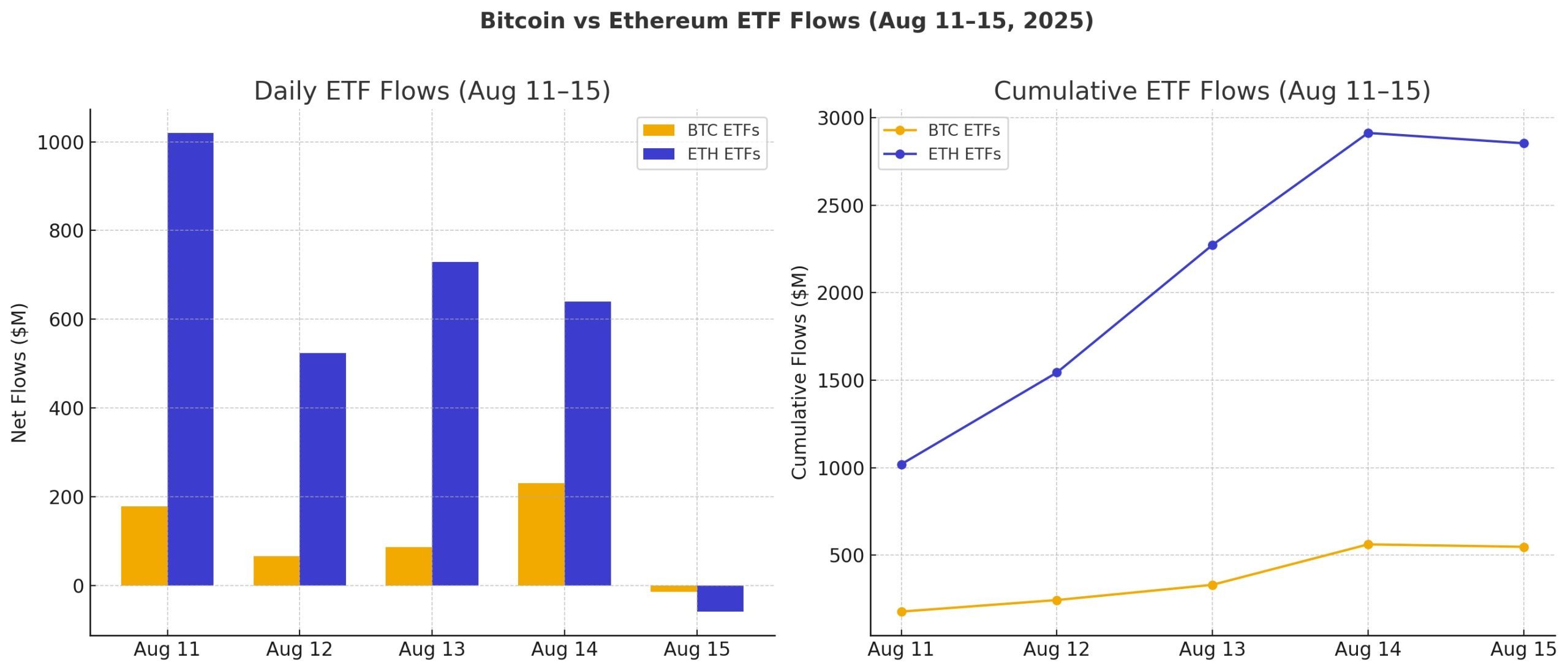

Steinbeck’s Take on Crypto ETFs: Ether Shines While Bitcoin Takes a Nap 😴

The week of Aug. 11-15 was a tale of two cryptocurrencies. While ether ETFs basked in the glory of unprecedented inflows, bitcoin ETFs seemed to be taking a much-needed nap. Investors, with wallets as deep as the Salinas Valley, poured their hard-earned cash into ether, signaling a shift in the institutional landscape.