern-day prophet of the blockchain. He claims the villain is Wintermute, a digital bandit who’s been dumping 40% of their stash like a kid tossing candy at a parade. “Selling pressure?” he says, “It’s more like a stampede of confused cows!” 🐄 The market maker’s still tossing millions of BTC and ETH around like confetti at a party that’s long over. 🎉

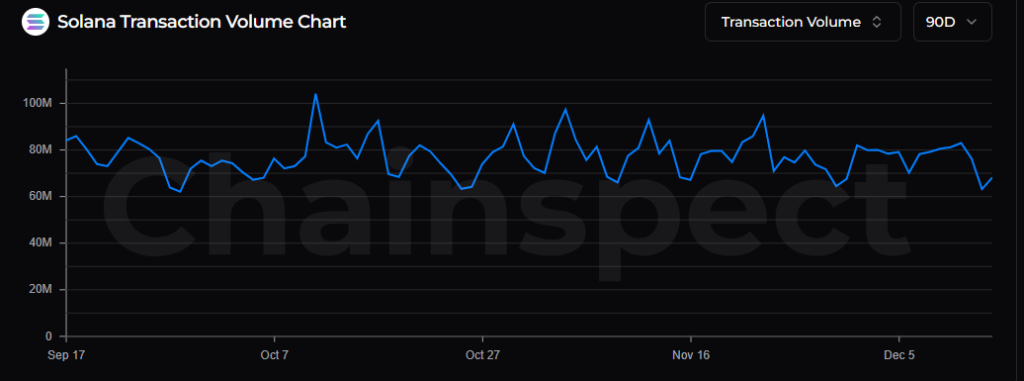

From a network perspective, Solana is the Tolstoy of blockchains-grand, unrelenting, and impossibly productive. Over the past 90 days, its throughput has consistently flirted with 1,000 transactions per second, a feat that leaves Ethereum blushing in the corner. 🏃♂️💨

Ali Martinez, that soothsayer of candlestick charts, points to a supertrend signal last seen before ADA’s 80% plunge in 2022. A grim omen, indeed! Yet in that bygone era, Cardano was but an infant-its research untested, its adoption a myth whispered among true believers. The ecosystem crumbled like stale bread when fear struck. Today, however, the market merely stumbles through uncertainty, as if searching for meaning in a godless void 🤔.

These are not random picks. They’re coins already trading within 5-15% of their previous highs, where momentum, structure, and liquidity align. If the broader market holds steady, these altcoins could surge higher without needing additional triggers. 🧠💥

Shall we witness the tremors of a financial earthquake, or merely the faintest ripple in the vast ocean of global liquidity? 🌊

Meanwhile, the cryptocurrency market, that fickle lover, has started the week in a sulky mood. Bitcoin and Ethereum, those stalwarts of the crypto world, have dipped nearly 1%, as if mourning the loss of their former glory. 🕊️ And Layer2 tokens? They’ve taken a tumble so steep, one might think they’ve fallen off a cliff. Celestia, for instance, is down 3%-a true tragedy, or perhaps just a bad day for a blockchain. 🚪

The Wall Street Journal, bearer of all things financial yet quirky, shared that the asset-management arm of this banking behemoth, which holds the hefty honor of managing nearly $4 trillion in assets, has now launched a tokenized money-market fund. And just for kicks, it’s built on the Ethereum blockchain, backed by a cool $100 million of JPMorgan’s own capital. They even gave it a name: MONY™️, because what else would you call a cash management vehicle infused with blockchain? Money On (a) Net Yell? 😂

We regret to confirm that the legacy Ribbon DOV vaults were exploited yesterday following a vulnerability in a smart contract update, resulting in a loss of approximately $2.7M USD.

“This proposal requests a grant for software research and development work, as well as related activities for the continued benefit of Curve,” Egorov said in the proposal posted on the Curve DAO governance on Dec. 14. Because nothing says “innovation” like asking for millions of dollars in cryptocurrency. 💸