DOGE’s Wild Ride: Will It Bark or Bite by July 27? 🐶💸

While its peers frolic in the green, DOGE, that incorrigible scamp, has tumbled by 0.19% since yesterday—a fall as graceful as a drunkard descending a staircase. 🥴

While its peers frolic in the green, DOGE, that incorrigible scamp, has tumbled by 0.19% since yesterday—a fall as graceful as a drunkard descending a staircase. 🥴

The price antics have been nothing short of comical: a ludicrous leap from $2.09 in late June to a dizzying peak over $3.50 by mid-July, only to cool off and perch precariously above $3. Despite a paltry 8.46% weekly dip, the short-term charts are gamely showing gains, and the market cap is swaggering towards $190 billion—like a nouveau riche upstart at a society ball. 😂

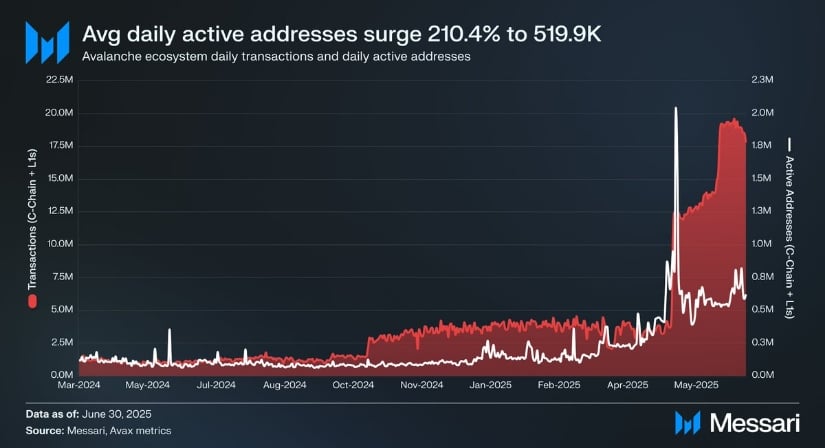

Q3 dawns with the momentum of a man fleeing his past, fueled by the Octane upgrade—a reduction in transaction costs that has, they claim, ignited a wave of growth in DeFi, gaming, and enterprise usage. Messari, that chronicler of financial tales, reports a 169.9% QoQ jump in daily transactions and a staggering 210.4% surge in active addresses. 🥳 But are these numbers the harbingers of true expansion, or merely the fleeting dreams of a fevered mind? The DeFi total value locked grows by 37.1%, a sign, perhaps, that capital is returning to the fold. Yet, one must ask: is this the dawn of a new era, or the last gasp of a dying star?

Even with sellers ruling the roost in the spot market, Ethereum [ETH] is slyly seeing more institutional and whale hoarding, like a cat plotting a midnight raid, hinting at an upside shenanigan that could catch folks off guard. 😏

Now, this little rumor fest was sparked by a throwback October 2024 post from CEO Luca Netz, who apparently had dreams of snagging the NFT marketplace. Some folks in the community thought the timing of Pudgy’s December announcements and OpenSea’s platform updates were like breadcrumbs leading to a big ol’ acquisition feast. But Beau was having none of it, quipping that they’ve got way more important priorities. He added, “Acquiring OpenSea doesn’t make sense for us right now,” which is code for “we’re busy turning candy canes into actual penguins, please.” 🍭🐧

This fragile euphoria is fueled by institutional inflows (because nothing says “trust me” like a former bankruptcy spectacle) and FTX’s creditor repayments, a redemption arc so improbable it belongs in a Dickens novel. All eyes now turn to two spectacles next week: the high drama of the FOMC meeting (July 29–30), where the Fed’s high priests will sermonize on interest rates 🏛️, and the SEC’s verdict on the Bitwise BITW ETF, a decision so anticipated it’s practically a national holiday. 📅

Brandt, who probably has a magnifying glass permanently attached to his hand, has shared a chart so bullish it could make a vegan reconsider steak. Apparently, XLM is forming a symmetrical triangle, which sounds like something you’d find in a geometry textbook, not a financial forecast. But hey, who am I to judge? I once thought a 401(k) was a type of yogurt.

Our cast of would-be Bond villains: Krish (the ringmaster), Deepa (talent acquisition, but make it felonious), Gaurav, Manthan, and the headline-stealing Nidhi Agarwal a.k.a. Crypto Queen. Apparently, the hook was irresistible: online jobs so fake, even the job assignments were fakes of fakes. The scammers weren’t just thinking small – they even took out personal loans of 8.8 lakh under a victim’s name, because nothing says “I care” like ruining someone’s credit score as well as their bank account.

Conceived by the illustrious National Data Association and presided over by the Ministry of Public Security’s Data Innovation and Exploitation Center (a name that begs for a cup of tea and a spot of gossip), NDAChain is destined to be the backbone of government verification. Whether it’s hospital records, school transcripts, or those oh-so-dignified supply‑chain logs, nothing escapes its watchful gaze. 😉

This chap called Ted Pillows (a rather silly name, if you ask me 🤔) has been poking around with numbers and discovered that Ethereum’s “on-chain volume”—which sounds frightfully complicated—has shot up by a whopping 288% in just THREE weeks! Imagine! That means more and more people are fiddling about with it. It’s like a sudden craving for pickled onions—everyone wants a piece! Apparently, some serious grown-ups with lots of money are getting involved and, well, things are getting a bit exciting. 🥳