Crypto’s Last Stand? Crenshaw’s Fury and the Eternal Struggle for Truth

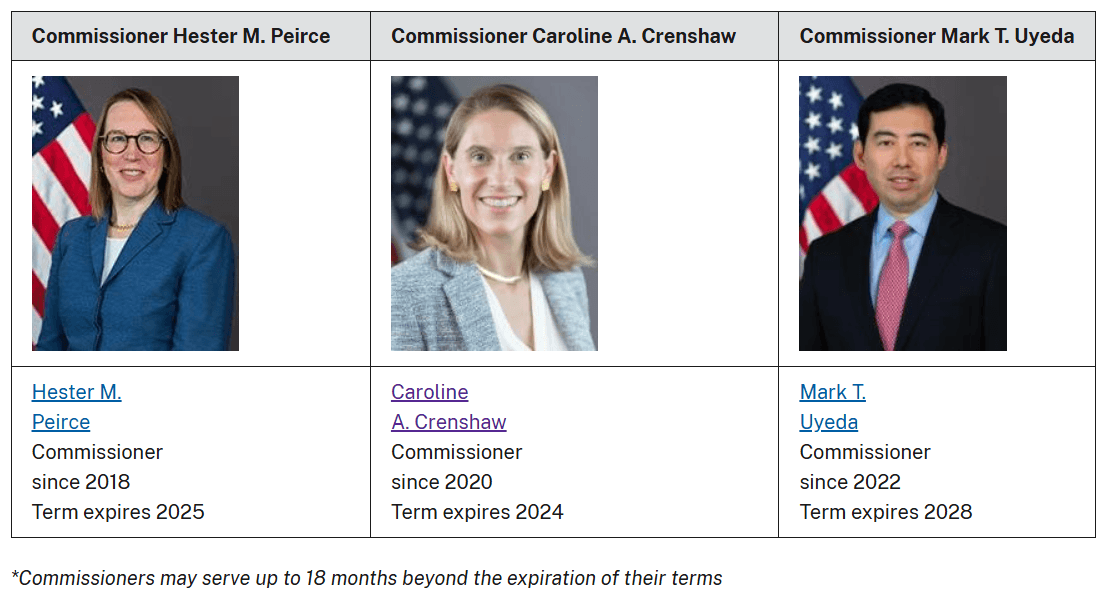

Commissioner Caroline Crenshaw-once dismissed as a “failure” by the Coinbase patriarch, Brian Armstrong-delivers her rebuke with the precision of a dying man’s confession. Her words cut through the fog of regulatory complacency like a dagger, revealing an industry drowning in its own muddy waters. The “Statement on Certain Liquid Staking Activities”-a document so vacuous it could be mistaken for a Dostoevskian explication of human despair-only adds to her disillusionment, as if the universe itself conspired to keep us mired in confusion.