Altseason’s Brewing? What Traders Are Really Watching 👀🚀

And yet, nothing has truly broken out. The pressure? Oh, it’s there. Right beneath the surface. Ready to explode like a glass of champagne dropped on the floor. 🍾

And yet, nothing has truly broken out. The pressure? Oh, it’s there. Right beneath the surface. Ready to explode like a glass of champagne dropped on the floor. 🍾

Behold, the noble Bitcoin (BTC) now rests at $89,855, a mere 0.92% above its former self, as if sighing in relief after a harrowing ordeal. With a trading volume of $35.65 billion, it is as though the market itself has taken a deep breath, yet the specter of $88,000 looms like a shadow, a testament to the resilience of its supporters. 📉

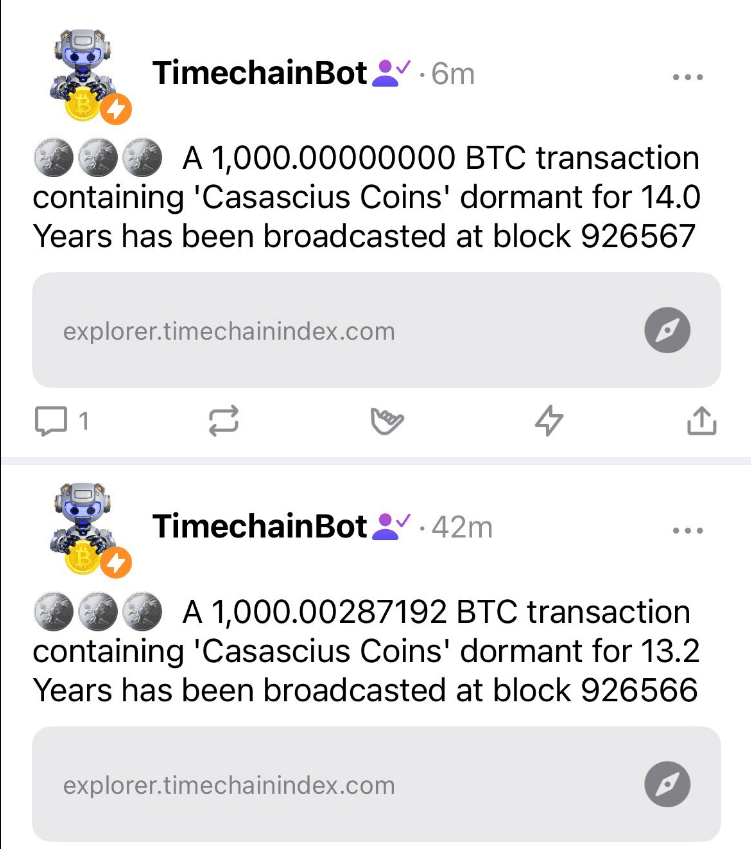

Selon les sages du réseau, l’une de ces joyeusetés fut frappée lors d’un mois d’octobre de l’année 2012, lorsque le Bitcoin était si abordable qu’il serait presque honteux d’y penser aujourd’hui!- à peine 11,69 pièces de monnaie pour un seul Bitcoin. L’autre, plus ancienne encore, date de décembre 2011, quand la pièce valait… si peu que même un poulail pourrait rire! Seulement 3,88 unités de la monnaie du bon Dieu. Ah! Si ces pièces pouvaient parler, ou plutôt, se débattre dans la main du cher optant! Et si l’on fait la mathématique, le gain est aussi faramineux qu’une pièce de théâtre de Molière: près de 2,3 millions pour cent, mes amis! 🎉🥳

Zcash’s price has suffered a debacle in the financial theater, having plummeted 16% in 24 hours, tumbling from a feeble attempt to breach the mythical $400 chandelier. A performance so dire, one might mistake it for a Bond villain’s money-laundering spreadsheet.

He posits – and really, one must use that word, doesn’t one? – that it’ll somehow deliver ‘greater stability’. As if stability is something one actively seeks in the perpetually chaotic world of cryptocurrency. Good heavens. He’s worried fees might go up, you see. Naturally. Because everything always does, doesn’t it? 💸

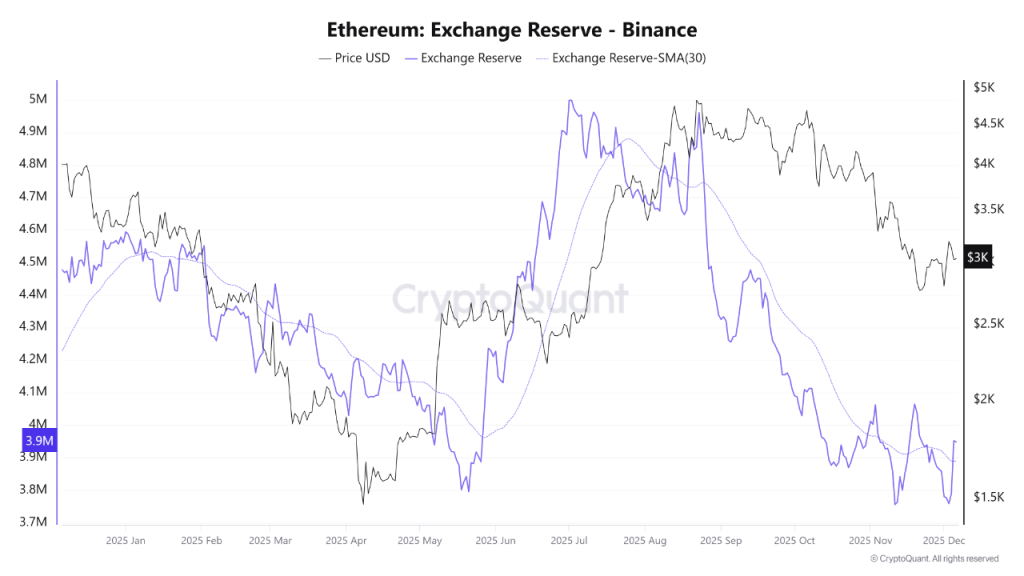

The timing? Perfect. ETH is wobbling near a one-month low, and the little wallets have begun their predictable exit, according to on-chain chatter. As if the chorus of tiny investors singing the swan song wasn’t enough.

Solana is hanging out in a seriously critical price zone, like that one friend who insists on making everything dramatic. As market chaos pushes major altcoins back to their comfort zones (aka their supports), SOL seems to have lost its mojo. After failing to stay above its recent highs, it’s now wobbling around the $130 mark-a place that has historically been make or break for its momentum. With sentiment dragging its feet and sellers on the warpath, everyone’s waiting to see if Solana can pull itself together or if this is the first sign of a bigger mood shift.

In a shocking twist no one saw coming (except everyone), XRP ETFs are the only ones seeing consistent inflows this week. That’s right-while the rest of the crypto market is doing its best impression of a sinking ship, XRP investors are still tossing coins into the fountain like it’s 2017. 🎰 But don’t get too excited-these inflows are about as impactful as a single raindrop in a hurricane. XRP’s price is still sliding faster than a penguin on ice, proving once again that crypto logic is… well, illogical.

Per CoinGlass, the past 24 hours were a dumpster fire of bad decisions. Leveraged longs? $350 million down the drain. Bitcoin? A 3.5% nosedive to $89,120-a price point so sad, even Elon’s doge would cry. 💸

Much like the Russian winter that humbles even the proudest generals, the shifting tides of the market have brought forth a flood of SHIB tokens back to exchanges-a phenomenon as subtle as a bear crashing a tea party. These movements, dear reader, are not to be ignored, for they whisper secrets of impending doom (or at least a slight dip).