DeFi Yield: Kraken’s Vault of Hope and Hype

Key Highlights

Key Highlights

The U.S. dollar, once the unchallenged emperor of currencies, now lies prostrate, its index at its weakest since September. The Federal Reserve and the Bank of Japan, in a rare act of camaraderie, intervene to prop up the yen, a gesture as futile as trying to stop the tide with a broom.

Binance has conducted its usual meticulous rummage through listed spot pairs-checking liquidity, volume, and whether anyone still remembers what COMP stands for. The result? a tidy pruning: BTC/UAH, COMP/BTC, ETC/ETH, MOVE/BNB, PNUT/FDUSD, SHIB/DOGE, TON/BTC, and a few others are being shown the door. Delisting takes effect on January 27, because apparently calendars in crypto markets love a dramatic countdown just as much as we do.

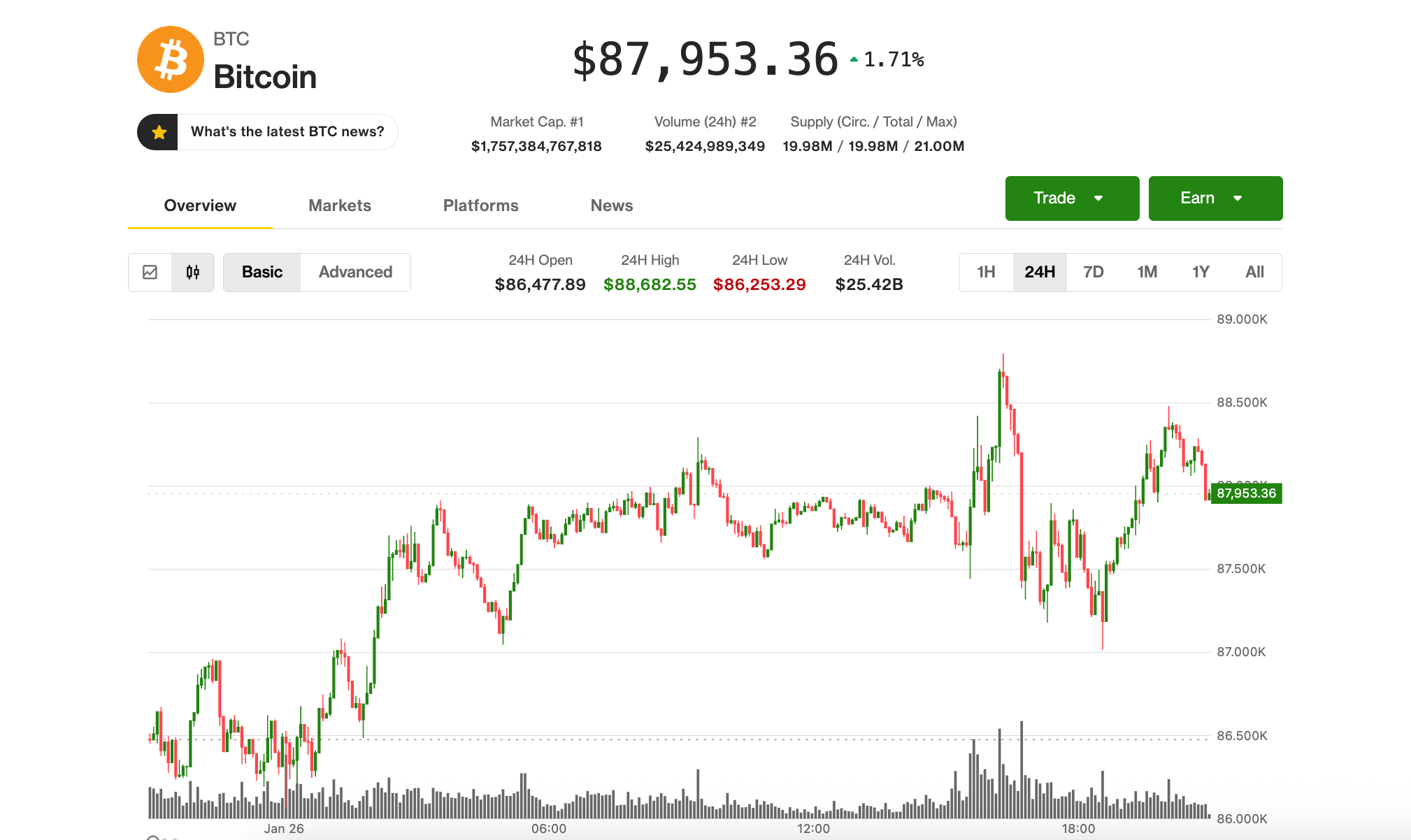

As BTC tiptoes closer to that tantalizing $86,000 mark, the on-chain data is waving a red flag like it’s at a football game. Momentum? Weakening. Enthusiasm? Fragile at best. If this were a rom-com, we’d be about to enter the dreary breakup montage.

Leading the charge of despair was none other than Bitcoin, our finicky friend, who lost a whopping $1.089 billion. Imagine the sighs echoing through the blockchain! XRP, bless its heart, came in a prestigious third place on the list of cryptos facing catastrophe – but wait for it… there’s more!

A new shutdown may descend before the curtain fall of January the thirty‑first, as if the calendar itself conspirèd with calamity to close the stage.

According to our esteemed analyst – who clearly enjoys a good game of market roulette – negative funding rates are signalling a turnabout in XRP’s fortunes. The poor little coin is currently hobbling about 47% shy of its July record, having bravely endured a 600%+ rally since November 2024, only to now take a well-deserved nap. Bless it! And the timing? Oh, it’s simply charming; the bearish whispers began not at the peak but during a hefty 50%+ downturn. Short sellers, darling, are having a field day, with Binance funding rates leaning negatively since December – a clear sign that the shorts are struttin’ around like they own the place.

After four splendid years filled with pivots that could make a gymnast dizzy and layoffs that would send shivers down the spine of even the bravest entrepreneur, our dear Tux has made the announcement that the company is winding up. The latter half of 2025 was dedicated to crafting a crypto automations platform with all the buzzwords one can muster: threshold cryptography, trusted execution environments (TEEs), and artificial intelligence (because why not?). A charming little post from our dear Voltairine Novatore Pacific, who, like a modern-day oracle, shared their insights with support from A16z. Meanwhile, the remaining crew is being offered a lifeline in the form of job-hunting assistance. Isn’t that sweet?

Whispers from the boards tell us that roughly seven in ten institutional investors deem Bitcoin undervalued when it dwells between eighty-five and ninety-five thousand dollars. Independent investors follow, not too far behind, with six in ten nodding the same thought.

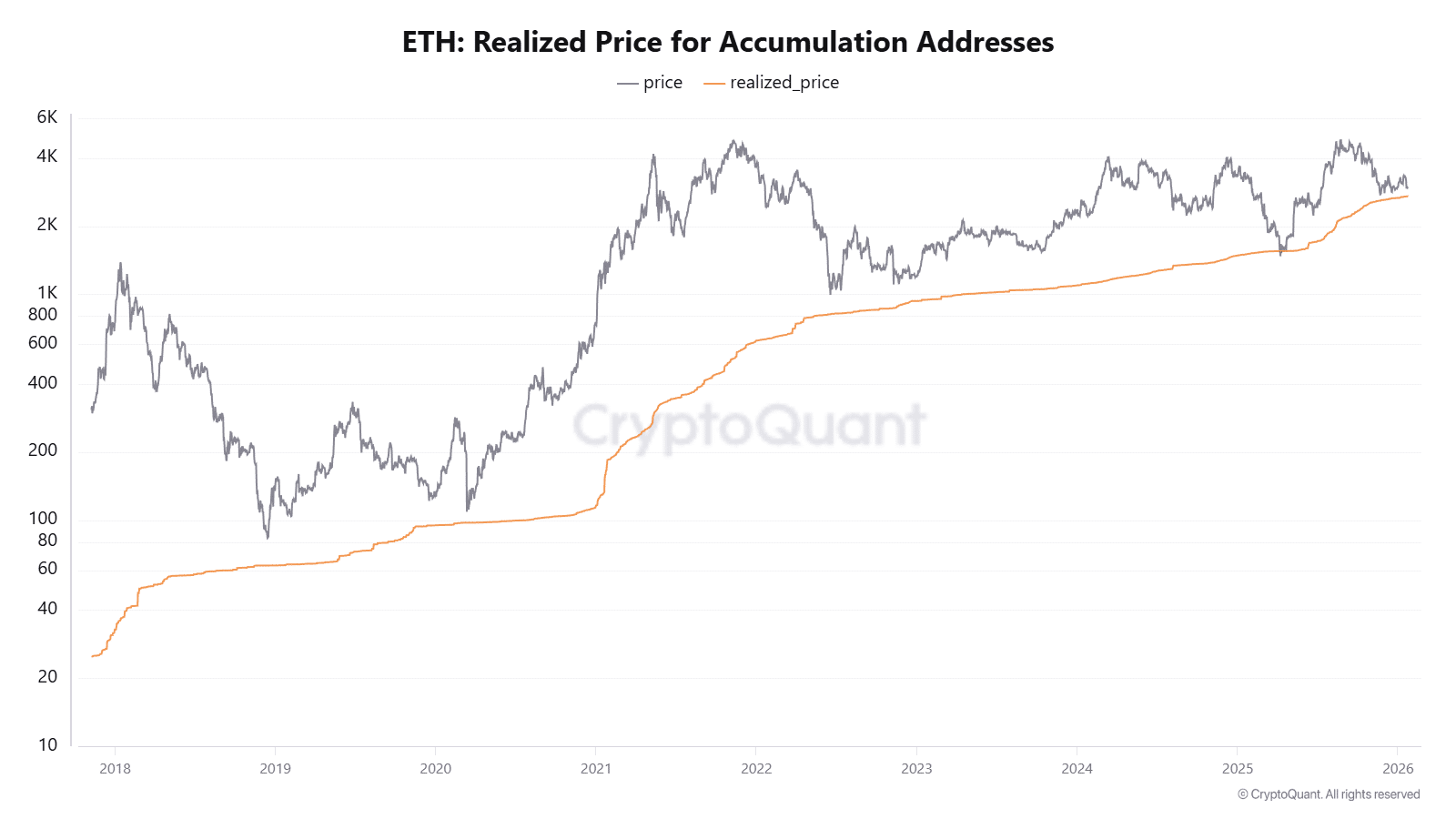

According to Lookonchain (yes, that’s a real thing), this same whale has hoarded 70,013 ETH in the past five days, totaling a cool $203.6 million. Because nothing says “I’m confident in the market” like buying enough crypto to buy a small island-or at least a really nice yacht.