XRP ETFs Soar & Binance Reserves Plunge: A Tale of Greedy Goblins and Vanishing Coins! 🚨🪙

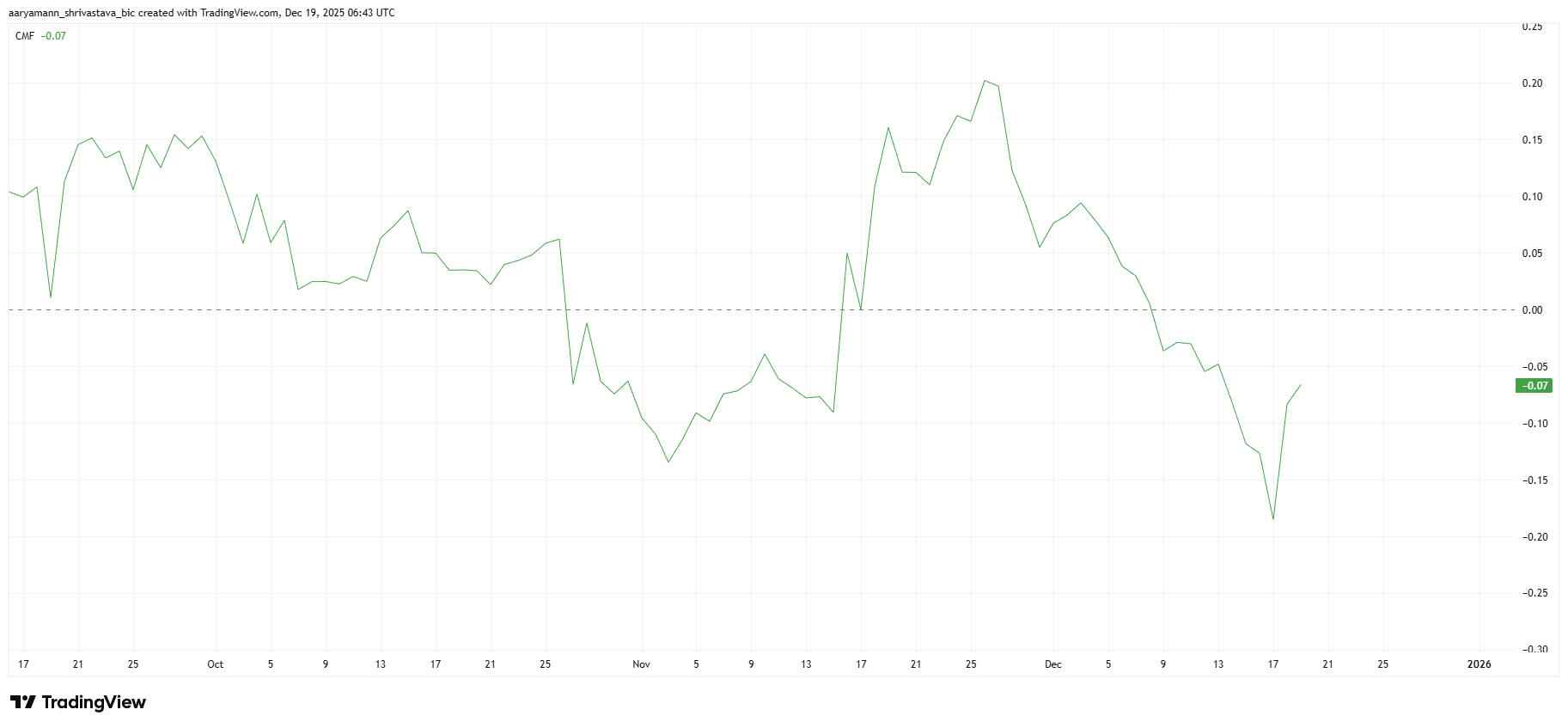

Thursday wasn’t just any day, oh no-it was a feast for institutional money goblins! 🧛♂️💸 $63.86 million sloshed around ETFs like a witch’s cauldron, bubbling up digital asset hype. Binance, meanwhile, watched its XRP reserves vanish faster than a snozzcumber in a sweet shop. 🚨