Brazil’s War on Stablecoins: The Logic is as Clear as Mud! 😂💸

So, Don’t let excitement fool you—regulation is lurking, just waiting to bring all that innovation crashing down like a poorly timed punchline. 🎤

So, Don’t let excitement fool you—regulation is lurking, just waiting to bring all that innovation crashing down like a poorly timed punchline. 🎤

The grand titan of public Bitcoin holdings decided not to seize the moment between March 31 and April 6, even as the price of BTC dipped below $80,000, then soared to $87,000 midweek, only to slump again. Some might call this prudence; others might consider it an odd tea-time break during a most dramatic war scene. 🤔

With fresh catalysts like Trump’s crypto strategic reserve and the tantalizing prospect of altcoin ETFs under SEC review, the question arises: Is $100 a realistic target for Dogecoin, or are we merely chasing a mirage in the desert of financial folly? 🌵

Severino, armed with the arcane knowledge of Elliott Wave theory, paints a picture of Bitcoin’s price trajectory as a tragic epic. The cryptocurrency’s journey, he claims, is far from over. The recent decline to $74,000 is but the opening act of a broader ABC corrective pattern, destined to drag Bitcoin down to its final nadir. 📜💔

Amid the “Is this depressing enough for you?” market sentiment, our humble XLM price prediction has become the talk of the town—right between gossip about Karen’s cats and the fact that nobody invited Dave to happy hour. Apparently, expert technical analysis claims our little token is playing a game of “how low can you go?” within a falling wedge pattern. Not the most exciting game night ever, huh? 😅

Should this spectral cross manifest within days, the bearish tide might swell, further eroding investor fortitude. With XLM having already breached its100-day and200-day moving averages—once bastions of support—the asset teeters on the precipice. Moving averages and resistance levels now tower above, a daunting wall for any aspiring ascent.

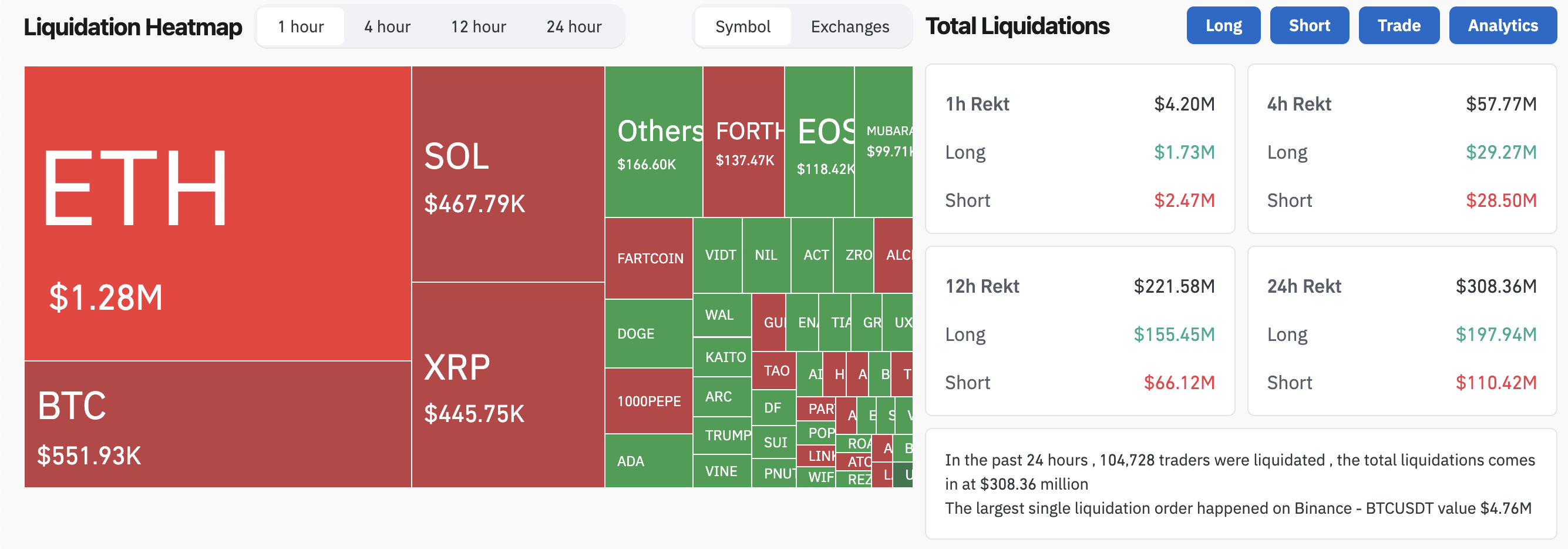

But hold your horses! There’s a glimmer of hope as Bitcoin’s long positions have risen to a robust 54%. Tomorrow promises to be a day of reckoning; it might just bring chaos to the traditional finance folks, but our dear crypto might just weather this storm like a seasoned sailor in a squall. 🌪️

Ah, the XXRP ETF, a creature of duality, a 2x leveraged fund that aspires to double the daily price movements of XRP! A tantalizing prospect, indeed, promising the sweet nectar of higher gains while simultaneously brandishing the sword of risk, for XRP is notorious for its capricious price fluctuations. The advent of this leveraged ETF arrives amidst a burgeoning interest in cryptocurrency-based ETFs, with other illustrious firms such as Bitwise, WisdomTree, and Franklin Templeton also dabbling in the XRP waters, albeit their filings languish in the bureaucratic limbo of the U.S. Securities and Exchange Commission (SEC). Ah, the joys of regulatory oversight! 😏

As if by magic, the SUI token has performed a bullish reversal, now fluttering around the $2 mark, having risen from the depths of $1.93. One might say this ETF filing is the fairy godmother of altcoins, potentially lifting this poor soul from its Year-To-Date losses of over 53%. Oh, the irony! 🎩🪄

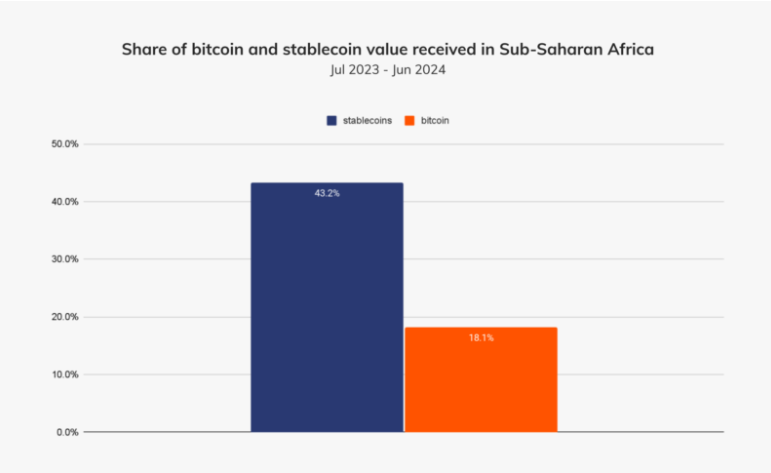

In a jaw-dropping exclusive with BeInCrypto (it’s like the gossip column for crypto insiders, right?), Maurice dishes out how Yellow Card is creating a stablecoin network across Africa that’s about to leapfrog traditional finance faster than I can say “blockchain.” It’s a wild ride fueled by clearer regulations, crumbling fiat systems, and let’s not forget the epic remittance revolution. 🚀💸