OKB’s Meteoric Rise: Burned, Boosted, and a Dash of Drama! 🚀🔥

Price Jumps on Token Burn and Upgrade

Price Jumps on Token Burn and Upgrade

In a desperate act to shield their crumbling temple, Odin.fun’s custodians slammed the gates shut-halting all trading, all withdrawals-thinking perhaps that silence could hide the chaos, or at least delay the inevitable. The founder, sounding like a man who’s just lost his last friend, confirmed the breach-“investigations are underway,” he declared, as if words could undo what has been lost. Meanwhile, security experts and law enforcement are probing the wreckage, attempting to piece together the puzzle-though, like a bad dream, the pieces seem to dissolve the moment you try to grasp them. 🕵️♂️

Prosecutors were pushing for a 10-year sentence, but the founders were like, “Nah, we’re good, thanks,” and somehow won the argument. 🙃 They’ll be monitored in Estonia, which I imagine is basically a holiday compared to prison. 🇪🇪✈️

On the 11th of August, Bitcoin’s value reached the noble height of \$122,190. Yet, much to everyone’s dismay, it could not maintain its upward march, culminating the day with a diminishment of 2.8%. The volume lacked the pizazz needed for a genuine rally; what ensued was merely a blip of hype, followed by an elegant liquidity sweep that swept away four sizeable long clusters-each averaging \$80 million. Truly, a masterstroke of economic theatre!

This prodigious expenditure, they tell us, is a ‘reflection of rising institutional demand.’ Of course it is. Everyone is simply dying to own digital tokens. One imagines board meetings filled with breathless pronouncements about ‘disruptive technology’ and the urgent need to embrace the future. The Ether, at the time of this, frankly bewildering transaction, was apparently hovering somewhere near the astronomical sum of $4,600. A bargain, no doubt.

The weird thing? The SEC’s approval of that DOGE ETF? Completely irrelevant right now. Looks like Dogecoin’s gonna do what it wants-probably mooning or crashing. Either way, crypto analysts are predicting more upside. Because of course they are! They’re always bullish until they’re not.

In a move that probably involved more coffee than strategy, multiple US and international law enforcement agencies conducted an operation against BlackSuit in late July. This wasn’t just your run-of-the-mill raid; it included unsealing warrants to confiscate cryptocurrency valued at just over $1 million. At least, that’s what they claim. Who knows? Maybe the value dropped by the time they finished counting. 🤷♂️

As our dear CryptoQuant analyst Maartunn eloquently put it on X (formerly Twitter, for those living under a rock), the Ethereum Open Interest has been climbing faster than a drunk up a staircase. 📊 This “Open Interest” thingamajig measures all the derivatives positions tied to ETH on centralized exchanges-long bets, short bets, and bets that are just plain reckless. 💣

What encouraged this turnabout, you may ask? Ah, the ever-elusive optimism twinkled upon the horizon-macroeconomic sentiments flickering with the promise of US Federal Reserve rate cuts, a faint glimmer of stability enveloping the jittery market like a warm hug from a well-meaning uncle.

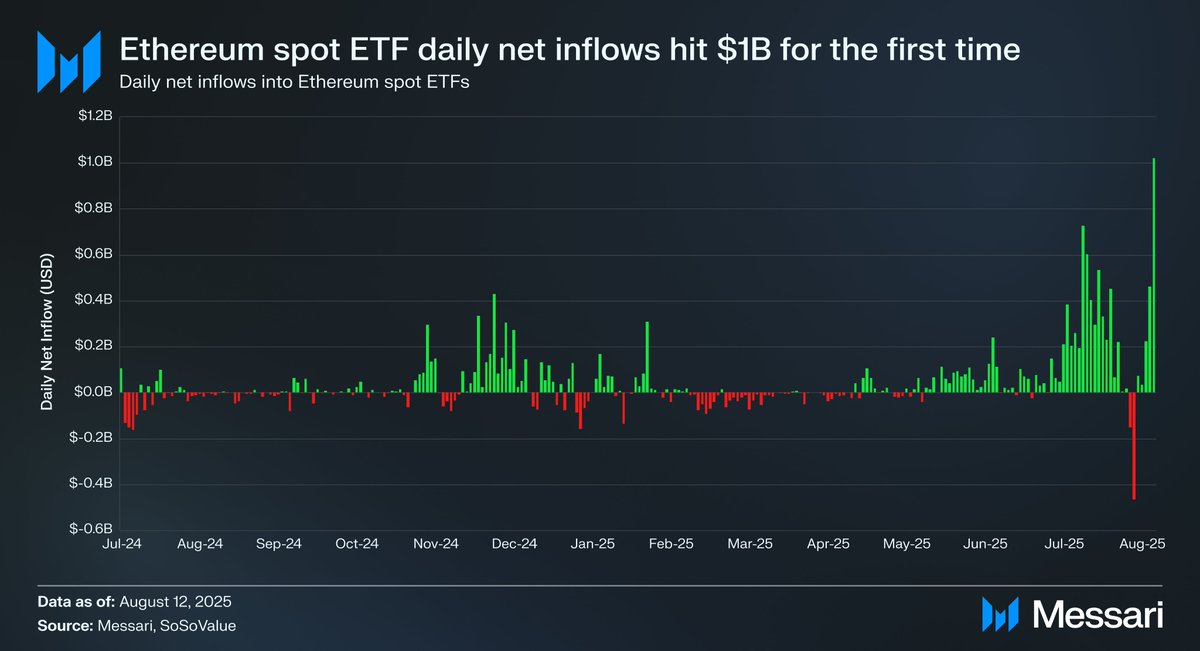

Here’s the tea: Ethereum spot ETFs didn’t just get a little boost-they got a *massive* one. Like, $1 billion in inflows in a single day massive. That’s not just impressive; it’s the kind of number that makes accountants weep with joy. Year-to-date? Oh, honey, we’re talking $8.2 billion in inflows, which is roughly 1.5% of ETH’s entire market cap. Meanwhile, Bitcoin ETFs are over here like, “Yeah, we got $178 million yesterday…so, uh, yay us?” 🐢