Hold onto Your Hats! ONDO Might Skyrocket 16%-And It’s Not Just Hot Air

Ondo Finance [ONDO], after loafing about like an old riverboat stuck in the mud, has finally decided to pull up anchor, climbing a respectable 6% in the last 24 hours.

Ondo Finance [ONDO], after loafing about like an old riverboat stuck in the mud, has finally decided to pull up anchor, climbing a respectable 6% in the last 24 hours.

The Nasdaq, that tech-laden barometer of our digital age, rose a modest 0.8%, while the Dow Jones loitered with all the purpose of a man waiting for a bus. The S&P 500, not to be outdone, managed a 0.3% ascent, though one suspects it did so with a yawn. 🥱

Behold! The enchanting tale of Bullish, a crypto darling that owns CoinDesk and dances to the tune of Wall Street’s whims. Compass Point, in their infinite wisdom, offers a “neutral” nod and a $45 dream-a number lofty enough to scare the cats away but modest enough to tempt the gamblers. 🎰

Apparently, Revolut decided to give its loyal employees a chance to cash in, allowing them to sell up to 20% of their personal holdings. Not a bad deal, considering each share is priced at a cool $1,381.06-enough to make your average office coffee budget seem pitiful. The announcement, made this Monday, was greeted with the sort of fanfare reserved for national holidays, after a period of what can only be described as “spectacular financial performance.” Last year, they turned a profit of £1 billion-yes, with a ‘B’-which, frankly, is enough to make most of us question our life choices. ☕🤔

September’s here, and the crypto circus is in full swing! 🎪 Investors are clutching their popcorn 🍿, trying to figure out which coin will steal the show after months of “meh” performances.

In one of them high-falutin’ interviews with Bloomberg, Novogratz prognosticated, “in the not-so-distant future, the biggest user of stablecoins is going to be AI.” I reckon you’ll be hollerin’ at some AI critter to rustle up your vittles, and that little contraption will be rustlin’ the coins all by its lonesome:

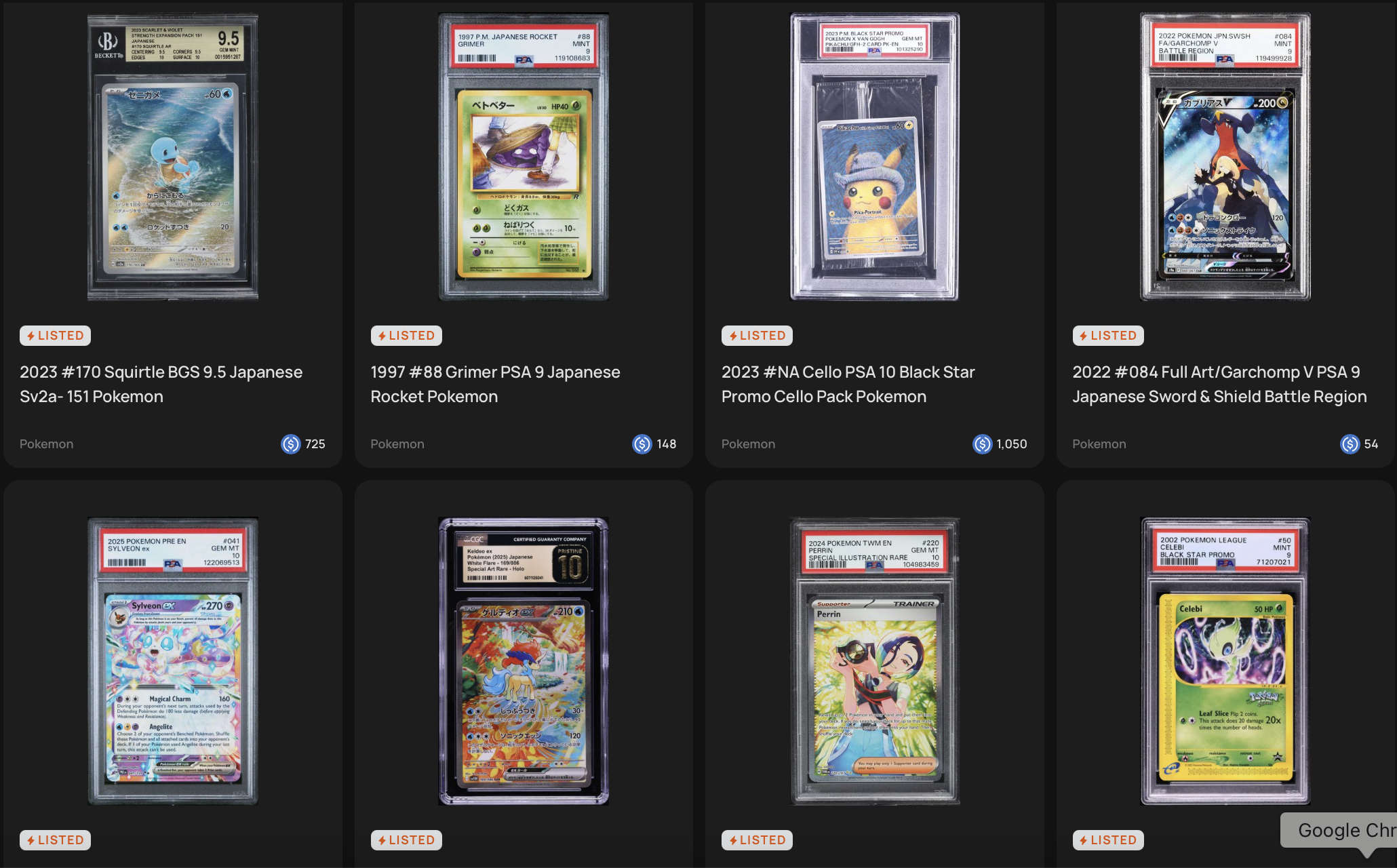

But wait-there’s more! While your typical card game enthusiast might still be collecting cards, oblivious to the wonders of the blockchain, Collector Crypt is already deep into the business of making every card on the planet an asset. And, naturally, it’s all powered by Raydium’s Automated Market Maker infrastructure. Because, why not add some real-time liquidity to your childhood nostalgia, right? The marketplace allows you to trade your tokenized Pokémon cards with the kind of speed and transparency that would make even the most seasoned stock trader envious. 💸

The custodians of this digital fortress executed “mass blacklisting,” an Orwellian phrase that sounds worse than it is-a bunch of accounts, deemed compromised, were permanently disinvited from the party before it started. They even offered a peek at the blockchain transactions, like showing off the scars of a battle won, or perhaps just a few scratches. All in all, the Lockbox-a mechanism supposedly locking away people’s tokens like a grandma’s secret cookie jar-stood resilient. Or so WLFI insists, puffing out chests and pointing at the blockchain “proof” like proud schoolboys showing off homework. 🎓

Enter Bravemorning Limited, the Elon Musk of investment firms, who handed over $110 million like it was lunch money. Why? To buy restricted common shares, obviously. Because nothing says “healthy relationship with money” like tying it up in a blockchain knot. 🎩💸

This little drama unfolded between July 2023 and August 2024, right before Europe rolled out its shiny new Markets in Crypto-Assets (MiCA) regime. Apparently, since early 2020, crypto firms have been expected to register with local regulators for Anti-Money Laundering purposes. But hey, who needs rules when you’ve got… uh… blockchain? 🤷♂️