Jobless Claims Drop, Bitcoin’s Big Moment: Will It Soar or Sink? 🚀💰

But lo! The resilience of our labor market is not without its shadows. Federal Reserve Chair Jerome Powell, in a recent gathering of economic minds in Chicago, proclaimed:

But lo! The resilience of our labor market is not without its shadows. Federal Reserve Chair Jerome Powell, in a recent gathering of economic minds in Chicago, proclaimed:

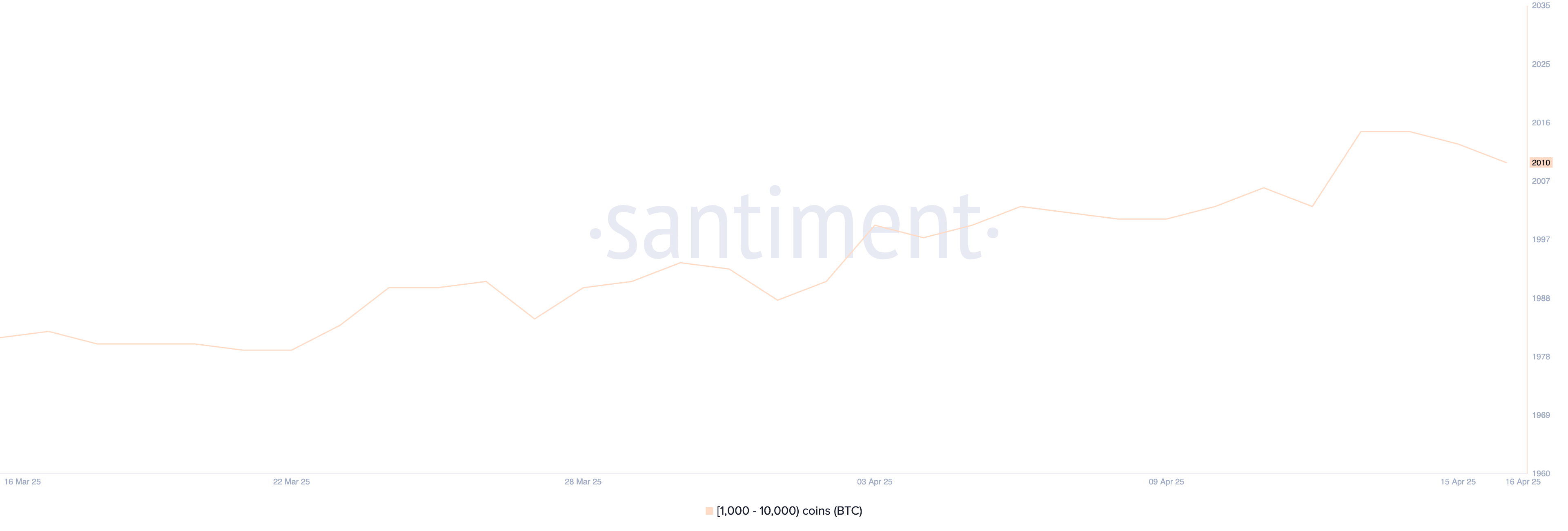

As a researcher, I’ve noticed a downward trend in the number of whale wallets, which is concerning. However, on-chain data indicates that large investors are still showing significant interest in Bitcoin. On the technical analysis front, Bitcoin appears to be in a period of consolidation, with Equalized Moving Averages (EMA) showing weakness and Ichimoku readings providing mixed signals.

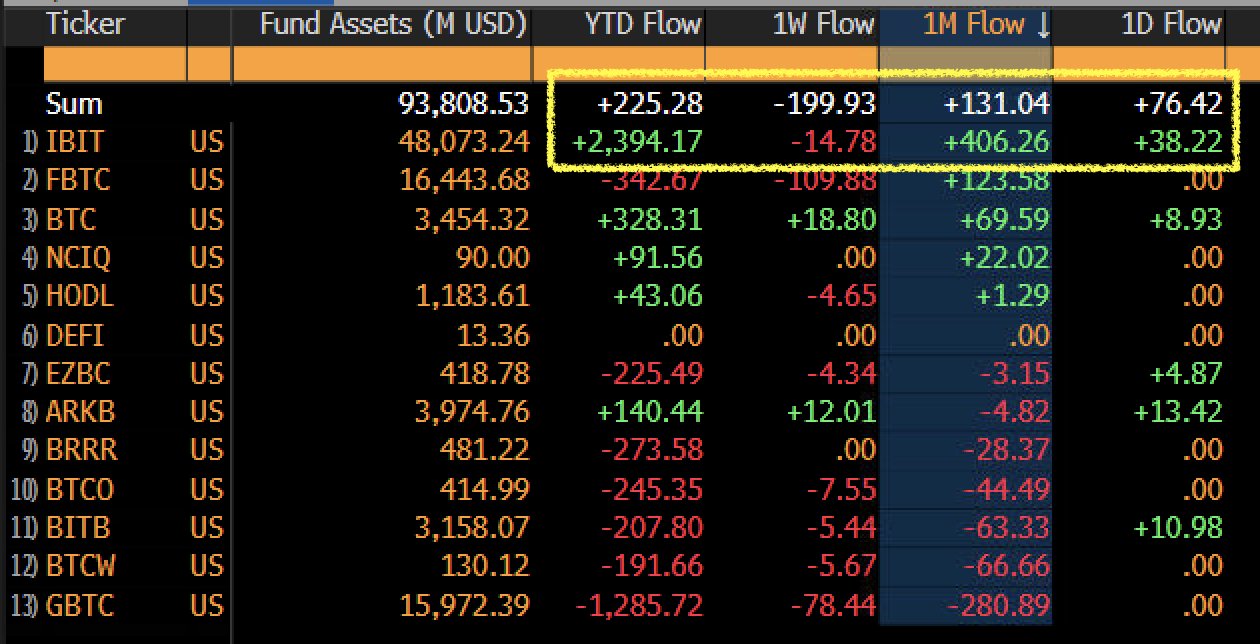

Leading this whole parade of profits is BlackRock’s IBIT, with a ka-CHING-ing $2.4 billion in flows this year! According to Bloomberg ETF data, this puts them in the top 1% of all ETFs YTD. They’re practically royalty! 👑

First up, Solana. Martinez, with a following of 135,500 on the social media platform X (formerly known as Twitter, but who’s counting?), warns that this sixth-largest crypto asset could plummet by a staggering 48% if it doesn’t manage to break through the resistance area lurking just below the $138 mark. Talk about a nail-biter!

The proposed tax, a veritable toll, shall be levied when crypto, that digital chimera, transforms into the more tangible euro, or when it dares to purchase the baubles and fripperies of this mortal coil. Yet, fear not, for the alchemists who transmute one crypto coin into another shall remain untouched by this fiscal decree. A curious exemption, wouldn’t you agree? 🤔

Whisper it: quantum computers might soon solve in seconds what our pedestrian machines would ponder for 47 years. Imagine! Seven decades of waiting, crushed beneath the boot of a quantum contraption. Such power threatens to turn crypto kingdoms like Bitcoin and Ethereum into very expensive digital sandcastles since newer coins have been minted with quantum-resistant charms.

In a twist of fate, a16z has pledged to lock these tokens away for three years, as if they were a prized possession in a wizard’s vault. 🧙♂️

Now, the central bank is pacing nervously, probably sipping artisanal mate, wondering if they should step in and buy dollars like it’s Black Friday, just to keep the peso feeling a bit weaker — because, you know, pride and all that. But President Javier Milei is playing hard to get: “Not until that sucker drops below 1,000 pesos per dollar,” he says, probably with a smirk and a dramatic pause for effect. 🎭

According to Coinbase’s announcement, they’ve made some, let’s say, *technical* improvements to their Solana setup. For those who like numbers (which may or may not include you), here’s the fun bit: they’ve increased block processing throughput by five times. Yes, five! It’s like giving a cheetah a Red Bull. 🐆💥 And if that wasn’t enough, they’ve introduced bare metal machines that improve RPC (Remote Procedure Call) performance by four times. We’re talking supercharged servers here.

Bloomberg spilled the beans that with this shiny new badge, Hidden Road can now strut its stuff for the big kids—prime brokerage, clearing, financing—you name it! Fixed-income assets? Oh yeah, they’re in the money-making game now, like a Hollywood agent but for bonds and stuff.