DeFi’s New ‘Forecast Markets’ – Will They Storm the Crypto World? 🧠🔥

These “forecast markets” are basically futures contracts for things that aren’t even assets. Bet on CPI? Sure, why not. Just don’t expect a refund if the economy collapses. 🧠💸

These “forecast markets” are basically futures contracts for things that aren’t even assets. Bet on CPI? Sure, why not. Just don’t expect a refund if the economy collapses. 🧠💸

So, how do you fight back? 🥊 Simple: waste their time, make them cry, and watch them scream into the void. Kitboga’s got your back (and their wallets).

BeInCrypto, in its infinite wisdom—or at least with a decent spreadsheet—has identified three altcoins that might hit all-time highs soon. Or crash spectacularly. Either way, it’s bound to be entertaining. 🎢

Ah, the audacious Salvadoran saga continues! Following a recent soiree of statements from the International Monetary Fund (IMF), the nation’s flirtation with bitcoin purchases has once again caught the eye of the financial gaze. During a press conference that would make any soap opera jealous, IMFer Julie Kozack energetically proclaimed that, lo and behold, since the ink dried on the $1.4 billion credit deal, El Salvador’s bitcoin stash has remained remarkably unchanged. Almost impressive, if you think about it! 🧐

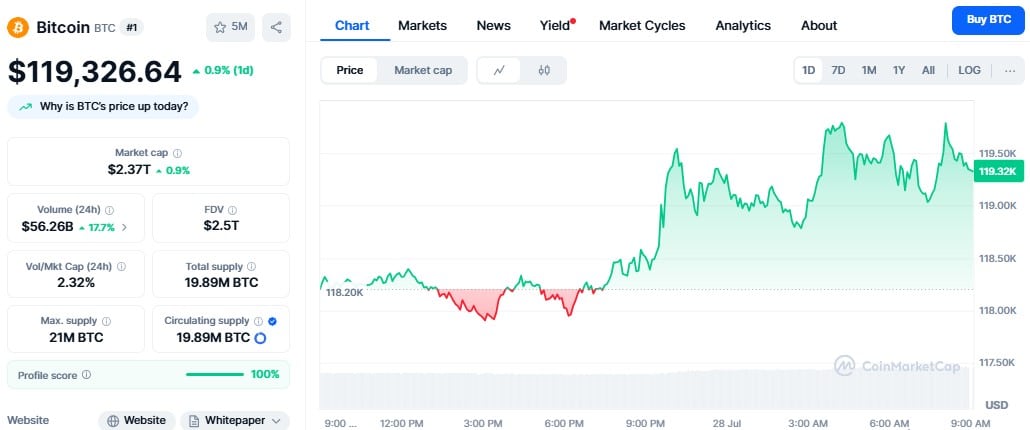

Meanwhile, Bitcoin, that capricious lover of libertarians and meme-stock enthusiasts, has once again abandoned its post at the $119,000 checkpoint, slinking back to the shadows of last week’s price trenches like a thief caught mid-heist. 🖤

Local media reports paint a picture of a well-oiled machine, where the accused leveraged Telegram to dupe unsuspecting victims into performing fake online tasks. These tasks, shrouded in the promise of lucrative rewards, were nothing more than a front to siphon off hard-earned money into the murky world of unregulated cryptocurrencies. 😂💸

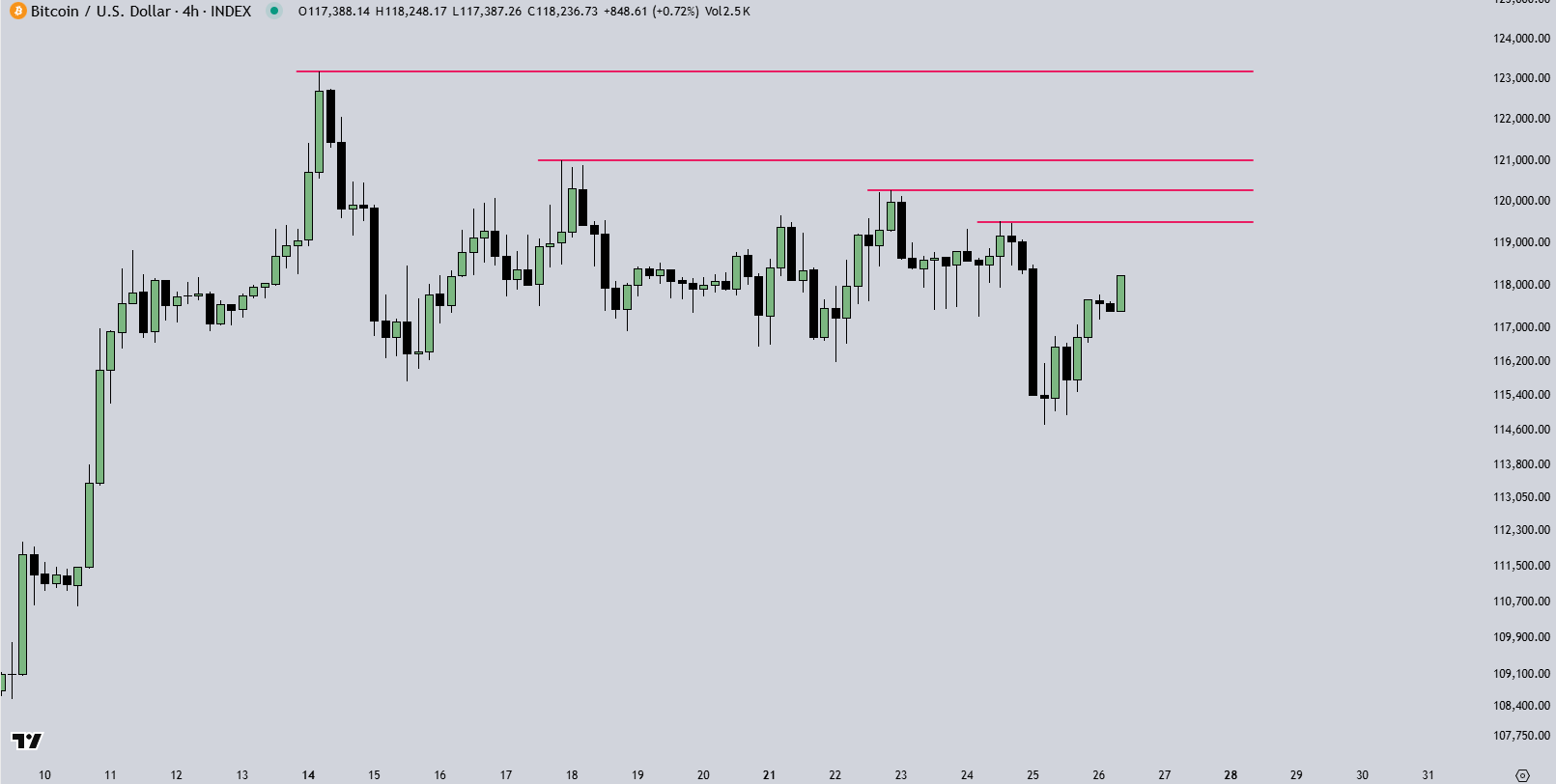

Methinks the market makers, those dashing rakes of finance, have orchestrated a most cunning trap. First, they feigned disinterest, allowing the price to plummet and flush out the faint-hearted longs—a ruse as old as the trading pits themselves! 🎩💸 But lo! A reversal was afoot, sweeping liquidity from support levels like a rogue stealing tarts at a country fair. The bears, lulled into complacency, found themselves dashed upon the rocks of £118,000, their liquidations ringing like a comedic bell.

It seems two cunning individuals (who clearly didn’t watch enough spy movies to know how NOT to get caught) were allegedly using local crypto exchanges to funnel funds straight into the coffers of Hay’et Tahrir Al-Sham (HTS), a Syrian terrorist group with more drama than a telenovela 📺💣. Naturally, Argentina wasn’t about to let this slide. “Freeze those funds!” they cried, slamming the door shut faster than a llama chasing its hat in a Patagonian windstorm 🦙💨.

//crypto.news/app/uploads/2025/07/Image-28-07-2025-at-05.35-1024×483.jpeg”/>

In just the last 24 hours, our beloved Bitcoin has managed to climb almost 1%—which, let’s face it, is better than my New Year’s resolutions. Currently, it’s sitting cozy at $119,326. And guess what? Daily trading volume has exploded by 17%, pulling in a whopping $56 billion. 💰 I mean, trading crypto is like hitting the jackpot, except the casino is also on fire and the dealer keeps asking for your social security number!