Canine Coin’s Cosmic Comeback: Will Your Wallet Wag or Whimper? 🐕🚀

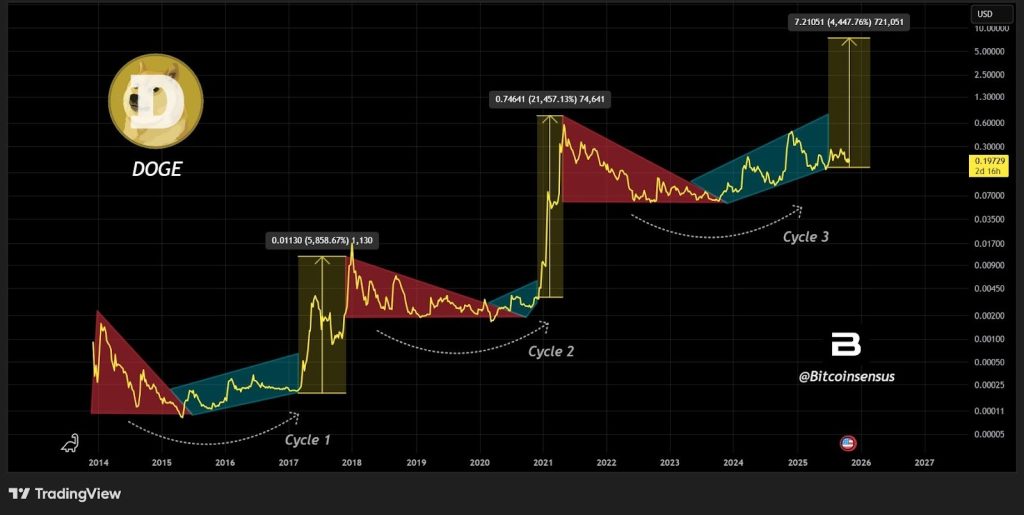

In seven sunrises, DOGE clawed back 6.5%, now lounging coyly near $0.136. A pittance, you say? Ah, but remember: even the mightiest storms begin as a whimper. 🌪️

In seven sunrises, DOGE clawed back 6.5%, now lounging coyly near $0.136. A pittance, you say? Ah, but remember: even the mightiest storms begin as a whimper. 🌪️

In the vast, tumultuous ocean of finance, where greed and despair dance a waltz as old as time, Tom Lee’s BitMine Immersion Technologies has cast its net wide. With a purchase of 96,798 ETH last week, the firm now hoards 3.73 million tokens, a treasure worth $10.5 billion. One might call it avarice, or perhaps the desperate hope of a man clinging to a sinking ship. Either way, the numbers speak louder than the Fed’s latest diktat.

Yet, as the market trembles like a leaf in a gale, BitMine dares to buy while others flee, selling their holdings like beggars at a feast. The firm’s coffers, however, brim with a $4 billion wound of unrealized losses-a price paid for the sin of optimism. “But wait!” cries Mr. Lee, “The Fusaka upgrade looms! The Fed shall soften its grip!” As if Ethereum’s scalability and a few rate cuts could mend the cracks in this crumbling edifice of hubris.

And what of the shares? They plummet 7.7% pre-market, mirroring ETH’s descent to $2,800-a far cry from the lofty heights of yesteryear. The world, it seems, is a stage for folly, and BitMine plays the tragic hero. “Positive tailwinds,” they say. One can only hope the wind doesn’t turn to hurricane.

From New York to Times Square

After a volatile November, XRP has stabilized in early December, with liquidity conditions improving and ETF-related activity becoming more visible. The current XRP price has recovered above $2 following a notable drawdown last month, indicating that long-term accumulation may be occurring despite broader market risk-off conditions. 🤯 A miracle? Or just a well-timed rally? Only the market knows-and it’s not talking. 🤐

Because Even Your Crypto Habits Deserve a Tax Break

In a lengthy post on X, Perera claimed Bitcoin’s dip wasn’t a crash but a “volatility dance.” The real culprit? Japan’s interest rates, which have suddenly decided to play the lead role in a financial thriller. For decades, Japan’s low rates lured investors like moths to a flame-only to scorch them when the flame flickered.

A mere 2-3% intraday swing on a $1.7 trillion behemoth is enough to make leveraged traders weep into their coffee mugs and newbies question every life decision. It’s like watching a toddler on a sugar rush-chaotic, unpredictable, and destined to spill juice on your laptop. 🍌

Sony Bank plans to issue a stablecoin in the U.S. as early as the fiscal year 2026, the Nikkei reported on Monday. How delightfully futuristic! 🚀

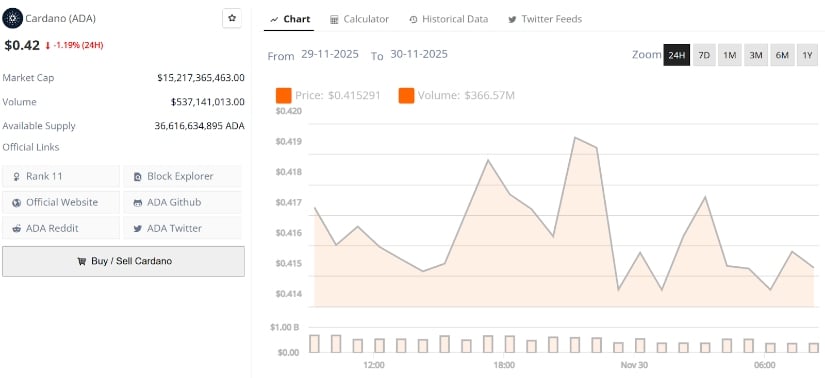

Guess what? ADA’s trading at the same price it was in 2017-around $0.4167. Yes, you read that right. Eight years, two cycles, and we’re back where we started. 🌀 It’s like that ex who keeps sliding into your DMs after all these years. Milk Road’s chart is basically screaming, “How deep is your drawdown?” But hey, Cardano’s back in its long-term value zone, where the cool kids accumulate like it’s going out of fashion. 💼

Market sentiment, once a ghost of itself, now pirouettes like a hopeful fool after John Williams, that benevolent overseer of the FOMC, hinted that monetary policy remains “restrictive”-a code word for “we’ll break the economy, but at least it’s exciting.” This masterstroke of ambiguity birthed the fantasy that December might bring a rate cut, prompting investors to fling money into crypto like it’s the last dance before the rapture.