Solana’s Glow-Up: Is It the Crypto Prom Queen Now?

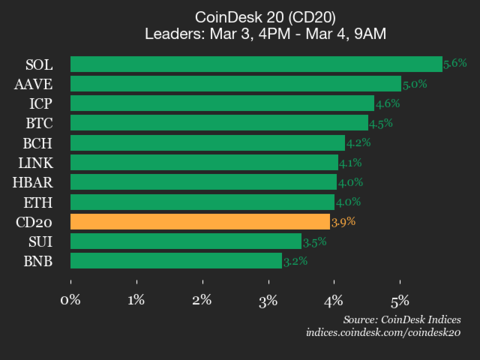

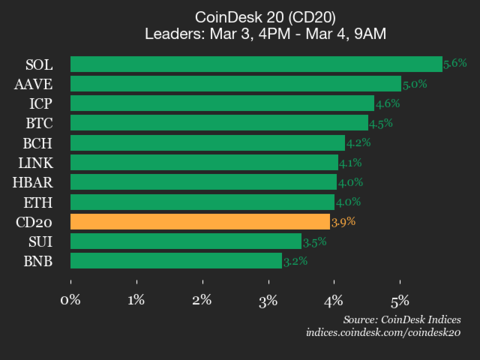

The CoinDesk 20 is strutting its stuff at 2029.47, up 3.9% (+76.88) since 4 p.m. ET on Tuesday. Yes, it’s basically the popular kid who just got a new haircut and everyone’s noticing.

The CoinDesk 20 is strutting its stuff at 2029.47, up 3.9% (+76.88) since 4 p.m. ET on Tuesday. Yes, it’s basically the popular kid who just got a new haircut and everyone’s noticing.

Even the big shots, the so-called whales, are trying to patch up this mess, but it’s like trying to fix a broken plow with a toothpick. The bear market growls louder than a hungry hound, and MYX is just another bone in its jaws.

Adeniyi Abiodun, co‑founder at Mysten Labs (the shadowy umbrella under which this quest was bootstrapped), explained that the interest from the bonds and liquid holdings will be used to either mop up circulating Sui tokens or pour cash into decentralized finance and automated market making. In other words, they’re moving money without paying taxes. Impressive.

Now, don’t you go thinking this here pup’s been napping in the shade. Oh no, it’s been a regular circus of mixed price actions, but the on-chain metrics-them fancy numbers the smart folks pore over-reckon this critter’s fixin’ for a comeback. And what a comeback it might be, with its burn rate shootin’ up like a rocket on the Fourth of July-53,954%, mind you. That’s more than a firecracker, that’s a downright explosion, courtesy of the good folks at Shibburn.

In a missive on the modern town square known as X, RippleX Head of Engineering J. Ayo Akinyele-a name that rolls off the tongue like a carriage wheel on cobblestones-proclaimed that the bug was spotted last week by Cantina AI. Reported with the solemnity of a village elder, it was swiftly validated as critical. Yet, like a farce in a Gogol novella, the issue never blossomed into exploitability on mainnet, for the amendment had not yet awakened from its slumber. A hotfix was dispatched posthaste, disabling both Batch and its related fix, while a broader remediation is pondered with furrowed brows.

Ah, Bitcoin. Once again, it defies all odds and soared past $71,000 on Wednesday, as if a few military conflicts in the Middle East were no more than a mild inconvenience. According to the ever-reliable CoinMarketCap, the cryptocurrency was trading at $71,306.68, with a 24-hour trading volume of more than $60 billion. Because who needs stability when you have digital gold?

Kraken Becomes First Crypto Firm with Fed Master Account Kraken Financial, the banking division of cryptocurrency exchange Kraken, has made history as the first crypto company in the U.S. to connect directly to the Federal Reserve’s payment system. This means Kraken can now settle dollar transactions instantly using Fedwire, bypassing the need for traditional intermediary … Read more

American Bitcoin, a company supported by the Trump family and co-founded by Eric Trump, is rapidly expanding its Bitcoin mining business. So far this year, they’ve mined 766 Bitcoins, currently worth $54.39 million.

The decentralized exchange PancakeSwap, not content with just flipping pancakes, has unleashed a suite of AI-powered tools designed to help software agents manage DeFi strategies across multiple blockchains. Enter PancakeSwap AI, with modular “Skills” designed to give agents the power to analyze opportunities and draft strategies-but without ever touching the execution part. Apparently, that’s beneath them.

Sui is actively trying to attract large investments from established financial institutions with its new “Sui Bank” initiative. This effort is designed to position Sui as a major player on Wall Street and increase its connections with traditional finance companies. Ultimately, this represents a move towards growth that prioritizes regulation and appeals to institutions.