Is the SEC About to Make Your Crypto Dreams Come True? Find Out Here!

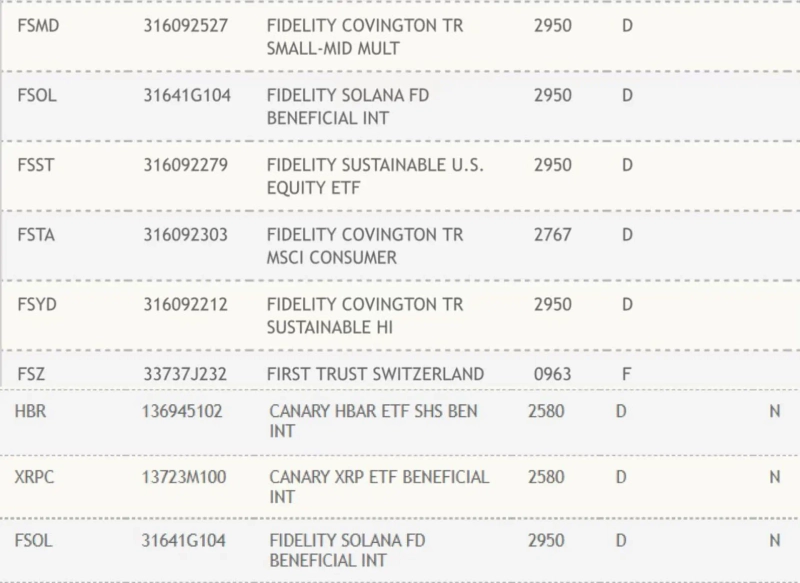

Hold onto your wallets, folks! These ETFs are pending regulatory approval. Yup, we’re still waiting on the green light from the SEC. But no worries, we’ve got a few juicy tidbits to keep you on the edge of your seat. 🍿