Is Bitcoin the New Flat Earth? Price Predictions with a Twist! 😂💰

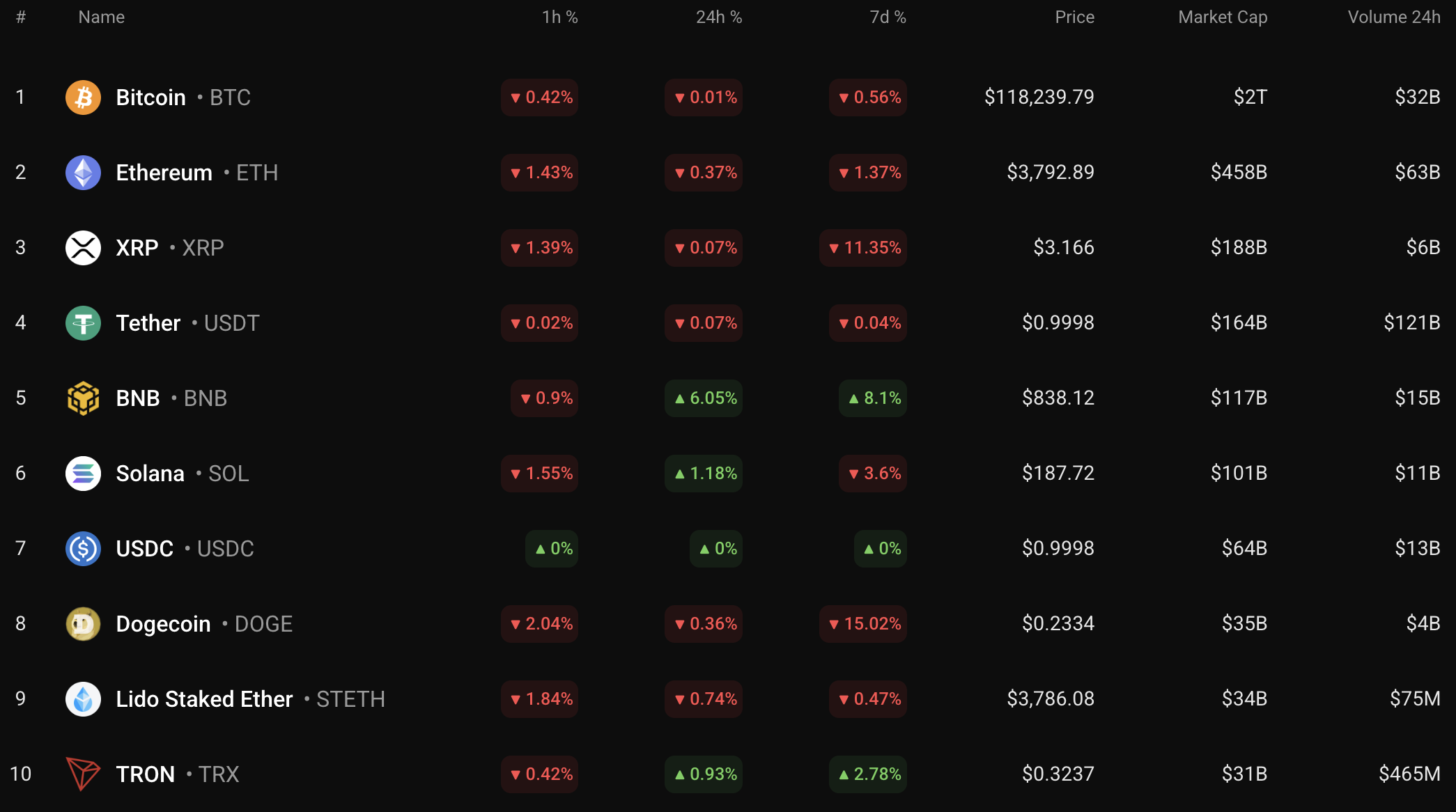

The ever-elusive price of our dear Bitcoin (BTC) remains astonishingly apathetic, teetering on the precipice of yesterday’s inconclusiveness. One would think it had stumbled upon a cat video instead of the market. 🐱💻