🚨 Bitcoin’s ‘Death Cross’ Drama: Macro Top or Just a Tantrum? 🚨

Bitcoin’s MVRV death cross is throwing a hissy fit, hinting at a bearish tantrum. Historically, it’s the drama queen before a price correction. 💔

Bitcoin’s MVRV death cross is throwing a hissy fit, hinting at a bearish tantrum. Historically, it’s the drama queen before a price correction. 💔

Now, hold on to your yarmulkes, folks! It was supposed to be a mere 3.69 billion! A pittance! A schnook! But NOOOO, they’re going for the big number. Twenty-seven billion! That’s more than I owe the IRS! 💸

Hearken to Tika Lum, the grand vizier of global business for VIPs and those cloaked in institutional finery at Kucoin. Our sage declares that though the tokenized RWA is no fledgling fable, ’tis the entrance of those dour, silver-laden institutions which hath breathed wingèd life into this spectacle.

Tokyo-listed Metaplanet, positively giddy with accumulating Bitcoin – honestly, the enthusiasm! – is discovering that even the shiniest coins can’t entirely insulate one from the vagaries of the market. Their share price, you see, has decided to take a rather precipitous tumble, down a rather shocking 54% since June. Really, the lack of restraint!

In a Medium post titled “Time to Say Goodbye” (which sounds more like a breakup letter than a professional resignation), Steve Guo announced he’s stepping down as CEO of Loopring (LRC) in August 2025. His reason? Family time. Because nothing says “I’m done here” like a sudden urge to bond with the kids. 🏠👨👩👧👦

Ethereum’s [ETH] ecosystem is now embroiled in a debate so intense it could rival the time Jerry refused to tip the pizza guy because the box was slightly crushed. The Ethereum Community Foundation (ECF) unveiled BETH-a token that “represents” ETH you’ve torched. Because nothing says “value” like owning a digital receipt for something that no longer exists. 👻

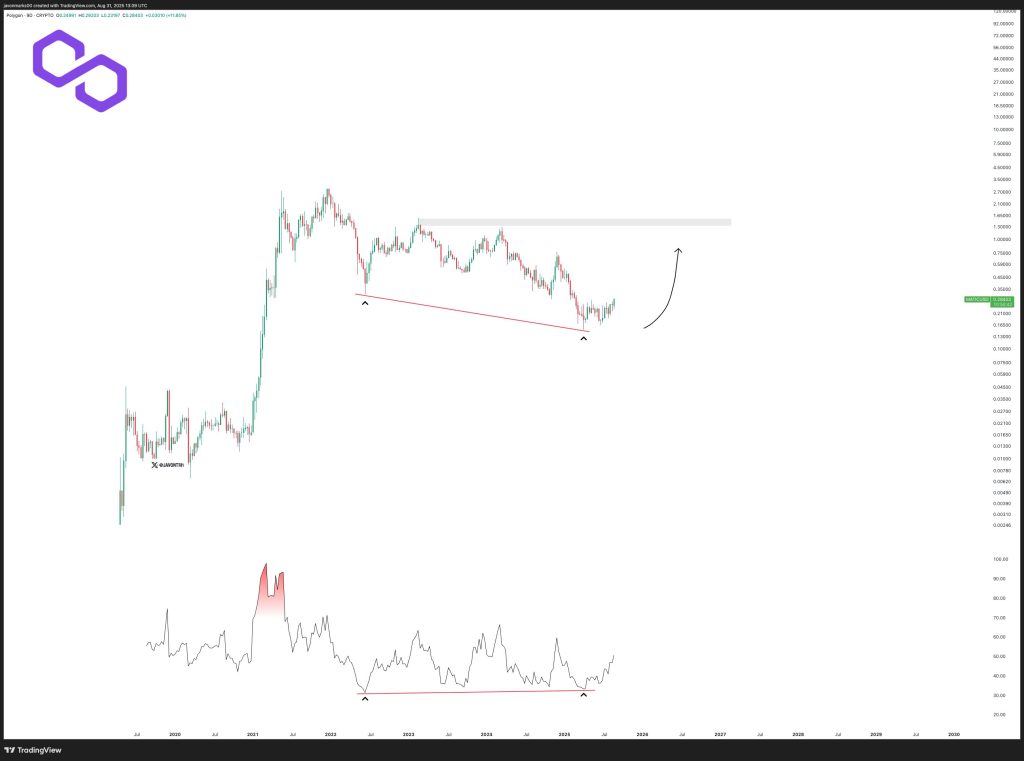

Behold! The Polygon network is buzzing like a swarm of bees on a sugar rush. Active addresses jumped 25%, from 447,000 to 665,000-more folks are actually using this thing. Daily transactions jumped nearly 8%, hitting 4 million. Looks like someone finally found the switch to turn this network from rust to robust. Or maybe just to catch some fish for once. 🐟

On August 8, Binance issued a most curious decree, reducing LRC’s collateral ratio from 40% to 25% for portfolio margin users. This change allows traders to borrow more against their LRC holdings, boosting liquidity and speculative leverage. The policy shift came alongside a massive 2362% surge in trading volume to $337 million, a figure that would make even the most stoic of investors blink in disbelief. 🤯

After a period of modest ascent, Cardano encountered sellers near $0.880, prompting a downturn as sudden as a scandal in high society. Like its peers, Bitcoin and Ethereum, ADA succumbed, dipping below the $0.850 and $0.8320 support levels with a lack of grace most unbecoming.

This is a daily analysis by CoinDesk analyst and Chartered Market Technician Omkar Godbole, brought to you with a sprinkle of sarcasm and a dash of emojis. 🧮