Dollar’s Midlife Crisis: Crypto Markets Get the Boot

Iran’s latest fireworks show-Israel’s strikes, drones at the U.S. embassy in Riyadh-turned the market into a timid mouse. Risk-off sentiment? It’s the only game in town.

Iran’s latest fireworks show-Israel’s strikes, drones at the U.S. embassy in Riyadh-turned the market into a timid mouse. Risk-off sentiment? It’s the only game in town.

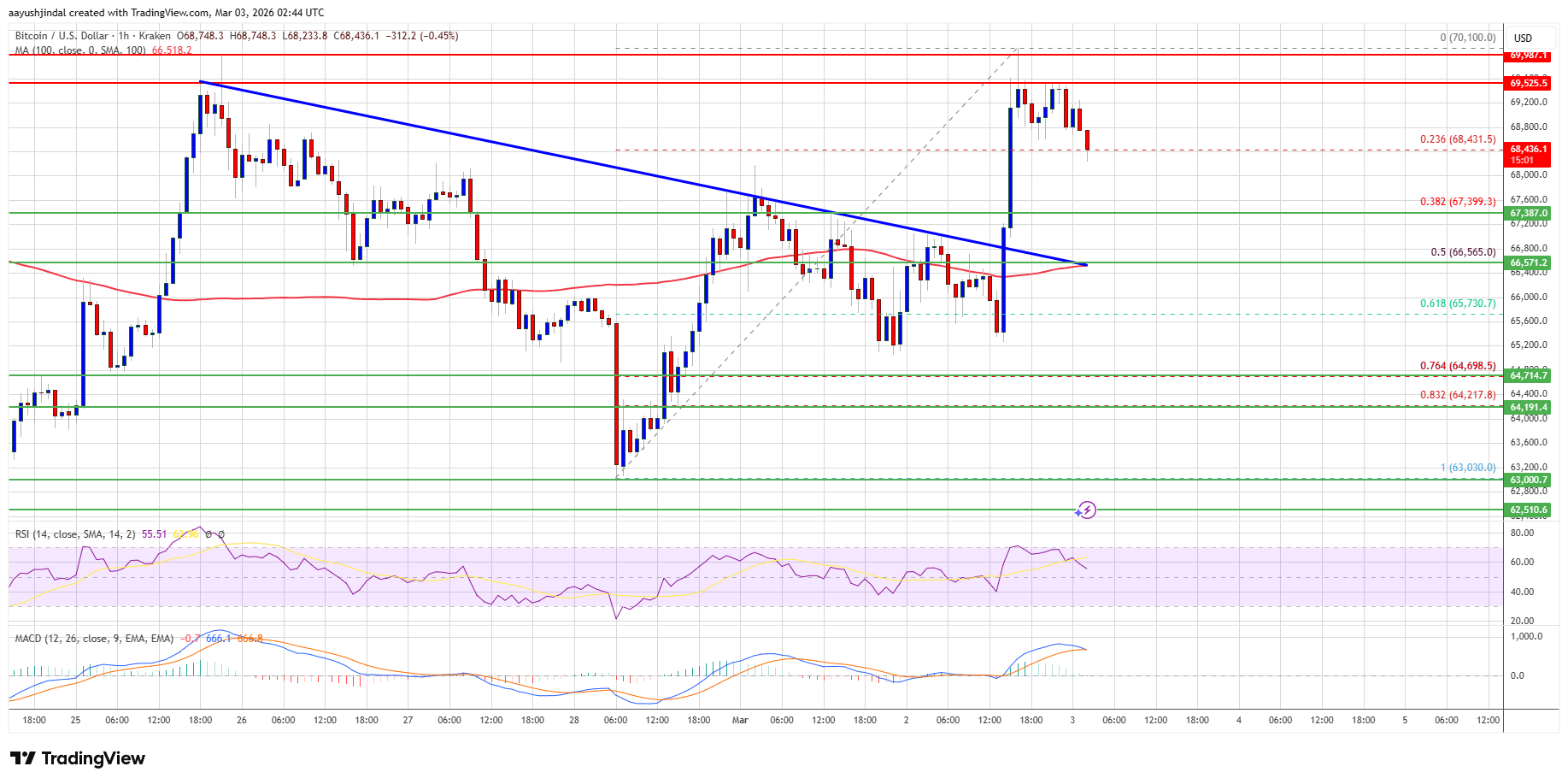

So, the bulls had their moment. A higher high? Cute. But that $69,000 resistance? It’s like the bouncer at an exclusive club, and Bitcoin keeps getting turned away. “Not tonight, sweetheart.” Now, the price is teetering at the top of the descending channel, looking like it’s about to do the walk of shame back inside. Will the bulls try again? Probably. Will they succeed? Well, if their track record is anything to go by, they’re about as reliable as a Tinder date.

Remember that time the U.S. and Israel decided to play a little game of “let’s see who can launch more missiles before breakfast”? Well, while the traditional financial world was still snoozing off its Saturday night hangover, Hyperliquid was already throwing a party. Oil, gold, silver, and even Bitcoin were all RSVPing, their prices fluctuating like a teenager’s mood swings.

In the shadow of geopolitical tempests, the noble citizens of Hyperliquid found themselves in a most peculiar predicament: their pockets grew heavy with gold, their barrels brimmed with oil, and their nerves frayed like a poorly stitched quilt. Behold! The open interest, that most sacred of metrics, surged past $50M, a monstrous sum that would … Read more

CZ finally breaks his silence on all the Binance FUD, the never-ending BNB drama, and the wild ride of Bitcoin control, all during a January 31st AMA session. The Binance co-founder had his chance to clear the air on market manipulation claims, dissect the BNB ecosystem, and even share his grand vision of the crypto market cycle.

NEAR, that ambitious minstrel, climbed 17%, its “Confidential Intents” a lute strummed in the dark, outshining even the CoinDesk 20 and its privacy-coin cousins. A 40% weekly rally, a fireworks display for the cryptosphere.

Well, folks, it’s back! The once-forgotten dream of banning the Federal Reserve from issuing a retail CBDC has been resurrected, lurking in the halls of Senate legislation. And just when you thought it was safe to forget about it, here it is again-months after its last humiliating failure to sneak into last year’s National Defense Authorization Act. They never give up, do they?

Bitmine Immersion Technologies, them clever varmints, have been stackin’ Ethereum like it’s goin’ outta style. Their treasury’s bustin’ at the seams with 4.47 million ETH, pushin’ their total stash of crypto and cold hard cash near $10 billion. And they ain’t lettin’ no market wobbles or geopolitical hullabaloo slow ’em down. Them recent purchases, coupled with their staking windfalls, have their balance sheet lookin’ sturdier than a Missouri mule.

Oh, the folly of it all! Bitcoin, having formed a base above the $65,500 zone, embarked on a fresh increase, breaching the $66,500 resistance with the fervor of a zealot. It rallied above $68,000, and even the bearish trend line at $66,800 was but a fleeting obstacle. But alas, the bears, those eternal pessimists, emerged near $70,000, forming a high at $70,100 before the price corrected, retreating like a coward from a battle it could not win. A move below the 23.6% Fib retracement level of the upward move from the $63,030 swing low to the $70,100 high-a technical detail, yet a harbinger of doom.

On the frosty evening of January 31, CZ, co-founder of Binance, ventured into the wild terrain of public speculation and media frenzy during an AMA session, like a lion stepping into a den of foxes.