You Won’t Believe What Galaxy Digital Did with $103M in Solana! 🤑

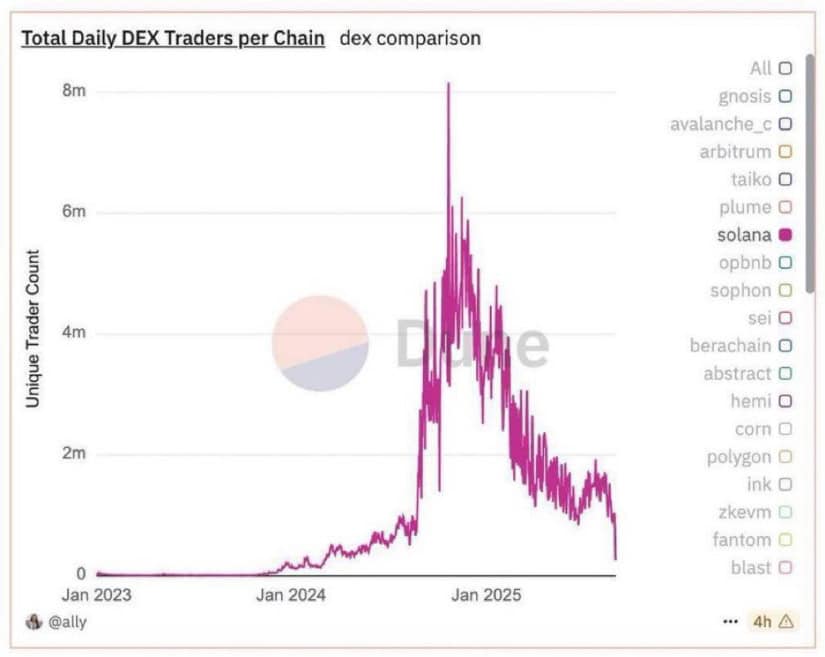

Now, some ‘experts’ (or so they call themselves) are saying, ‘Hey, Solana might pull back, maybe go down a little.’ Yeah, no kidding. It’s like them telling you not to eat the last slice of pizza-thanks for the news flash! The market’s all volatile, like a rollercoaster designed by a drunk, and everyone’s holding their breath-waiting for that next big move, or collapse, whichever comes first.