Ethereum’s Wild Ride: 449K ETH Pours In, But Will It Crash or Soar? 🤔💸

On April 22, Ethereum’s accumulation addresses hoarded a staggering 449,000 ETH — a record so audacious even the blockchain blinked.

On April 22, Ethereum’s accumulation addresses hoarded a staggering 449,000 ETH — a record so audacious even the blockchain blinked.

The Department of Justice spilled the tea: the Austins snagged a cool $5 million in one swoop, then carved out another $4 million. But returns? Nah, that’s for suckers. They redirected the cash straight into lavish escapades involving five-star hotels, probably sipping cocktails with tiny umbrellas rather than investing in anything remotely productive.

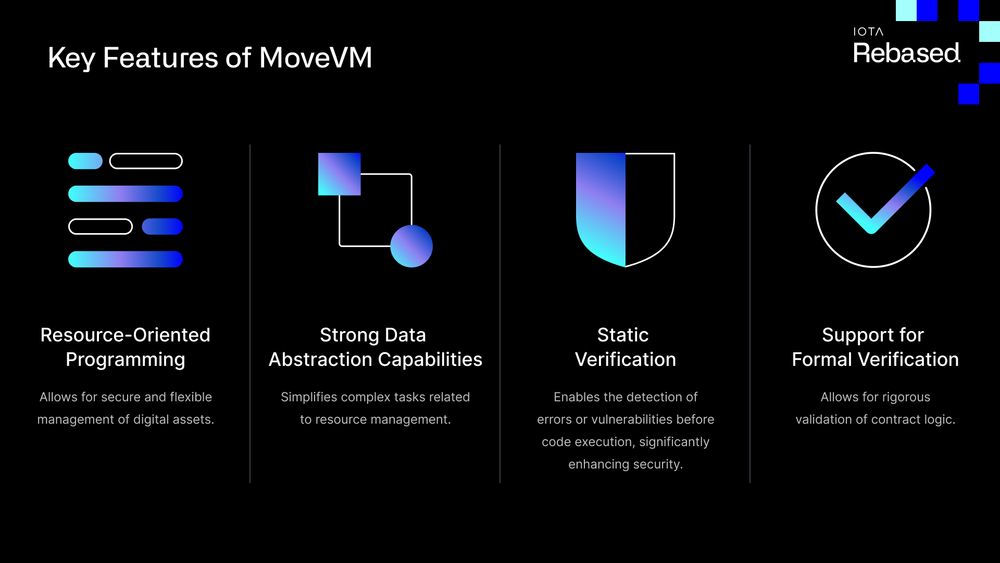

It’s not just an upgrade, it’s a digital renaissance, swapping out legacy bits for shiny decentralization bits and chucking out the Coordinator like last season’s socks. IOTA started life proudly proclaiming itself a “blockchain without blocks” – think of it as a blockchain who refuses to wear a suit, instead choosing the Tangle, a tangle-y graph thingy that processes transactions in parallel, which sounds like the blockchain equivalent of doing eight things at once without losing your snark.

Meanwhile, ETH’s price has decided to take a tiny breather, dipping by 1.87% and landing at $1,766.31. Some people just can’t resist taking profits after a good run, and hey, who can blame them? But don’t get too comfortable, dear reader. The charts are hinting that ETH might soon burst through that glorious $1,850 mark. Popcorn, anyone? 🍿

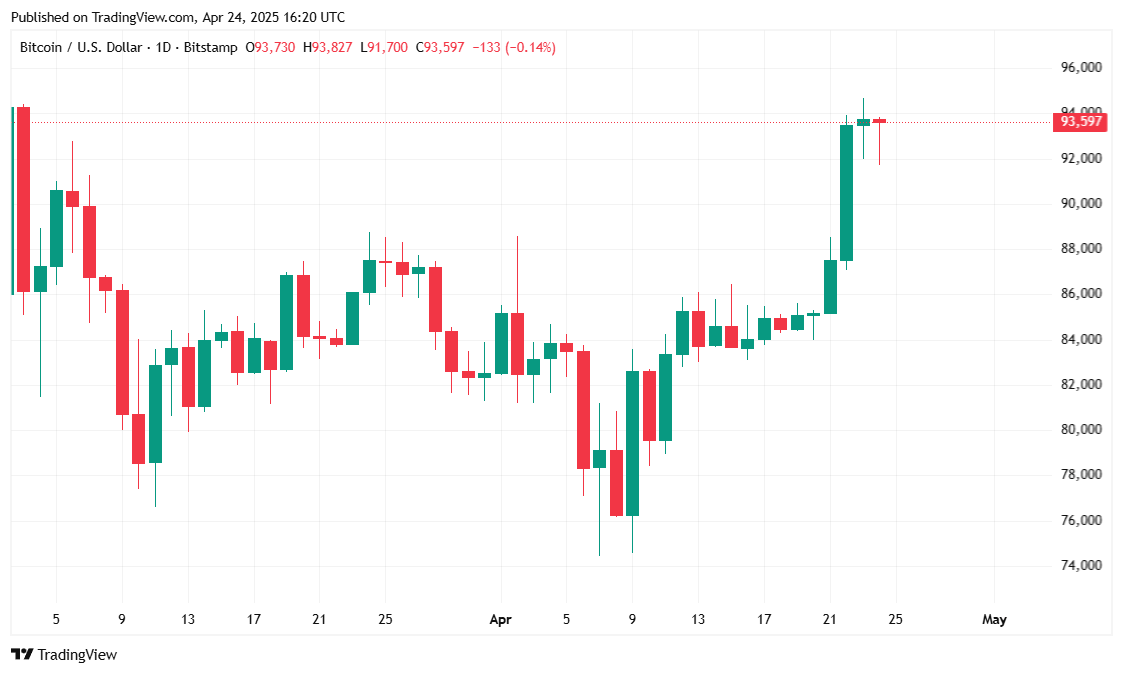

Bitcoin, the cosmic jester of finance, has been practically hibernating around $93,000 for 24 hours—nodding up and down as if trying to decide whether to buy a latte or just meditate on its existence. Meanwhile, gold, the grandpa of shiny things, surged last week and is now hanging out above $3,300, humming confidently about $4,000 next year, as if it’s betting investors will abandon those boring old Treasuries and the U.S. dollar faster than you can say “Where’s my gold?”

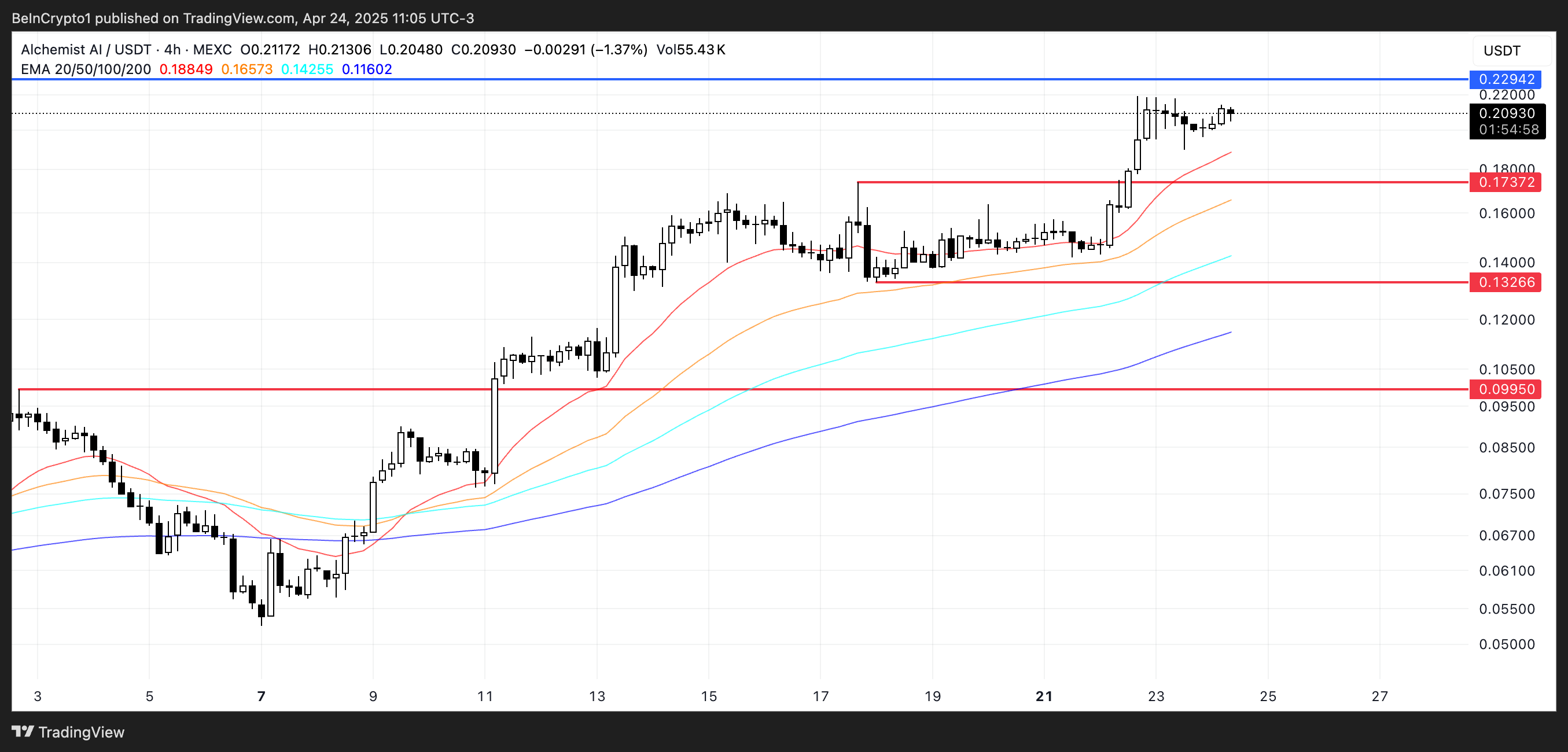

Amid this carnival, three merry jesters have somehow outdanced the chaos: Alchemist AI (ALCH), FARTCOIN (yes, you read that right), and AI Rig Complex (ARC), each brandishing technicolor stories, chart acrobatics, and crowds of intrigued onlookers.

Brad Garlinghouse, Ripple’s proud ringmaster, can barely contain his glee: “At long last, a step forward for XRP’s so-called glory parade!”

Maximilian’s charm lies not merely in his ledger skills but in the labyrinthine acquaintance with financial gatekeepers and regulators, a dance most perform with grimaces rather than grace. Despite this promotion, one suspects a soft tether as he remains perched on MoonPay’s board, like a well-fed cat unwilling to abandon the kitchen.

Canada’s story with digital assets ain’t just bedtime tales told by fireside yarn-spinners. It’s stitched into the fabric of the nation by firsts and leapfrogs:

So, CandyDrop—a stage where your toil is measured by clicks and clicks alone. Trade enough, deposit this or that, summon others into the hive, and *poof*—collect candy points as if you’re in some sugar-coated factory of dreams. Exchange these points for tokens, because nothing says “quality” like ticking boxes for digital candy.