💰 Crypto Heist: Thieves Drain Wallets Like Fine Wine 🍷

The ever-vigilant ZachXBT, that Sherlock of the blockchain, hath uncovered this most audacious theft. Truly, the risks of holding digital gold are as persistent as a court jester’s bad jokes!

The ever-vigilant ZachXBT, that Sherlock of the blockchain, hath uncovered this most audacious theft. Truly, the risks of holding digital gold are as persistent as a court jester’s bad jokes!

A principal spectacle in this grand carnival is the burgeoning influence of the modest investor, that fervent army of Robinhood aficionados who now possess approximately 8.3% of PEPE’s entire trove. Here lies the conundrum: Numerous small investors staunchly acquire and clutch this token close to their volatile hearts, rather than surrendering it readily during fleeting tempests of price. Truly, this mass show of fortitude is a sight to behold.

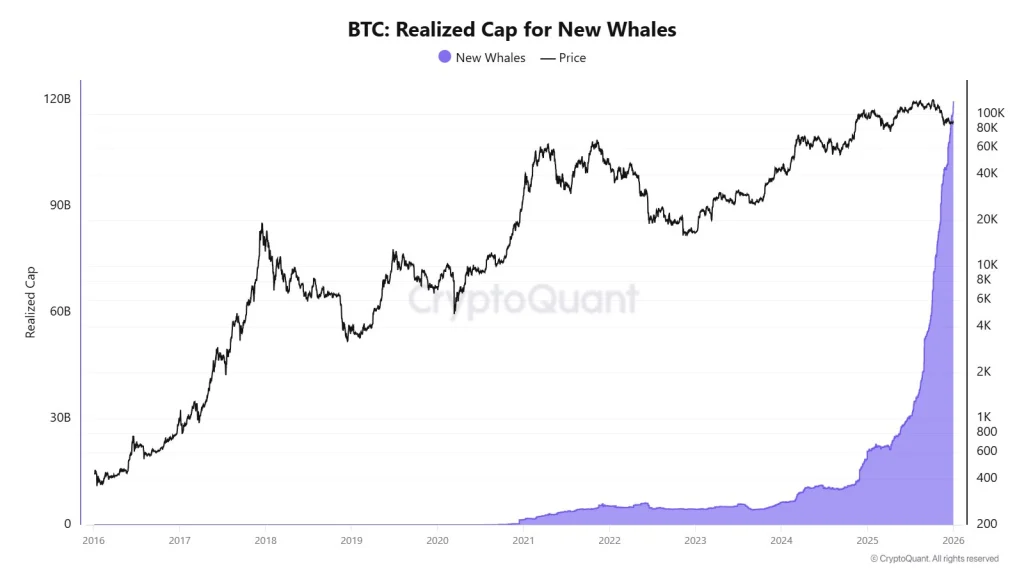

One would be forgiven for thinking Bitcoin’s 2025 performance acted much like a grand masquerade, full of elegant turns masking the expectations held by many. There was no grand display of exuberance to signal a climax-no, that was reserved for its more refined market behavior. Currently perched at the lofty $85K level, whispers of buying activity suggest an accumulation as discreet as a whispered secret rather than the cacophony of panic. What truly tickles the curiosity is the potentially bullish year ahead for Bitcoin in 2026. However, one must tread with elegance and caution, for the fickle heart of the market is prone to bouts of melodramatic shocks and may dash hopes with liquidity woes and curious failures of the most logical models.

What’s causing this price increase, and will it last long enough to start a new wave of popular, speculative investments in early 2026?

Right then. Tether, under the command of a chap called Paolo Ardoino, started 2026 by chucking a substantial amount of Bitcoin – 8,888.88, to be precise – into their treasury. It’s their Q4 2025 profit allocation, apparently. Must be nice.

Oh, darlings, the digital markets are strutting into a new age-think of it as the ruffled tuxedo of finance: institutionally approved, regulatory whisperings, and tech on the most glamorous catwalk. On December 18, Galaxy dropped a hefty report that reads a bit like a fancy party invitation-covering crypto, finance, policy, and AI-while predicting that our dear Bitcoin, blockchain, and friends will be making a fuss about the next big phase. 💃🕺

This Ethereum-based, privacy-obsessed perp DEX has been showing off a bit, with traders farming like there’s no tomorrow-until the farmers finished, of course. Then, poof! $625 million in airdrops given out faster than you can say “free money.” And what happened? Traders, or maybe just the cows that were grazing, started heading for the hills, specifically Hyperliquid [HYPE].

So, here’s the scoop: Humidifi has strutted onto the scene, processing nearly half (47% to be exact) of daily DEX trading volume on Solana. With a $39.5 million market cap, it’s like the little engine that could, chugging along while the bigger kids play ball. Recent data shows trading activity hit an impressive $4.13 billion-high-fiving everyone and their crypto grandma across the sector! 🎉

Our dear Ethereum (ETH) is in a spot of bother, you see, stuck in a triangular pickle that’s been brewing for weeks. Dynamic support and resistance are playing a game of chicken, squeezing the price into a corner where something’s got to give. It’s like watching a balloon inflate-you know it’s going to pop, but which way will the confetti fly? 🎈💨

So, why the drama? Oh, you know, just your typical macro pressure, ETF drama, and a broken four-year cycle that’s now officially “out of the friend zone.” Let’s be real: The old “halving = bull run” script was written by someone who hasn’t seen a bear market since 2018. Now BTC’s trading like it’s on a dating app – swiping left on supply mechanics and swiping right on liquidity, rates, and geopolitical drama. 💔