- Onyxcoin, the darling of the crypto world, decided to triple its worth in a mere three days. How quaint.

- Technical indicators, those ever-reliable harbingers of doom, whispered of an impending cool-off. How thrilling.

Onyxcoin [XCN], that paragon of digital absurdity, emerged as the week’s top-performing altcoin, skyrocketing by 135% in just three days. It also graced the daily gainers list and became the most talked-about asset on CoinMarketCap, with a staggering +260% surge in trading volume in the past 24 hours. Truly, a spectacle for the ages. 🚀

The frenzied upswing propelled the daily RSI (relative strength index) into the overbought zone, hinting that the rally might be due for a breather. Meanwhile, the OBV (On Balance Volume) made a valiant recovery from April’s lows but stumbled at the 91B resistance. How dramatic. 🎭

//ambcrypto.com/wp-content/uploads/2025/04/Onyxcoin-XCN-08.25.50-11-Apr-2025.png”/>

At the time of writing, Santiment’s data revealed that those who had held the altcoin for a month enjoyed an average of 45% unrealized profits per the 30-day MVRV. Typically, this would invite profit-taking and stall the recovery. But, in a twist of fate, there was low selling pressure from these profitable holders. According to Santiment’s Supply on Exchanges metric, the declining trend (yellow) indicated that more XCN tokens were withdrawn from exchanges than deposited for sell-offs. How peculiar. 🕵️♂️

In essence, bulls had little room to push higher, per the above indicators. How limiting. 🚧

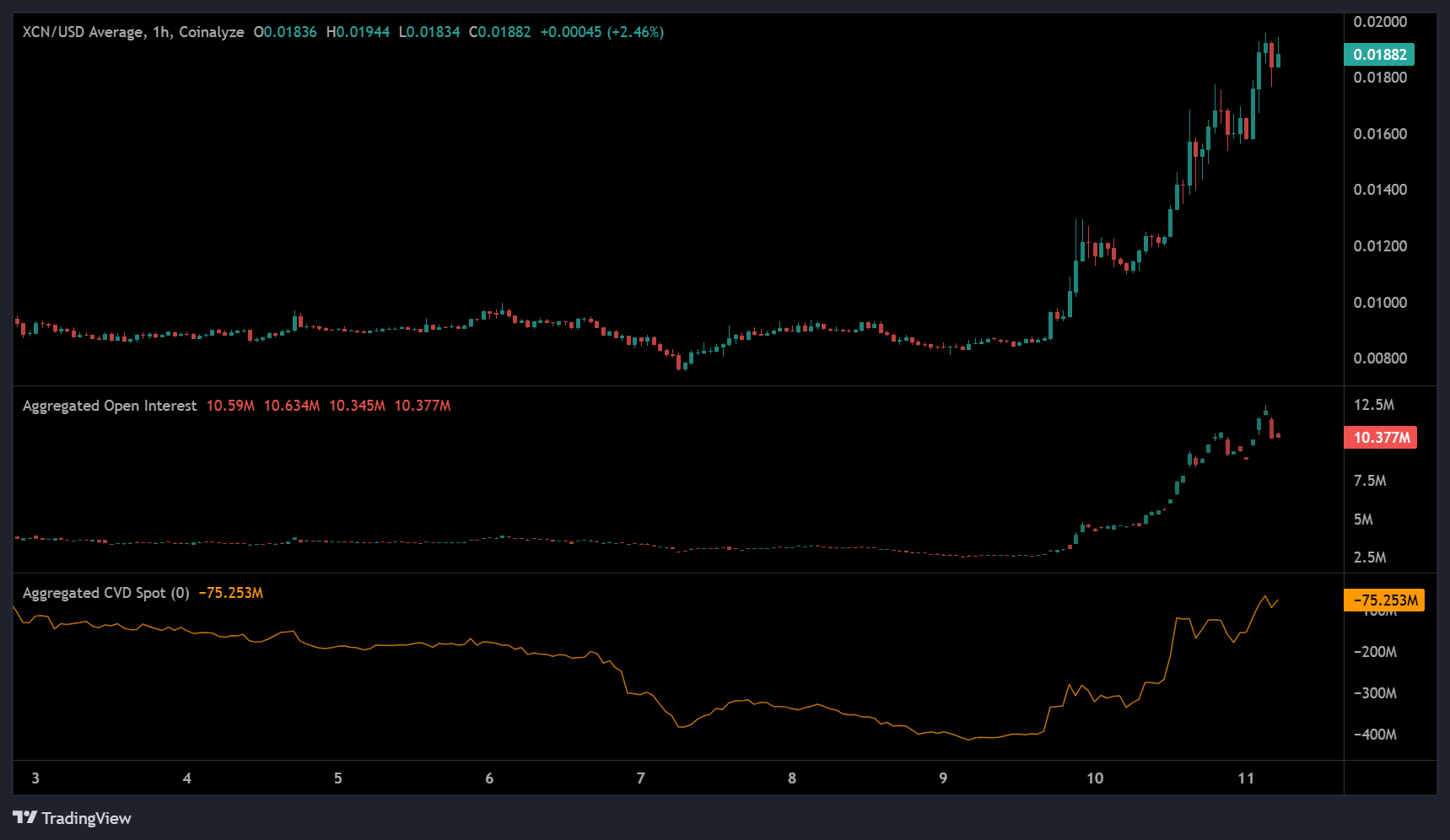

On a brighter note, the rally was fueled by robust spot and derivatives demand, as evidenced by the rising CVD Spot and Open Interest (OI) rates. Wild liquidations could abruptly tank the asset’s value if the rally were driven purely by leverage (spike in OI). But, in XCN’s case, the rally was bolstered by strong spot demand. How reassuring. 🛡️

In conclusion, Onyxcoin might extend the rally to $0.023, adding another 25% gain. However, technical indicators hinted at a potential price reversal and cool-off. How anticlimactic. 🎬

Read More

- Silver Rate Forecast

- SPEC PREDICTION. SPEC cryptocurrency

- USD PHP PREDICTION

- OM PREDICTION. OM cryptocurrency

- ETHFI PREDICTION. ETHFI cryptocurrency

- RUNE PREDICTION. RUNE cryptocurrency

- Solana’s Meltdown: $111M Longs Liquidate Like It’s Going Out of Style! 💸🔥

- ILV PREDICTION. ILV cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- ZK PREDICTION. ZK cryptocurrency

2025-04-11 16:17