Unmasking Bitcoin Secrets: The Hidden Chart Satoshi’s Ally Doesn’t Want You to See

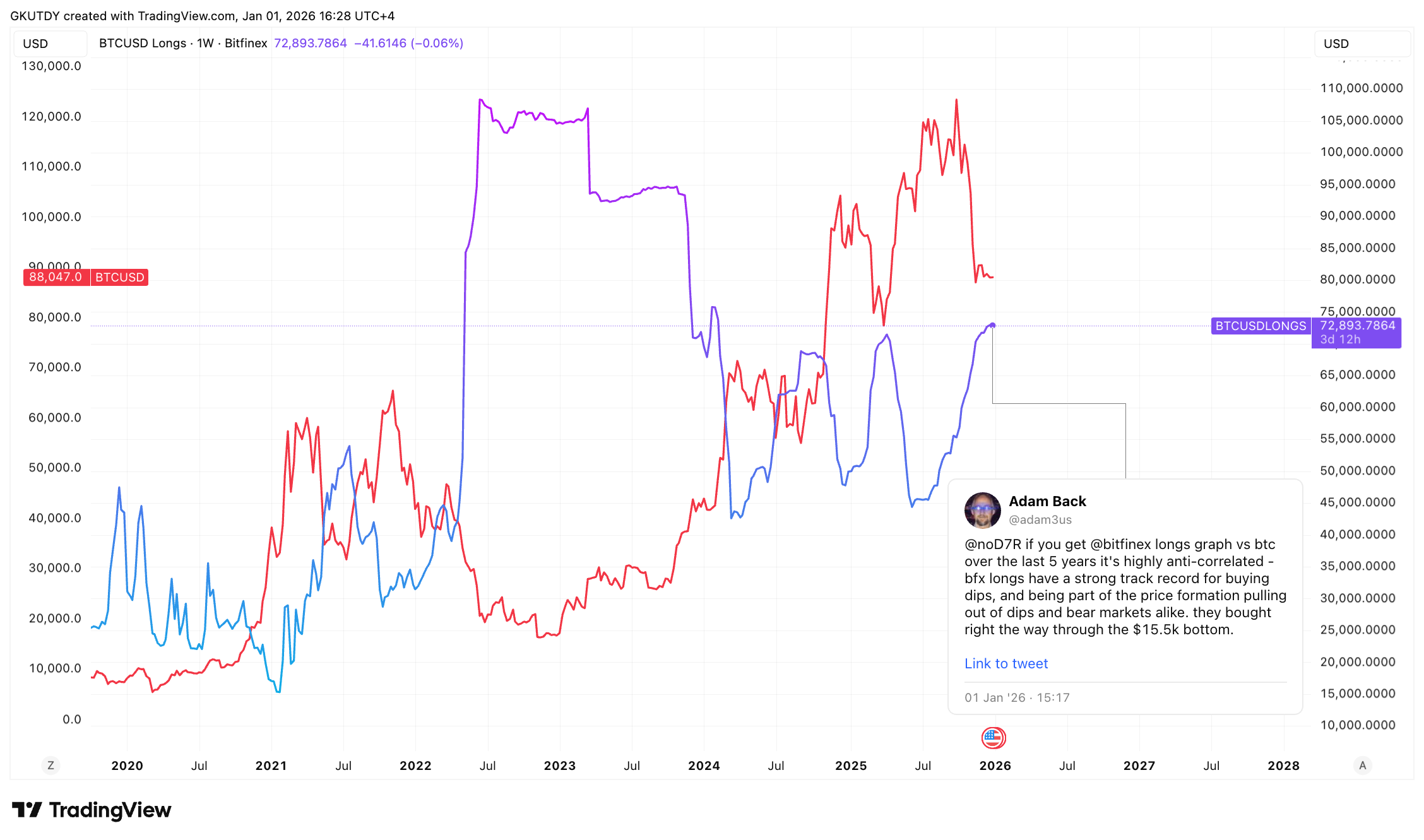

He displayed a TradingView overlay-oh, what a tool of enlightenment!-that plots the eternal struggle between Bitfinex BTCUSD longs and the mercurial whims of Bitcoin’s majestic price. This chart whispers the tale of how a certain segment of the market, brave or perhaps foolhardy, ramps up its exposure even as prices wobble like a drunkard on ice. 💸❄️