Mine BTC at Home? 🏡💰 LOL!

Bitcoin, you see, is rapidly gaining legitimacy, and one couldn’t possibly be blamed for wanting to peek behind the curtain to see how it’s made. It’s all terribly intriguing, isn’t it?

Bitcoin, you see, is rapidly gaining legitimacy, and one couldn’t possibly be blamed for wanting to peek behind the curtain to see how it’s made. It’s all terribly intriguing, isn’t it?

Erwin Voloder, Head of Policy at the European Blockchain Association, sat down with BeInCrypto to unpack how Musk turned a meme into a market mover, blurring the lines between satire and speculation, and leaving a trail of ethical questions in his wake.

Enter the experts: John Deaton and MetaLawMan, the dynamic duo of crypto legal drama, who wasted no time in pointing out the glaring inconsistencies in the IG’s Hinman report. Let’s dive into their scathing critiques and unravel the report’s potential impact on the XRP lawsuit. 🕵️♂️

This “Crystal Caves,” forged in collaboration with World3, promises not only entertainment but also the allure of material gain through a so-called “Play-to-earn” model. How novel! To toil not for the sake of creation, but for the accumulation of digital trinkets. The goal: earning $USDC.

And lo, the altcoins, those merry pranksters of the crypto-carnival, have also capered with impressive gains! Among them, Solana (SOL), that nimble harlequin, doth emerge as the top trouper from the troupe of ten largest. Bravo! 👏

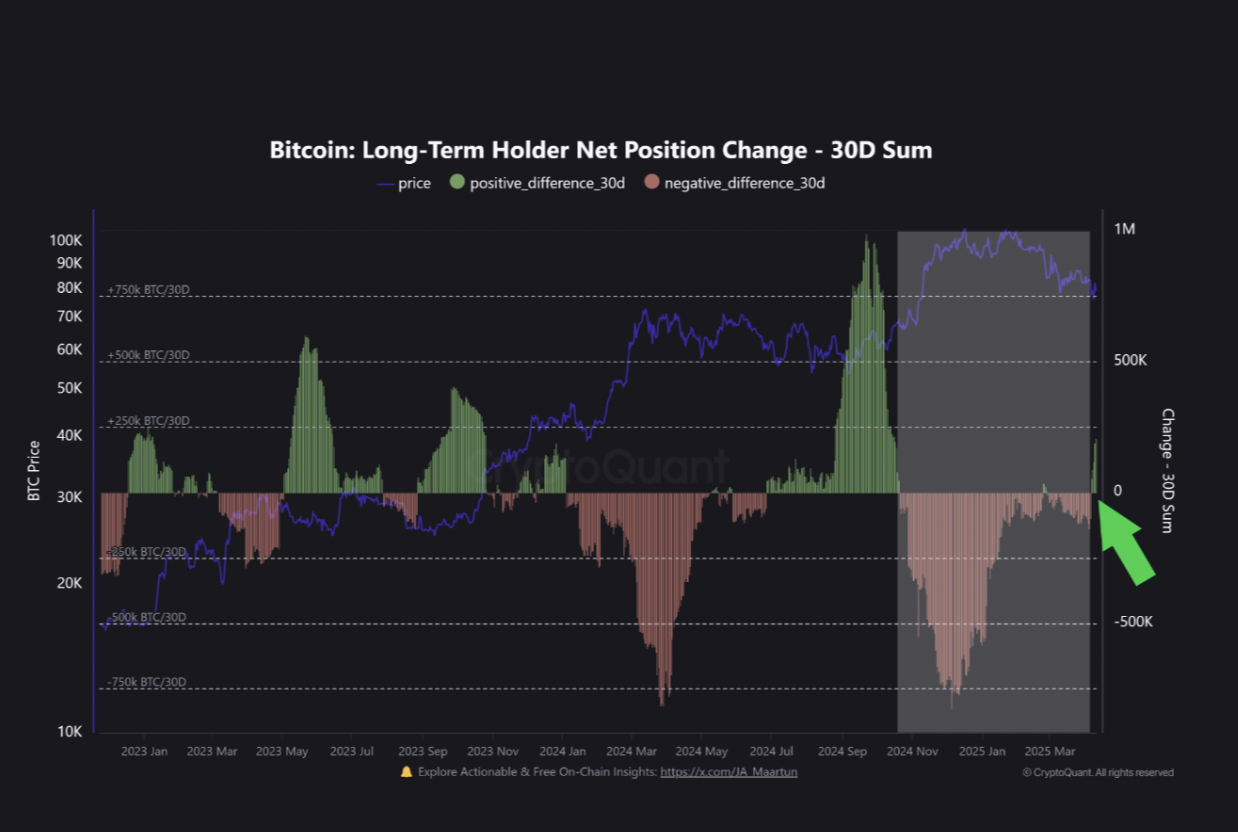

Yet, even amidst this delightful volatility, the long-term holders (LTHs), those paragons of patience, remain as steadfast as a statue in a storm. 🗿 They show no signs of relinquishing their ambition to elevate BTC back to the dizzying heights above $85,000. The question, of course, is: How soon will their dreams materialize? 🤔

Par Shayan, le sage des cryptomonnaies.

Long, with the gravitas of a prophet, declared the global financial system to be at a crossroads—a fork in the road where one path leads to obsolescence, and the other to a tokenized Eden. Backed by a joint study with the Boston Consulting Group, she prophesied that tokenizing physical and financial assets—transforming them into digital phantoms on the blockchain—could redefine the very essence of value transfer. The study, with the audacity of a fortune teller, predicts this sector could swell to a staggering $18.9 trillion by 2033. 📈💰

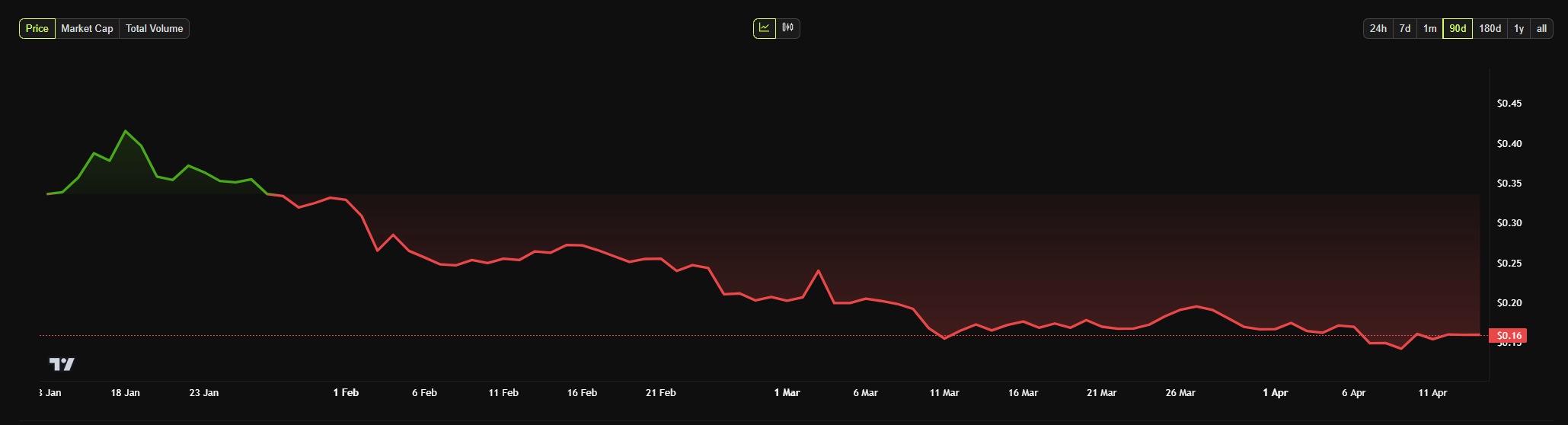

After enduring a rather dramatic correction of over 70%—a fate that would make even the stoutest heart quiver—Dogecoin (DOGE) now appears to be flirting with the idea of a breakout. It is currently engaged in a tight falling wedge pattern, a classic technical setup that the optimistic might consider bullish. Or perhaps just a fancy way of saying, “Look, it’s trying!”

According to the data (because we all trust data implicitly, don’t we?), Ethereum is currently lounging at $1,558, which is basically the same as its August 2022 price of $1,600. Meanwhile, Bitcoin has gone from $21,500 to $82,302 – a 270% rise that’s basically the crypto equivalent of a glow-up. Mow’s using this widening gap to double down on his claim that Ethereum’s price is, well, a bit of a joke. 🃏